Roundhill Roundup: The Degen Economy

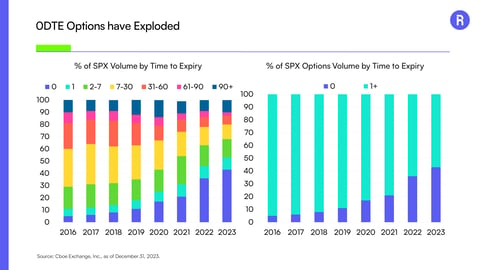

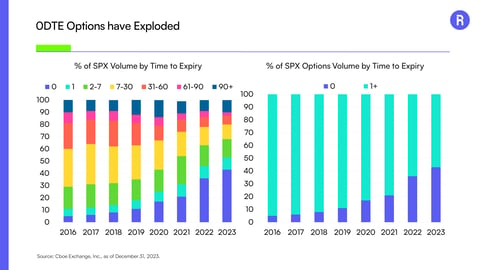

0DTE Options. Meme Coins. Parlay Bets. What do these three have in common? The growth of 0DTE (zero...

For all other registered brokerages, contact them directly to invest.

Explore our research and insights on the trends driving global markets and how our ETFs may help you achieve your investment goals.