Are the Magnificent Seven Still Magnificent?

In the lead-up to the second quarter 2024 earnings season, the Magnificent Seven stocks were at a precarious juncture. From the end of 2023, the Bloomberg Magnificent Seven Index rose 51% into the July 10 peak as investor optimism reached its boiling point. Following a subsequent 18.1% correction, expectations have moderated somewhat, potentially setting a more realistic bar for third quarter earnings as Tesla (TSLA) prepares to report on October 23rd. Here’s what we’re watching for the Magnificent Seven stocks as earnings season approaches.

Price Correlations Spiking as Volatility Rises

For the past two years, price correlations have been a positive for the Magnificent Seven. Despite being typically associated as a group, the Magnificent Seven interestingly saw their average three-month price correlation fall from mid-2022 to mid-2024, reflecting how the price movement of one member had less impact on other members. However, correlations have been rising since late June as the Magnificent Seven, and the S&P 500, approached the market high on July 10. As the Magnificent Seven have corrected from the July high and attempted to recover the drawdown, correlations (and volatility) have risen.

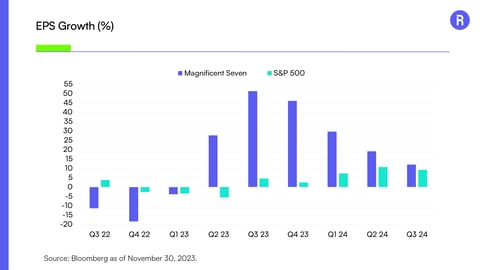

Net Income Growth Settling in Double Digit Territory

Naturally, investors have been focused on the slowdown in growth at the aggregate level for the Magnificent Seven. In our opinion, this feels exaggerated. While year-over-year net income growth is slowing from the peak growth rates achieved in the fourth quarter of 2023, the Magnificent Seven are still expected to post double-digit growth quarterly throughout 2025. Meanwhile, the broader market is expected to broaden out fundamentally, a healthy ingredient for a bull market to continue.

Margins in League of Their Own

Margins remain a major tailwind for the Magnificent Seven despite increased focus on margin growth deceleration. While the Magnificent Seven have seen margin estimates only increase by ~65 basis points over the last six months, the group’s aggregated estimated margin remains near record highs at 25.8%. The remaining 493 stocks in the S&P 500 are projected at a next twelve month estimated margin of 16.0%, almost ten percentage points lower than the Magnificent Seven. The Magnificent Seven’s level of profitability remains a major tailwind for the group.

Magnificent Seven in Spend Mode

During the second quarter 2024 earnings season, the Magnificent Seven’s earnings highlighted that the AI investment cycle remains in spend mode. Despite various and nuanced commentary from Alphabet, Amazon, Apple, Microsoft, Nvidia, Meta and Tesla on the artificial intelligence investment cycle, their clear collective intention is to keep spending. The Magnificent Seven’s aggregate capital expenditure is a record high for the group and appears set to continue growing over coming quarters.

Buyback Contribution Nearly 30% of S&P Total

S&P 500 stock buybacks are estimated to be around $236 billion for the second quarter of 2024. Five of the Magnificent Seven are in the top twenty of contributors, estimated to contribute $67 billion (about 28.4%) of that total amount to the S&P 500. A differentiator from other high-growth companies in the market, the Magnificent Seven’s collective balance sheet strength has enabled them to execute elevated buybacks, leveraging their robust financial positions to return capital to shareholders while continuing to invest in growth.

Valuations are Moderating

As of September 30th, the Magnificent Seven currently trades at 29.8 times next twelve month earnings, below the 2024 high of 31.2x. On a relative basis versus the S&P 500, the Magnificent Seven are looking more attractive, with the relative ratio off its year-to-date high. Historically, the Magnificent Seven have typically traded at a premium when compared to the broader market. While valuation likely can’t serve as a market timing tool alone, the absolute and relative price to earnings ratios for the Magnificent Seven could be seen as an entry opportunity for some investors.

The Next Catalyst

Since the August 7th correction lows, the Magnificent Seven have risen about 15.8% on a price return basis and are now 5.5% off record highs (as of October 10th). The catalyst for their next move higher remains pending. While the group’s valuation is still high relative to the broader market, it is below the elevated levels of previous years. Despite moderating net income growth, the group is expected to post double-digit growth over the coming quarters and throughout 2025. The Magnificent Seven’s profitability, viewed through margin expectations, remains in a league of its own. Although market sentiment around their AI investment cycle has cooled, robust buyback programs underscore their commitment to shareholder returns.

Overall, with earnings season underway, the Magnificent Seven appear to be on more realistic ground with a more balanced and rational outlook.

This information is provided solely as general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment related course of action. Investing involves risk, loss of principal is possible.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact 1-855-561-5728 or consult with the professional advisor of their choosing.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Use of Third-party Information: Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Roundhill Financial Inc. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Roundhill Financial Inc. or any other person. While such sources are believed to be reliable, Roundhill Financial Inc. does not assume any responsibility for the accuracy or completeness of such information. Roundhill Financial Inc. does not undertake any obligation to update the information contained herein as of any future date.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index.

Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision. The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

Glossary:

Bloomberg Magnificent 7 Price Return Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS).

Bloomberg US Large Cap ex Magnificent 7 Price Return Index is a float market-cap weighted benchmark designed to measure the most highly capitalized US companies, excluding members of the Bloomberg Magnificent 7 Index.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.