Roundhill Roundup: When Rates Rule Everything Around Us

It is hard not to think of the classic lyric “cash rules everything around me” when looking at markets today, because it’s clear that the path of rates rules everything around us. After months of steady gains across major indexes, November delivered the kind of crosscurrents that tend to define late cycle markets: we witnessed rate cut expectations shifting rapidly, stock leadership flipped, and speculative areas unwound hard.

And yet, underneath the noise, the macro backdrop remains steadier than headlines would suggest. As we move toward year end and look ahead to 2026, investors are navigating a market that is more nuanced but also more balanced than it was even a few weeks ago.

Several themes now stand out.

Options and Volatility Continue to Shape Stock Prices

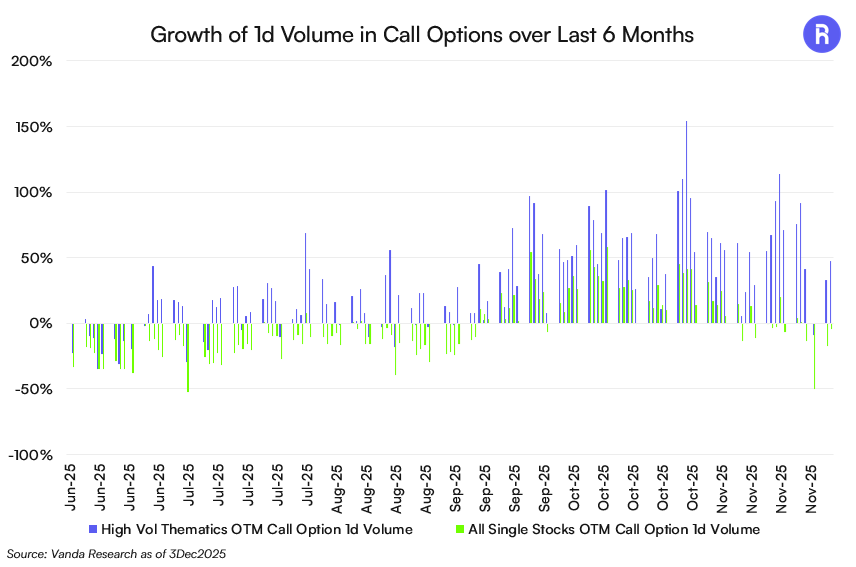

One of the clearest dynamics this year has been how outsized the influence of single stock options has become. In the more speculative corners of the market, option markets are clearly leading equities in a bold way. Retail favorites and high volatility names have increasingly traded on gamma dynamics rather than fundamentals, amplifying daily moves to a degree that simply did not exist a few years ago.

That speculative surge was finally forced to reset in November. High beta AI, crypto and quantum computing stocks all saw sharp unwinds as leverage came out of the system. While painful for those exposures, we believe the reset left the market in a healthier place with cleaner positioning, more balanced risk, and the distortions created by rapid inflows into weekly and zero-day options eased.

Compare the growth of call option volumes in these high volume thematics (AI, crypto, quantum computing) versus the total universe of single stocks below.

Tax Loss Selling and Profit Taking Are Adding Seasonal Noise

This time of year always introduces calendar driven flows. Tax loss selling has weighed on underperformers, particularly in small caps and speculative growth, while investors have also taken profits in the year’s biggest winners. After one of the strongest multi-month runs ever for the largest technology names, some trimming was inevitable. These seasonal flows can temporarily distort leadership but tend to reset quickly as the calendar turns and new capital reenters the market.

Rates Still Dictate Leadership

The last week or so has shown that interest rates remain the dominant force in determining who leads and who lags, even after a far better than expected earnings season. We first witnessed the reversal as money rotated out of high momentum tech and into defensives. The magnitude was striking. Health Care outperformed Technology by more than 13% in November (highlighted by the red arrow in the below chart), the widest monthly spread between the two sectors in more than 20 years.

One could see the rate sensitivity in real time. On November 20, NVIDIA posted a sharp intraday turnaround, flipping from solid gains on the heels of another strong earnings release to losses within hours as yields pushed higher. Even the most fundamentally supported mega cap names remain tethered to the direction of rates.

One could see the rate sensitivity in real time. On November 20, NVIDIA posted a sharp intraday turnaround, flipping from solid gains on the heels of another strong earnings release to losses within hours as yields pushed higher. Even the most fundamentally supported mega cap names remain tethered to the direction of rates.

Then came the reversal of the reversal beginning on November 21, when futures and bond markets began to price the possibility of rate cuts again. Growth and AI-linked names snapped back almost immediately. This pattern demonstrates how tightly equity leadership is tied to the rate path.

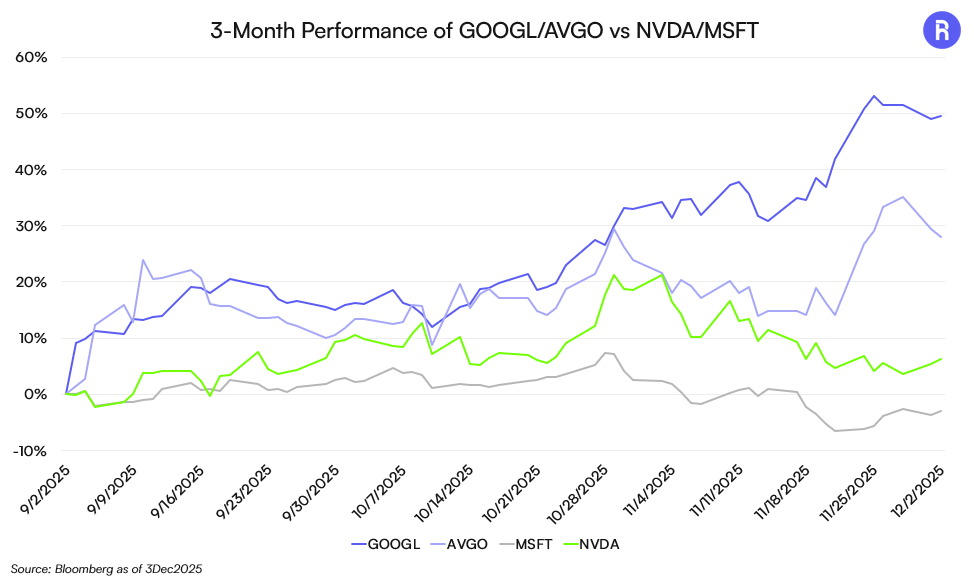

AI Leadership Is Being Re-Ranked

The broader AI trade is entering a more mature phase. Investors are no longer buying every company with an AI label. They are distinguishing between platforms with the infrastructure, silicon and distribution to monetize foundational and generative AI.

Google is increasingly being positioned as a genuine leader as momentum builds around Gemini, TPUs, and a rapidly strengthening cloud AI business. Amazon’s unveiling of Trainium3 reinforced that hyperscalers intend to own a larger share of their AI silicon stack rather than rely entirely on third party GPUs. At the same time, companies with heavy OpenAI exposure have faced headwinds tied to concerns over circular financing structures and debt.

This begs the question: is the AI trade still tradeable? Yes, it is not fading, it’s simply focusing. Leadership is shifting toward firms with durable economics, proprietary silicon and real customer adoption. This underscores the importance of individual stock selection and active management when investing in AI.

Fundamentals Still Have Room to Run

Even with the rotation we saw in November, we believe that the fundamental backdrop for the most profitable and systemically important technology platforms remains intact. The companies driving index level earnings continue to enjoy strong balance sheets, clear product roadmaps and multiple avenues for monetization. The Magnificent Seven, taken collectively, remain supported by real earnings power rather than narrative alone.

Glossary

Gamma: A measure of the rate of change of an option’s delta with respect to changes in the price of the underlying equity. Gamma indicates how quickly an option’s directional exposure increases or decreases as the stock price moves and is a key determinant of an option position’s sensitivity to volatility.

Beta: A measure of an asset’s sensitivity to movements in the broader equity market. Beta indicates how much an asset’s price is expected to change, on average, in response to a 1% change in a specified market benchmark, reflecting the asset’s relative systematic risk.

OTM (Out-of-the-Money): An option is considered out-of-the-money when it has no intrinsic value, meaning its strike price would not result in a profitable exercise relative to the current price of the underlying asset. For a call option, this occurs when the strike price is above the underlying price; for a put option, when the strike price is below the underlying price.

Graphics Processing Unit (GPU): A specialized semiconductor designed to perform highly parallel computations efficiently, making it well suited for graphics rendering and large-scale numerical workloads such as machine learning and artificial intelligence model training and inference.

Tensor Processing Unit (TPU): A custom application-specific integrated circuit optimized for machine learning workloads, particularly deep learning, enabling high-throughput, energy-efficient training and inference of neural network models.

This is not an offer, recommendation or professional advice.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Roundhill Financial Inc. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Roundhill Financial Inc. or any other person. While such sources are believed to be reliable, Roundhill Financial Inc. does not assume any responsibility for the accuracy or completeness of such information. Roundhill Financial Inc. does not undertake any obligation to update the information contained herein as of any future date.