How to (and How Not to) Gain Exposure to the Magnificent Seven

Why Precision Matters

Investing with precision is critical. When it comes to exchange-traded funds, this means that a fund’s composition can make or break whether a portfolio is positioned for an investor’s desired exposures. This isn’t to say that being precise can guarantee an outcome – of course it can’t. But if you’re using a blunt tool for a specific targeted exposure, you might not win on a trade, even if you got it right!

With this in mind, let’s review how investors may look to gain exposure to the Magnificent Seven stocks — Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla — via an ETF or index.

Currently, the only ETF offering precise exposure to the Magnificent Seven is the Roundhill Magnificent Seven ETF (NASDAQ: MAGS). MAGS uses an equal weighted approach across the seven market leaders and rebalances back to equal weight each quarter.

Why MAGS versus the Nasdaq-100 Index?

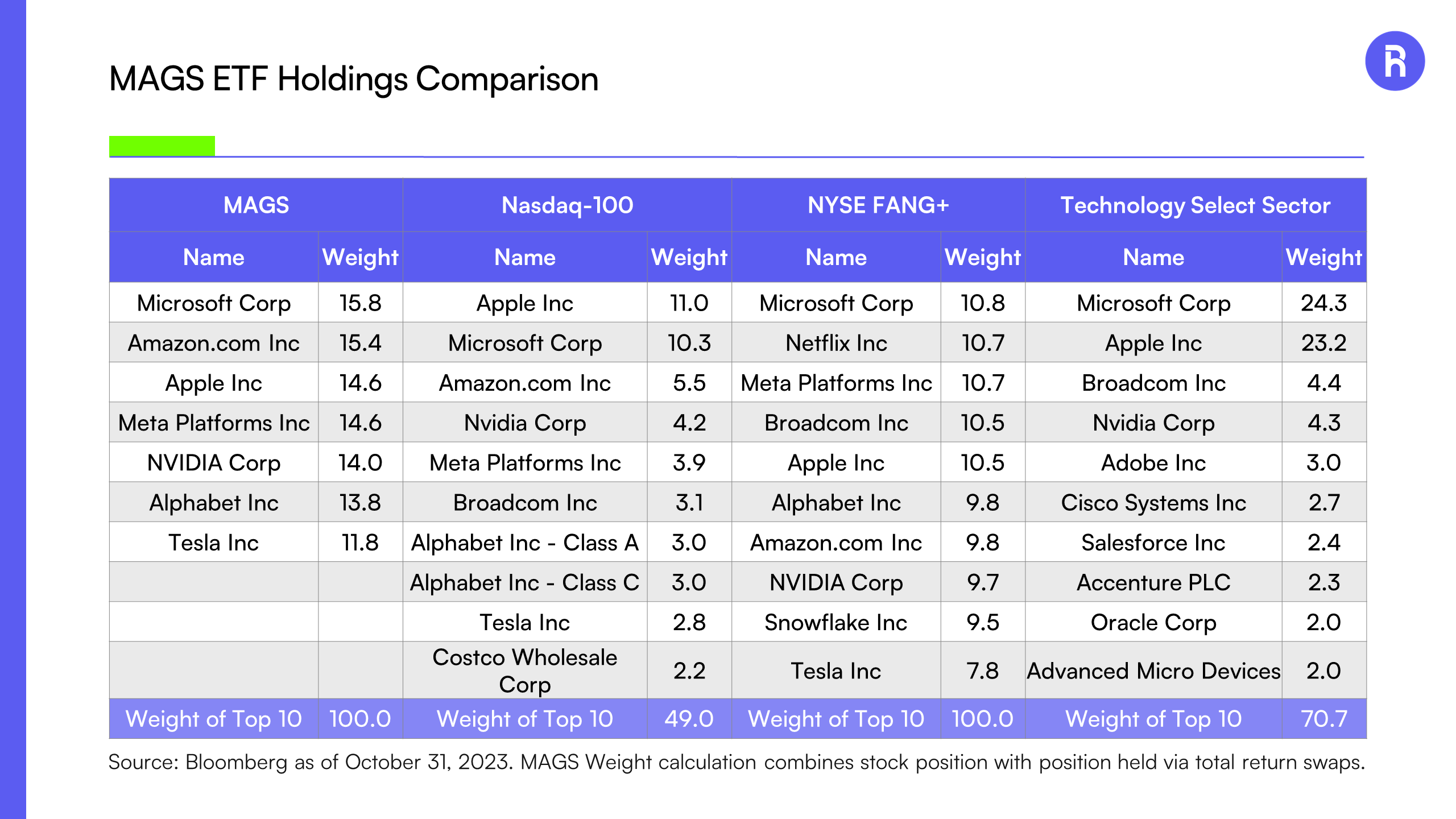

The Magnificent Seven stocks are all top 10 holdings in the Nasdaq-100 Index.1 As a result, many investors use Nasdaq 100 tracking products to gain exposure. However, the Nasdaq-100 Index consists of the 100 largest non-financial stocks listed on the Nasdaq, regardless of their sector. This means that investors will find names like Costco and Pepsi amongst the top 15 holdings. In fact, less than 50% of the Nasdaq-100 is actually tech.

Why MAGS versus the NYSE FANG+ Index?

The NYSE FANG+ Index2 improves on the dilutive nature of the Nasdaq by focusing on ten tech stocks, but it creates other challenges for investors. In addition to including Netflix, which is not a Magnificent Seven name, Broadcom and Snowflake are index constituents. These might be perfectly fine companies, but we believe they are not Magnificent in the way that the seven tech giants are.

Why MAGS versus the Technology Select Sector Index?

The Technology Select Sector Index3 offers precise exposure to the Information Technology sector, specifically to the IT components included in the S&P 500 Index. However, due to Global Industry Classification Standard (GICS) categorizations, the index misses out on exposure to four of the Magnificent Seven stocks – Amazon, Alphabet, Meta and Tesla.

In conclusion, MAGS is the only ETF solution that offers investors with a precise vehicle to trade the Magnificent Seven.

Why MAGS versus the Underlying Stocks?

While there are only seven Magnificent Seven stocks, using an ETF for exposure eliminates friction and the ongoing management of the exposure. One can easily purchase the 7 securities initially, but the reality is that an investor needs to consistently rebalance them over time to reduce single stock risk. However, behavioral finance would suggest that investors often fail to do time and time again. Meanwhile, an equal weighted approach like MAGS takes the emotion out of it, forcing one to sell high and buy low.

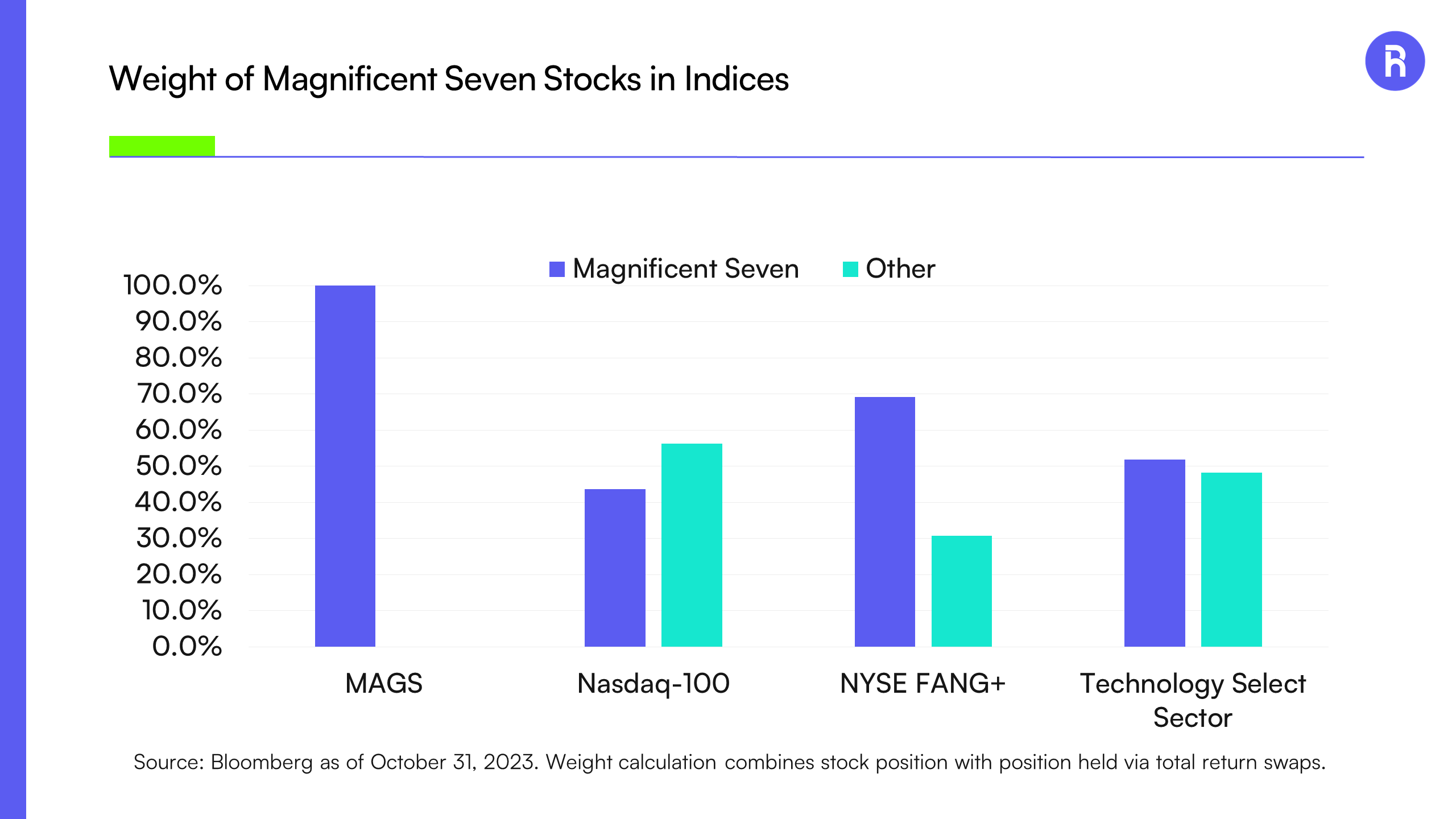

MAGS Only Owns the Magnificent Seven

Source: Bloomberg as of October 31, 2023. Weight calculation combines stock position with position held via total return swaps.

MAGS Does Not Water Down Exposure

Source: Bloomberg as of October 31, 2023. Weight calculation combines stock position with position held via total return swaps.

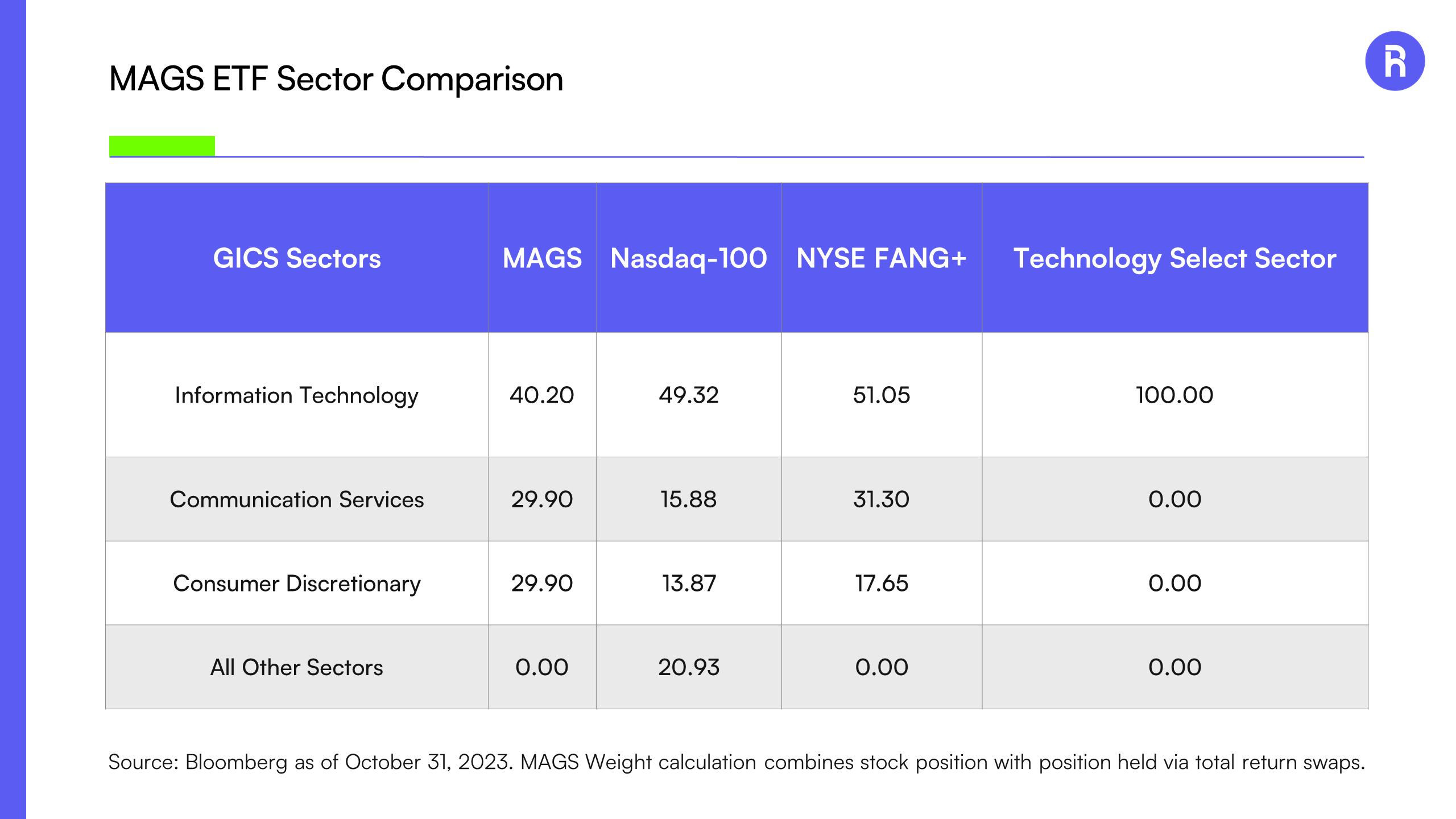

MAGS Sector Weights are Driven by the Magnificent Seven, Not the Other Way Around

Source: Bloomberg as of October 31, 2023. Weight calculation combines stock position with position held via total return swaps.

1 The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. No security can have more than a 24% weighting.

2 The NYSE FANG+ Index is an equal-dollar weighted index designed to represent a segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks of technology and tech-enabled companies such as Facebook, Apple, Amazon, Netflix, and Alphabet's Google.

3 The Technology Select Sector Index is a modified cap-weighted index. The index is intended to track the movements of companies that are components of the S&P 500 and are involved in the development or production of technology products.

Carefully consider the Fund's investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund's prospectus. Read the prospectus carefully before investing.

The Fund expects to have concentrated (i.e., invest more than 25% of its net assets) investment exposure in one or more of the Technology Industries at any given time, which may vary over time. Further, the Fund expects to obtain such investment exposure by transacting primarily with a limited number of financial intermediaries conducting business in the same industry or group of related industries. As a result, the Fund is more vulnerable to adverse market, economic, regulatory, political or other developments affecting those industries or groups of related industries than a fund that invests its assets in a more diversified manner. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Foreside Funds, LLC: Distributor.