The BIG Picture - Not Your Buddy’s MEME

Driven by the Federal Reserve’s aggressive rate hike cycle and persistently high inflation, many economists expected a material growth slowdown to materialize in 2023. Some pundits called for an outright recession. And market strategists followed suit publishing dour outlook after dour outlook.

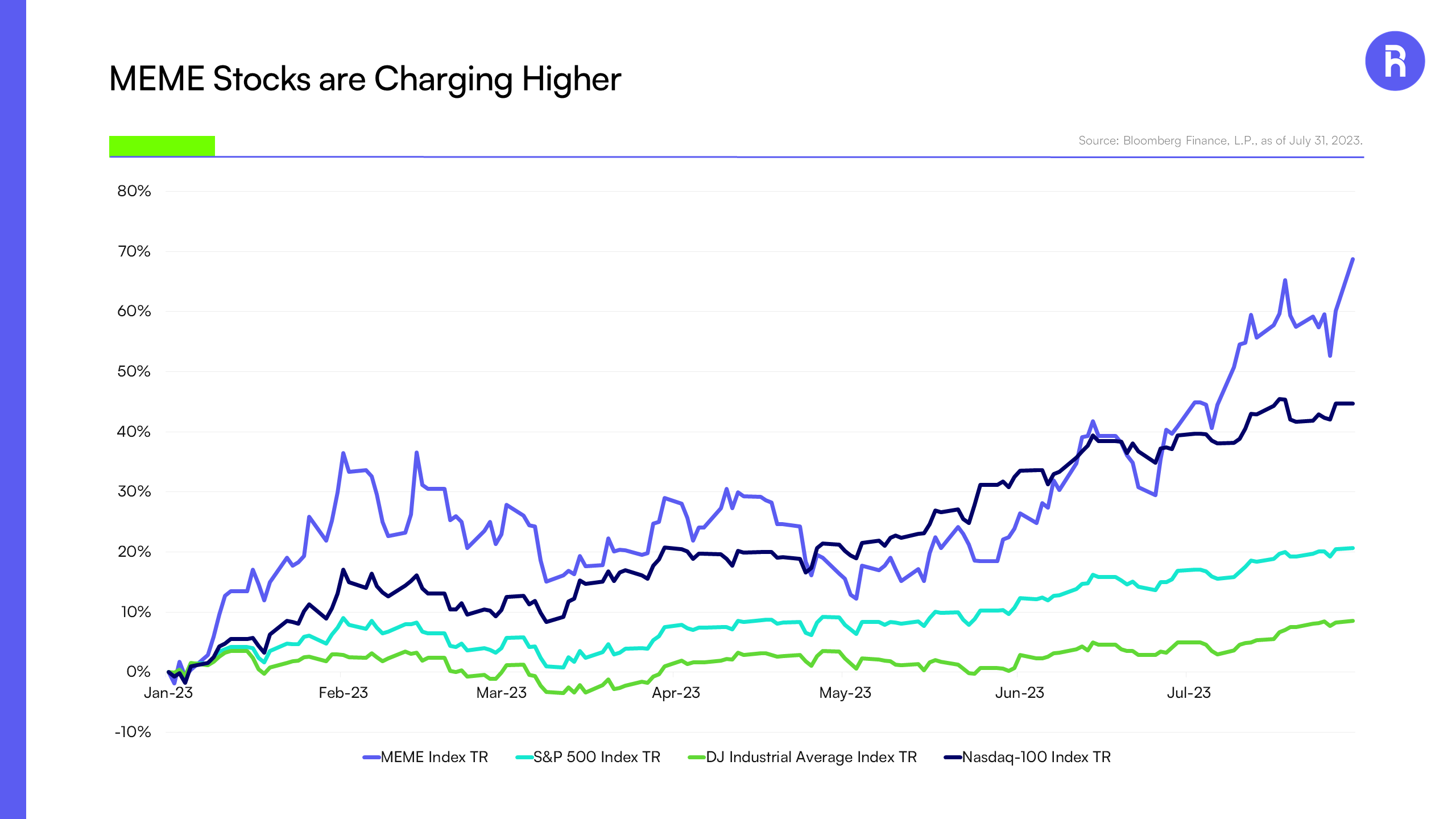

Yet with the S&P 500 Index up over 20% and the Nasdaq 100 Index up close to 45% through the first 7 months of 2023, it’s clear these forecasts weren’t exactly accurate. July did little to help the bear case, with another strong month for stocks as all 11 GICS1 sectors finished in the green. Returns broadened out as well with small caps, value, and international stocks all beating the S&P 500 Index last month.

As we’ve seen this year, investors may end up losing out on opportunities if they wait around looking for the “aha moment”. With 11 rate hikes since March 2022 and the Federal Funds Rate now at 5.50%, it remains difficult to say the economy and markets can continue to sail along without any repressions.

Bears can now point to recent surveys highlighting tighter lending standards and weak demand for credit, implying that companies may start to feel the pinch. There’s also ample evidence for them to point to across the globe, evidenced by slowdowns in manufacturing and industrial production for various G-7 countries.

Source: Bloomberg Finance, L.P., as of July 31, 2023. The S&P 500 Index index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The Dow Jones Industrial Average Total Return Index tracks the total return of the member stocks of the DJI Index. The NASDAQ-100 Tr Index is a modified market cap- weighted index that includes 100 of the largest domestic and international non-financial securities listed on NASDAQ based on market cap.

Meanwhile, bulls can point to credit spreads, which remain extremely tight for both investment grade and high yield issuers. Bulls can also highlight what’s been a relatively strong earnings season. Coupled with moderating inflation, momentum continues to mount in favor of the US economy avoiding a recession and securing a so-called “soft landing”.

As noted, July saw market returns broadening out from the “Magnificent Seven”

MEME consists of 25 equal-weighted U.S. stocks that exhibit a combination of elevated social media activity and high short interest. The fund’s underlying index rebalances every two weeks, meaning it can dynamically adjust into stocks that are exhibiting meme-like characteristics. In other words, this rally isn’t simply about euphoria in meme stocks, as the underlying holdings in MEME have continually changed over the course of the year. Instead, the rally in meme names may be more reflective of how our theme of the bulls being back in charge is playing out. Investors interested in boosting their potential upside, albeit with higher volatility than the broader market, may find MEME to be an attractive opportunity.

1 GICS (Global Industry Classification Standard) is defined as an industry classification standard developed by MSCI in collaboration with Standard & Poors (S&P).

2 The Magnificent Seven is defined as a term used for a group of 7 stocks, Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Tesla Inc. and Meta Platforms Inc.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Meme stocks are stocks whose trading volume increases not necessarily because of a company’s performance, but because of social media attention which may result from a variety of factors unrelated to the company’s performance, financial position, or other business fundamentals. As a result, meme stocks are prone to high volatility which may be a result of panic selling. Because meme stocks are heavily dependent on investor sentiment and opinion, they may be overpriced in comparison to the company’s fundamentals, resulting in losses to the Fund. The Fund’s investment strategy relies heavily on social media analytics, which are relatively new and untested. “Social media” is an umbrella term that encompasses various activities that integrate technology, social interaction and content creation. Investing in companies based on social media analytics involves the potential risk of market manipulation because social media posts may be made with an intent to inflate, or otherwise manipulate, the public perception of a company stock or other investment. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors.

Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may be more risky and fall more than diversified funds. Depositary receipts, including ADRs, involve risks similar to those associated with investments in foreign securities, such as changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies and may not provide a return that corresponds precisely with that of the underlying shares. The Fund may invest in equity securities of SPACs, which raise assets to seek potential acquisition opportunities. Unless and until an acquisition is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Because SPACs have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. There is no guarantee that the SPACs in which the Fund invests will complete an acquisition or that any acquisitions that are completed will be profitable. As an ETF, the fund may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments. The Fund is a recently organized investment company with no operating history. Please see the prospectus for details of these and other risks.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with

Roundhill Financial Inc., U.S. Bank, or any of the companies or individuals referenced herein.