Roundhill Roundup - Trump Bump, or Trump Slump?

As we march through 2025, the U.S. economy is a mixed bag of solid realized growth coupled with lurking dangers following years of relative calm. The S&P 500 is down roughly 5% from its all-time high on February 19. Interestingly, the greatest pain has been centered around stocks with the greatest interest from retail investors, as evidenced in the chart below. After returning nearly 76% in 2024, the Nomura Animal Spirits basket is down nearly 7% year-to-date in 2025.

While the broader market has not yet experienced a correction, let alone a bear market, investors did not seem to appreciate how quickly the ‘Trump bump’ would turn to the ‘Trump slump’, especially for previously high-flying names. The Trump administration appears comfortable with short-term pain in equity markets in order to achieve their long-term initiatives. Consequently, uncertainty around the extent of tariffs and short-term trajectory of economic growth are both elevated, particularly since economic growth was already showing some signs of slowing.

On balance, the U.S. economy does not appear to be in major trouble quite yet. The jobs market has been strong, the Manufacturing Purchasing Managers’ Index (PMI) is in expansionary territory and S&P 500 just registered +17% year-over-year earnings in Q4. But stock prices, as well as bond yields, have fallen as the U.S. Economic Surprise index entered negative territory and diverged from the Eurozone and China Economic Surprise indexes.

We are mindful that extreme readings in soft data (sentiment and confidence) can serve as powerful contrarian indicators and may produce tactical lows in the equity market. At the same time, hard data (earnings, GDP, unemployment, and retail sales etc.) seem to be stable enough as the economy enters the digestion phase as tariffs, as well as their consequences, come into effect. To that end, we find ourselves cautious on equity markets in the near term, but let us review the balance of positives and negatives.

The Silver Lining: Economic Bright Spots

Solid Economic Growth: The U.S. economy expanded by 2.8% in 2024, following a 2.9% growth in 2023. While sticky, inflation has decreased from 9.0% year-over-year increases in 2022 to 3.0% today.

Labor Market Resilience: Unemployment rates have remained low, reflecting a tight labor market that supports consumer spending and economic stability.

The Dark Clouds: Tariffs and Inflation Stirring the Pot

Escalating Tariffs: The U.S. administration's recent decision to slap a 25% tariff on imports from Mexico and Canada, along with hiking tariffs on Chinese goods, is a potential ticking time bomb for supply chains, set to jack up costs for businesses and consumers alike.

Inflationary Pressures: Tariffs could catalyze an inflation reacceleration, as import taxes often lead to higher prices for consumer goods. At the same time, Sticky-Price U.S. CPI has struggled to decelerate further while Flexible-Price CPIs now positive and rising, making for an unattractive combination.

The Fed's Conundrum: Wrestling with Persistent Inflation

The Federal Reserve is caught between a rock and a hard place. Despite pulling out all the stops, inflation remains a thorn in the Fed's side, complicating monetary policy decisions. Walking the fine line between supporting economic growth and reining in inflation ties the Fed's hands in adjusting interest rates, preventing them from cutting to the extent previously forecasted.

While much of the above is increasingly consensus, here is what else we're watching.

Yield Curve Inversion

Longer-term U.S. interest rates have fallen sharply in the first two months of 2025. As a result, the U.S. 3-Month/10-Year yield curve re-inverted after finally turning positive in December 2024. Historically, this inversion has preceded recessions. Is the U.S. economy on course for a recession or is this a false alarm? Time will tell, but the signs may be ominous.

GDP Growth & Earnings

Historically, S&P 500 earnings growth has moved with changes in U.S. Gross Domestic Product (GDP). While the latest reading in real GDP may not signal trouble yet, investors have increasingly focused on the Atlanta Fed’s GDPNow measure, which serves as a real-time estimate of real GDP growth for the current measured quarter. As of March 3, 2025, the GDPNow estimate for 1Q’25 real GDP growth (seasonally adjusted annual rate) is -2.8%. While also just an estimate, one quarter of economic contraction does not make a recession. However, a prolonged slowdown in the economy will weigh on corporate profit growth, which has been a source of strength for stocks.

Magnificent Seven Valuations

While it is hard to argue the Magnificent Seven are inexpensive at an average of 28.4x next twelve months (NTM) price/earnings, it is hard to call the group expensive relative to the S&P 500. Valuation has been a pain point for the Magnificent Seven for investors over the past few quarters, but the current relative premium of 1.3x is the cheapest spread since January 2023. The Magnificent Seven are becoming more attractively valued, which we view as a welcome development.

Trade Policy Uncertainty

Mentions of tariffs and trade wars are surging in both company transcripts and news publications to the highest levels on record. The extent of tariffs, as well as any retaliatory tariffs, remains a moving target and consequently, has catalyzed further uncertainty on trade policy.

Historically, statistically extreme readings in the Trade Policy Uncertainty index have tended to result in short-term equity market pain over the next 3 and 6 months, while resulting in outperformance over the following year. So far, the market appears to be on track with historical precedent.

Extreme Bearish Sentiment

The spread between the American Association of Individual Investors (AAII) % Bullish and % Bearish readings is at historically extreme levels. 19.4% of respondents reported bullish expectations for the direction of the stock market over the next 6 months, while 60.6% reported bearish expectations. This has led to a spread of -41.2%, which ranks as the 8th worst reading in its history back to 1990.

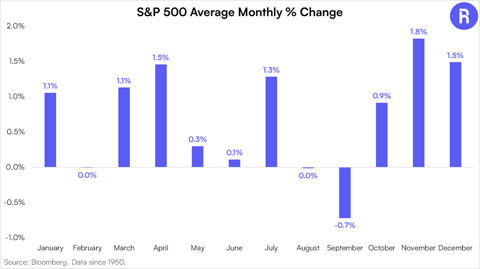

Interestingly, pronounced periods of extremely bearish sentiment tend to lead to better-than-average S&P 500 returns. In prior instances of overwhelming bearishness, the S&P 500 returns on average 3.3%, 5.8%, 12.2% and 15.9% over the next one, three, six and twelve months respectively. From a contrarian perspective, bearish sentiment could be a tailwind going forward.

Mixed Signals & Uncertainty

While the U.S. economy flashes some green lights with solid growth and a resilient labor market, the red flags of escalating tariffs and relentless inflation can't be ignored.

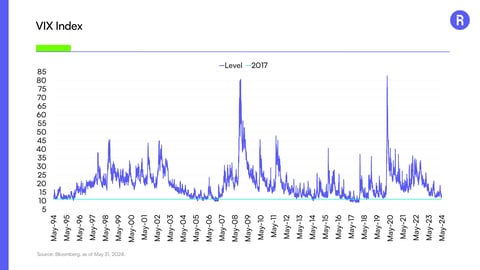

Ultimately, we view the uncertain macro backdrop as a fair reason to be more cautious over the coming weeks and months. As the results above indicate, extremely bearish sentiment from the AAII Bull/Bear survey paired with historic readings from the Trade Policy Uncertainty Index could serve as good buying opportunities for investors taking a longer-term view. However, the ongoing downside volatility has seen internal trends within the S&P 500 deteriorate, with less than 50% of stocks trading above their respective 200-day moving average. This has coincided with below average returns over the next twelve months. The market can rely on a small group of stocks to buoy the market higher, but sustainable trends require broad participation at this stage.

This information is provided solely as general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment related course of action. Investing involves risk, loss of principal is possible.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact 1-855-561-5728 or consult with the professional advisor of their choosing.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Use of Third-party Information: Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Roundhill Financial Inc. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Roundhill Financial Inc. or any other person. While such sources are believed to be reliable, Roundhill Financial Inc. does not assume any responsibility for the accuracy or completeness of such information. Roundhill Financial Inc. does not undertake any obligation to update the information contained herein as of any future date.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index.

Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision. The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

Glossary:

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

The Nomura Animal Spirits Basket includes stocks offered in levered single stock ETFs (LETFs). The LETF market boomed in popularity over the last two years, appealing to investors looking to amplify gains, hedge positions, and speculate without a margin account.

The AAII Sentiment Survey offers insight into the opinions of individual investors by asking them their thoughts on where the market is heading in the next six months and has been doing so since 1987. This market sentiment data is compiled and depicted below for individual use.

The ISM manufacturing index, also known as the purchasing managers' index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at manufacturing firms nationwide.

U.S. Categorical Economic Policy Uncertainty: Trade Policy - The Categorical Data include a range of sub-indexes based solely on news data. These are derived using results from the Access World News database of over 2,000 US newspapers. Each sub-index requires our economic, uncertainty, and policy terms as well as a set of categorical policy terms.

- Trade policy - import tariffs, import duty, import barrier, government subsidies, government subsidy, wto, world trade organization, trade treaty, trade agreement, trade policy, trade act, doha round, uruguay round, gatt, dumping