Roundhill Roundup: Sell the News = Range Bound Crypto

The widespread anticipation for the approval of spot bitcoin ETFs concluded with a paradoxical decline in bitcoin's price in a classic case of "sell the news".

The lead-up to the approval of spot bitcoin ETFs saw a surge in bitcoin's price, fueled by speculative optimism in the short-term. Investors banked on the premise that ETFs would democratize bitcoin access, attracting a flood of institutional and retail investment. This optimism was not unfounded; historically, the introduction of ETFs has been a boon for underlying assets, such as gold, offering broader market exposure and enhanced liquidity.

However, the actual approval of these ETFs marked a turning point, with bitcoin's price experiencing a sharp decline. This counterintuitive outcome can be attributed to a "sell the news" event, a phenomenon where investors capitalize on the run-up to major announcements by exiting positions once the news is out.

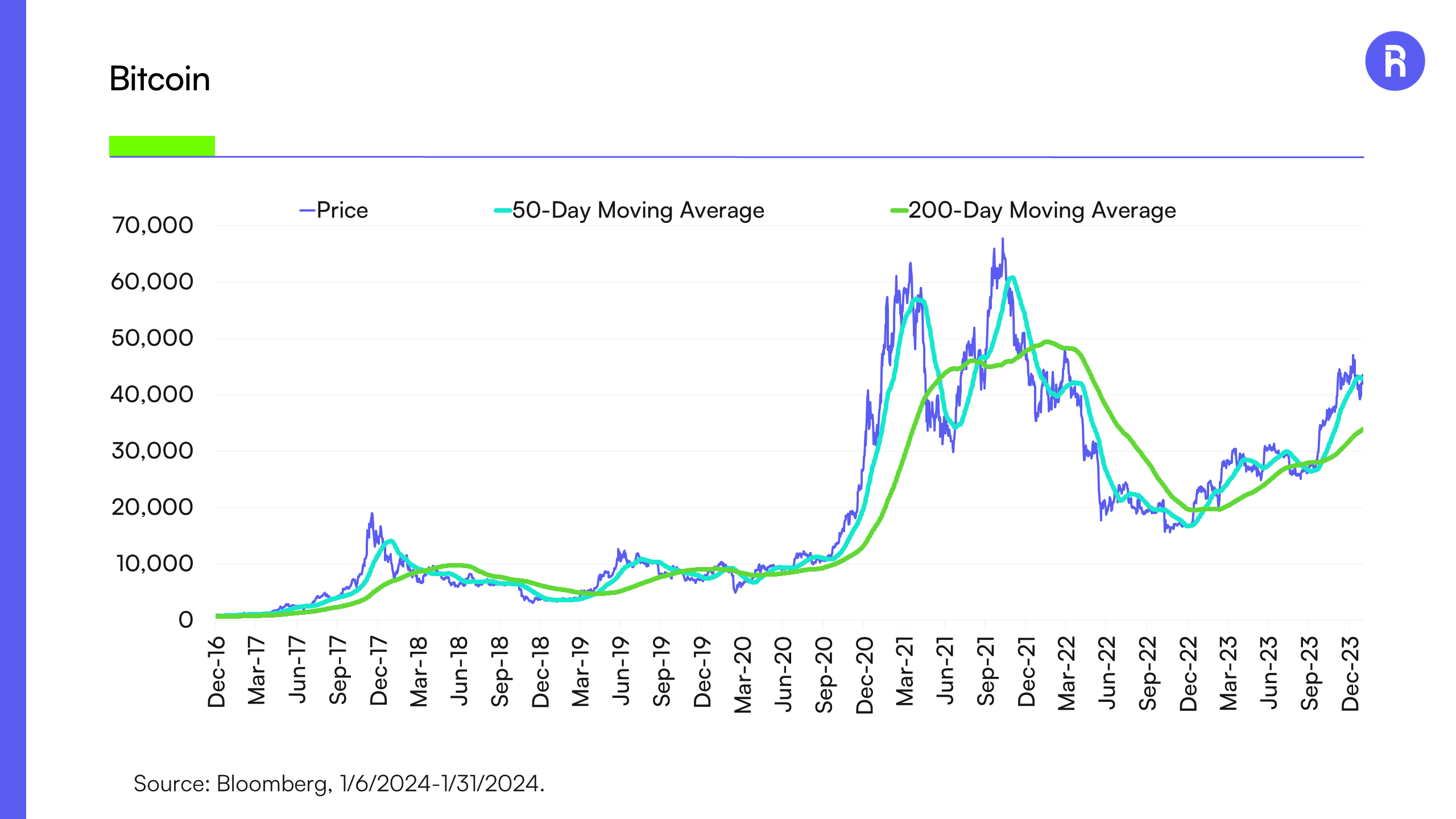

Bitcoin's behavior around major events such as the launch of CME bitcoin futures in December 2017 and the Coinbase IPO in April 2021 reveals a pattern of initial enthusiasm leading to price spikes, followed by corrections. These cycles suggest a propensity for bitcoin to enter periods of consolidation post-major announcements. Currently, bitcoin's price remains extended from its 200-day moving average, indicating a potential for range-bound trading.

Bitcoin’s Recent Runup

Source: Bloomberg Finance, L.P., as of January 31, 2024.

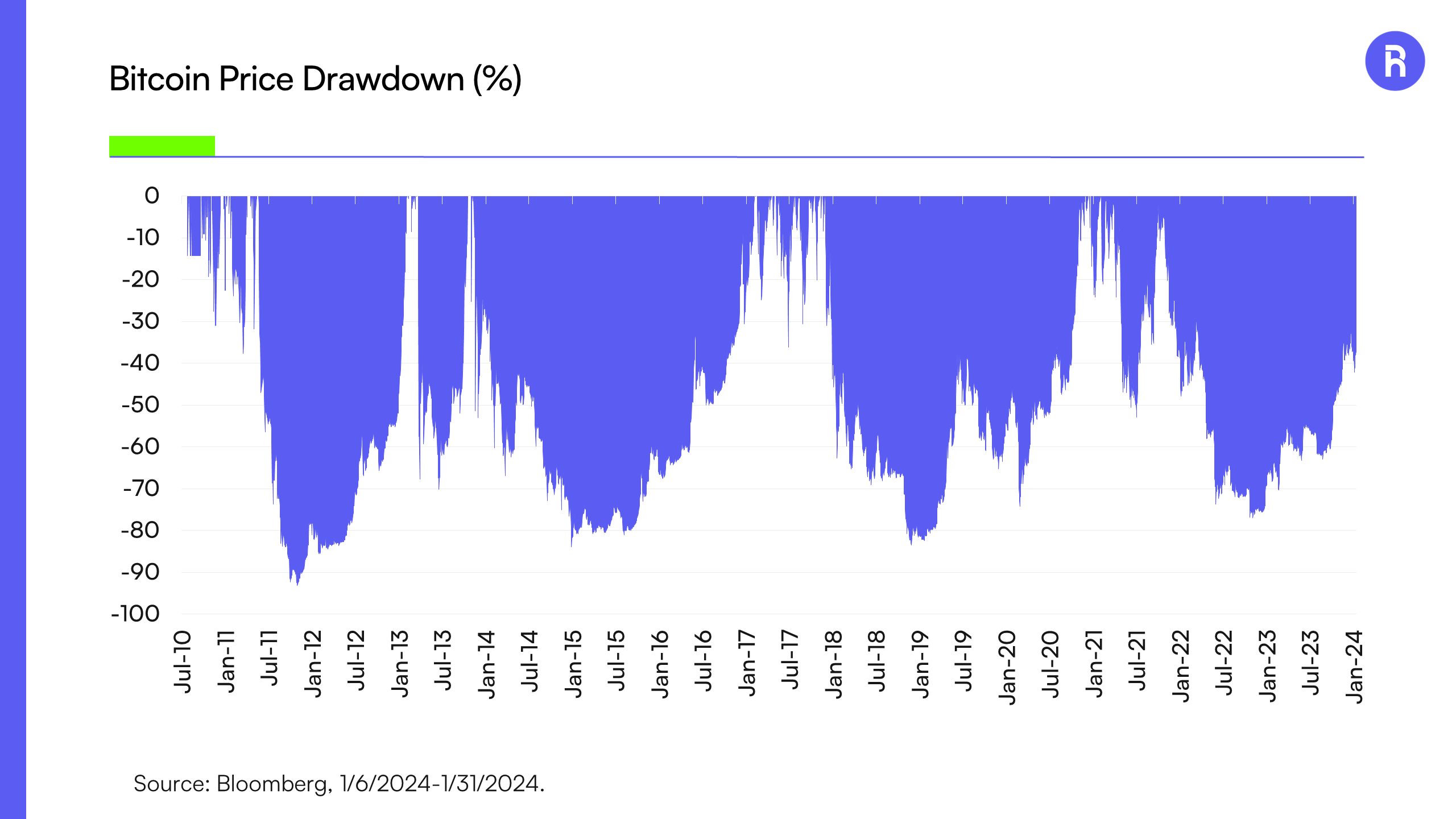

Bitcoin's high volatility and its large drawdowns can be attributed to several factors. Firstly, its market is relatively nascent, leading to price sensitivity based on news, regulatory changes, and market sentiment. Secondly, bitcoin's value is largely driven by speculative interest rather than intrinsic value, making it susceptible to rapid price swings as investors react to short-term developments. Thirdly, liquidity can vary significantly, with large transactions having the potential to move the market considerably. Additionally, the decentralized nature of cryptocurrency markets means that geopolitical events, regulatory announcements, and technological advancements can have unpredictable impacts on price. Together, these aspects contribute to bitcoin's volatility, making it capable of producing significant gains but also exposing investors to the risk of substantial drawdowns. In fact, bitcoin is in the midst of a 37% drawdown as of today.

Bitcoin has Experienced Periods of Long Drawdowns

Source: Bloomberg Finance, L.P., as of January 31, 2024.

Leveraging Range-Bound Markets with Covered Calls

In the context of a range-bound market with high volatility, a covered call strategy on bitcoin presents an attractive potential opportunity for income generation. This strategy entails holding a long position in a bitcoin futures ETF while selling call options on the same asset. The objective is to earn premium income from the options sold, which could provide returns even if the underlying asset's price remains stagnant.

A covered call strategy is particularly suited to range-bound markets for several reasons. First, it seeks to capitalize on the lack of strong directional movement in bitcoin's price, helping to allow investors to generate income from the premiums of the call options sold. Second, should the price of bitcoin rise to the strike price of the call options, the investor potentially benefits from the appreciation of the underlying asset up to the strike price, in addition to the premiums received.

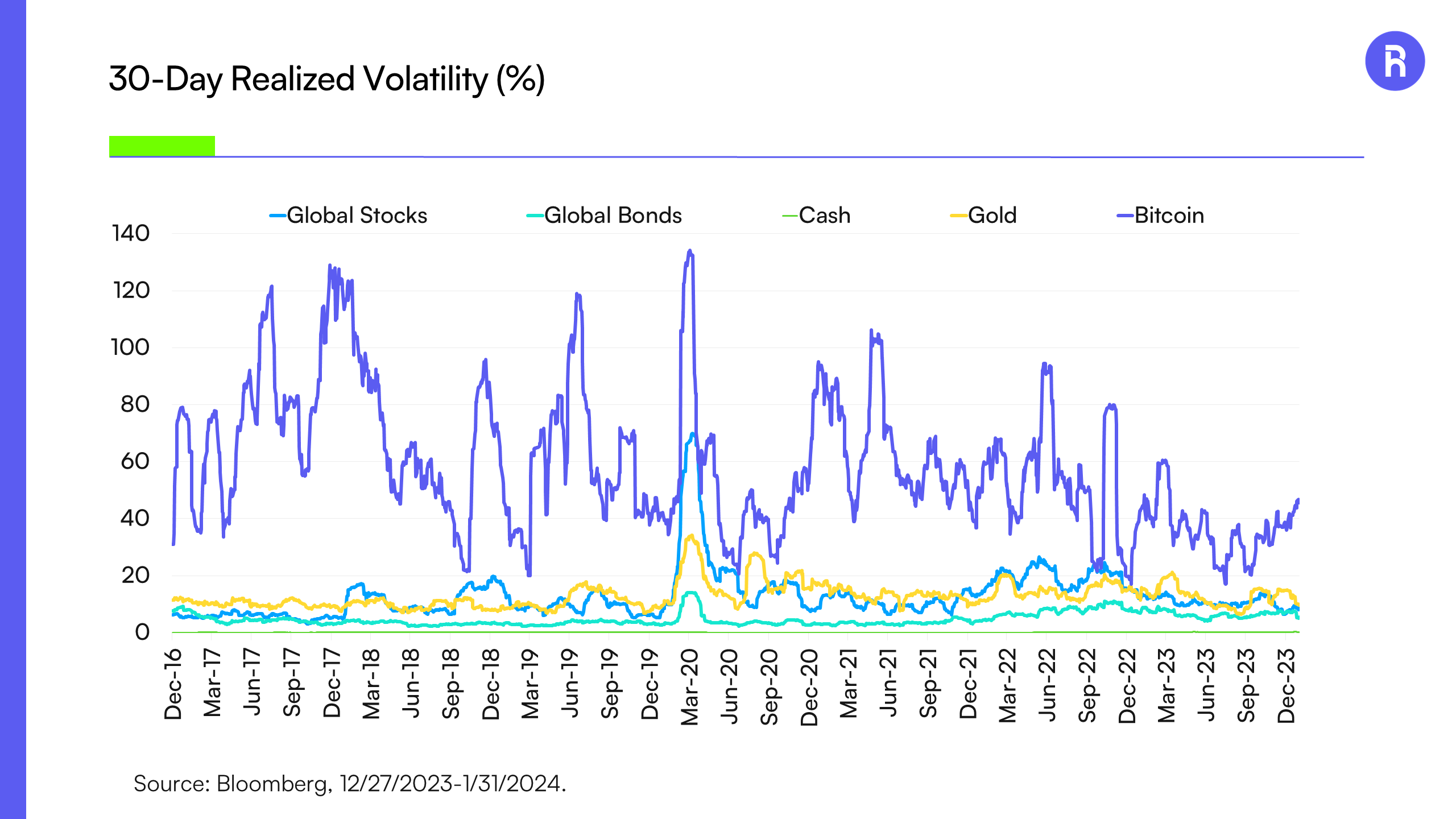

Implementing covered call strategies on volatile assets like bitcoin can help mitigate drawdown challenges. Due to bitcoin's high volatility, investors could earn high premiums thanks to the greater risk of price fluctuations. For context, bitcoin’s historical volatility is 5 times greater than that of global equities. When an asset experiences significant price fluctuations, the premiums for call options increase, reflecting the heightened risk and potential reward for option buyers. This strategy helps to provide a buffer against the asset's volatility, turning market fluctuations into a potential opportunity for income, making it particularly attractive for assets with high volatility.

Bitcoin’s Volatility Makes it Well Suited for a Covered Call Strategy

Source: Bloomberg Finance, L.P., as of January 31, 2024. Global stocks represent the MSCI ACWI, Global Bonds represent the Bloomberg Global Aggregate Index and Cash represents the Bloomberg 1-3 Month U.S. Treasury Bill Index.

Implications for Investors

For investors navigating the post-ETF approval landscape, the shift towards range-bound trading may necessitate a reevaluation of traditional approaches to bitcoin. The covered call approach offers a method to potentially derive value from bitcoin without relying on significant price appreciation in the near-term. It also has the potential benefit of increasing an investor’s income and improve their risk-adjusted returns.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact 1-855-561-5728 or consult with the professional advisor of their choosing.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (855) 561-5728. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the Primary Exchange official closing price. Brokerage commissions will reduce returns.

Carefully consider the investment objectives, risks, charges and expenses of Roundhill ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Funds investments may be non-diversified, meaning its assets may be concentrated in fewer individual holdings than a diversified fund and, therefore, more exposed to individual stock volatility than diversified funds. Investments in foreign securities involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more develop countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

NERD, BETZ, METV, WEED, CHAT, BIGB, MAGS, LNGG, LUXX, KNGS, and YBTC are distributed by Foreside Fund Services, LLC. DEEP is distributed by Quasar Distributors, LLC.