How to Invest in Cannabis: The Complete Beginners Guide

The legalization of cannabis for both medicinal and recreational purposes in various jurisdictions, both within the US and internationally, has facilitated a range of investment opportunities.

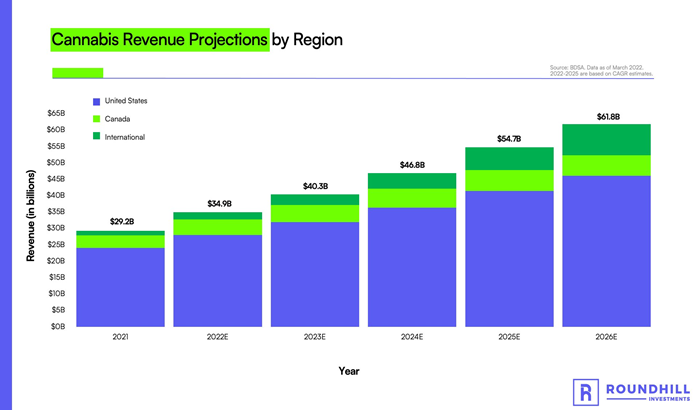

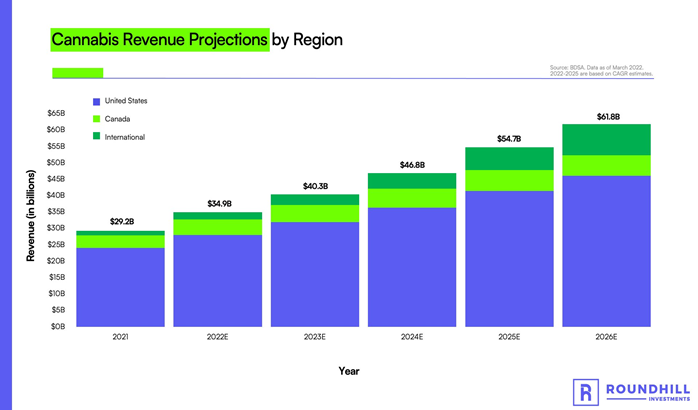

With new and existing companies developing legal products for a growing consumer base, this sector is unmistakably in its ascendancy, creating opportunities for investors to access a potentially lucrative new market. The value of the worldwide legal cannabis market is projected to increase, Cannabis market research firm BDSA projects a 16% compound annual growth rate (CAGR) for the global market between 2021 and 2026.

Source: BDSA, as of March 2022

This guide examines the emerging market, explores critical products, and presents ways for investors to capitalize on projected global growth trends.

An Introduction to Cannabis

Cannabis refers to three plants, each of which has psychoactive properties. It is made up of over 120 components known as cannabinoids. Two of these components are cannabidiol (CBD) and tetrahydrocannabinol (THC).

CBD is a psychoactive cannabinoid, but it isn’t intoxicating, and users don’t experience any kind of ‘high’. Its use is principally medical, helping to reduce pain and inflammation. It is also often used to ease migraines, nausea, and seizures and is sometimes used as an anti-anxiety treatment.

THC is the principal psychoactive compound in cannabis and creates the feelings of euphoria that are readily associated with the drug.

Types of Marijuana Products

The cannabis industry features marijuana products for both medical and recreational use. Medical marijuana is cannabis that’s used for medicinal purposes. It is often prescribed to adults as a treatment for chronic pain, anxiety, stress, and various forms of depression. Recreational marijuana is the use of cannabis for pleasure or leisure rather than for medicinal purposes.

Current Legal Landscape for Cannabis

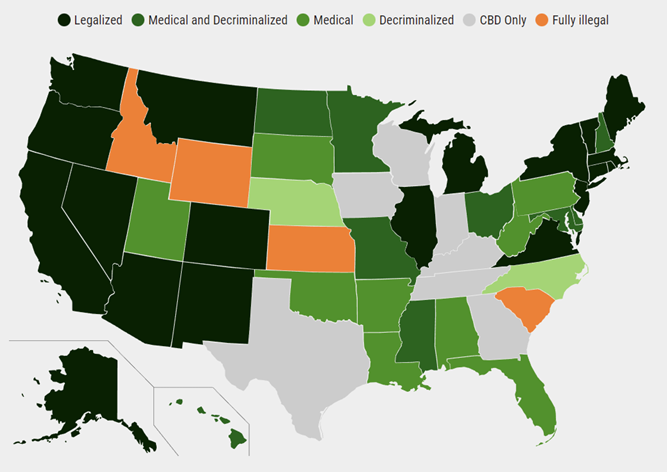

Medical marijuana is currently legal in 36 U.S. states, plus the District of Columbia. Outside the U.S., medical marijuana is legal in more than 40 countries.

As of June 2022, 19 states, two territories (Northern Mariana Islands and Guam), and the District of Columbia have fully legalized the adult use of cannabis for recreational purposes. A further ten states permit its medical use and have decriminalized the substance, a step just short of legalization. It is also legal in Canada, Georgia, Malta, Mexico, South Africa, and Uruguay.

Source: DISA, as of June 2022

Recreational Legalization of Cannabis

Since the Controlled Substances Act (CSA) of 1970 was signed into law, cannabis has been listed as a “Schedule I” controlled substance in the United States. This classification includes drugs that, according to the law, have a high potential for abuse, no accepted medical use in treatment, and a lack of accepted safety under medical supervision. While cannabis has remained on this schedule for over fifty years, the legalization story has been much more complicated than the implied blanket ban.

A milestone was reached in 2012, as Colorado and Washington became the first states to fully legalize cannabis for recreational use, in a period known as the “Green Rush.” The Cole Memorandum in 2013 attempted to clarify the government’s role in marijuana-related offenses, stating that the Justice Department would not enforce prohibition in states that have “legalized marijuana in some form.” In 2018, the United States Farm Bill legalized the cultivation of hemp containing minimal amounts of THC.

Categorization of Cannabis Companies

Cannabis companies fall into two primary categories: those that grow and prepare cannabis plants for commercial use and those that are ancillary to the process and the broader legal cannabis industry.

Since cannabis remains illegal at the federal level, plant-touching companies have come up with unique ways to operate nationally while abiding by the regulatory framework. These restrictions do not bind ancillary companies, as they manufacture the products and provide the services that support the industry without dealing with the plant itself.

Plant-touching Cannabis Businesses

Plant-touching businesses are licensed by the state(s) in which they operate and handle cannabis directly. Due to federal law, cannabis grown in one state must remain there for sale. Larger companies within the U.S. usually structure themselves as “multi-state operators” (MSOs), a business structure that involves multiple legal entities in several states. This is a complex model as each state operates as its standalone market, with unique localized regulations.

Products that are legal in one state may not be in other states. Seven states have legalized CBD oil, provided it does not exceed a certain THC level, but they do not permit the medical or recreational use of the plant.

MSOs can also face unique banking issues within the states in which they operate. They must open separate accounts for each licensed operation, even if they fall under the same parent. Most of these companies trade on Canadian exchanges because state-legal cannabis businesses cannot currently be listed on national U.S. exchanges like NYSE and Nasdaq.

Ancillary Businesses

Ancillary cannabis businesses supply their products and services to MSOs but do not handle the plant themselves. Some subsectors within this category include packaging and labeling companies, nutrient suppliers, capital goods manufacturers, and real estate investment trusts (REITs). Many of these companies do not exclusively service the cannabis industry, given federal banking regulations do not bind them. As such, most which serve the U.S. market are listed directly on a domestic exchange such as NYSE or Nasdaq.

The Investment Opportunity for Cannabis

With a more liberal legal landscape developing in the U.S. and beyond, alongside new products and market development, cannabis represents a growing investment opportunity for investors of all levels of experience.

Forecasted Cannabis Market Growth

The cannabis market is growing rapidly within the U.S. and beyond as more jurisdictions develop a more relaxed legal framework for cannabis products.

Cannabis market research firm BDSA projects a 16% compound annual growth rate (CAGR) for the global market between 2021 and 2026. This period may see the U.S. grow from $24 billion in cannabis sales in 2021 to $46 billion by 2026, a CAGR of approximately 14%, while international markets may grow from $1.4 billion to $9.5 billion, a CAGR of roughly 46%.

The research firm states that the bulk of this spending will be driven by Germany and Mexico, with France and the UK also expected to contribute significantly. Domestic growth will be driven by the number of non-legal states dwindling amid “unprecedented bipartisan support at the state level.”

While international sales in 2021 only amounted to 5% of the global total, BDSA projects this share will triple to 15% by 2026.

This growth in the international market could represent just the early stages of a much larger global movement as the use of medicinal cannabis products becomes increasingly widespread. Investing at this relatively early stage in the development of a legal cannabis industry could prove lucrative for longer-term investors.

Source: BDSA, as of March 2022

A Positive Shift in Social Attitudes

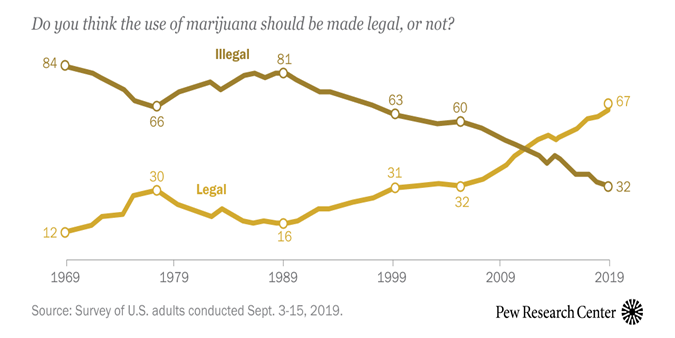

Social attitudes to cannabis are shifting in line with the changing legal landscape and increased normalization of cannabis products. CBD-based products are now widely available, with a growing understanding of the medical benefits that cannabis products can deliver. Discussions and debates about cannabis use now tend to be more measured and better informed, helping to create a facts-based environment allowing consumers to be better informed.

The United States has seen public opinion regarding the legal use of cannabis shift dramatically over the last 50 years. In 1969, Gallup polls indicated that just 12% of Americans supported the legalization of cannabis. Fifty years later, a Pew Research Center survey published in 2019 showcased that more than two-thirds of Americans support legalization, a figure that has increased steadily since 1989. An overwhelming majority of adults (91%) now believe the substance should be legal either for recreational use or medical use, with less than one in ten preferring to keep it illegal under all circumstances.

Potential Changes in Federal Law

At a Federal Level, the Secure and Fair Enforcement Regulation Banking Act (SAFER) is progressing toward becoming law. This would remove the difficulties that State-sanctioned cannabis businesses have in accessing banking and financial services, such as loans and deposit accounts.

While mainstream banks and more traditional financial institutions are expected to exercise caution in providing services to the legal cannabis industry, fintech companies are already developing new products designed to serve the industry. An average of 25-30% of all dispensary transactions across the sector rely on cashless payment processing services.

Federal Law is moving slowly, but there is increased bipartisan support to provide the industry with a regulatory and financial framework to provide customers with products and services. Full federal legalization of cannabis is widely predicted over the coming years, a development that would be a game-changing moment for the legal cannabis industry worldwide.

Source: Pew Research Center, as of September 2019

How to Invest in Cannabis Stocks?

In such a relatively new and largely untested market, it can be challenging to know how best to invest in the emerging legal cannabis industry. For most investors, the route to building an investment in cannabis companies will be through stocks in individual companies or through a dedicated cannabis industry ETF.

Buy individual Marijuana Stocks

It’s possible to buy stocks in individual legal cannabis-related companies. These include the cannabis growers and retailers who harvest crops and distribute the finished products to customers. Some of these companies have physical retail outlets that allow them to distribute marijuana directly for both medical and recreational purposes.

Cannabis-focused biotechs are researching the production of new medicinal and other goods that use cannabinoids. This sector is expected to experience sustained growth as research expands and develops new avenues.

Finally, there is a growing number of companies that provide ancillary services to legal cannabis companies. These can include companies that provide tools and equipment, packaging, management, and financial services to legal cannabis companies.

Some of the leading names in all investment categories include GW Pharmaceuticals, Scotts Miracle-Gro, and Canopy Growth.

If you purchase stocks in individual companies, you must extensively research the company, its financial position, management team, and future prospects.

Cannabis ETFs

Cannabis ETFs typically hold a diversified portfolio of stocks from various companies within the cannabis industry. This diversification can help spread risk across different industry segments, such as cultivation, distribution, and ancillary services. It reduces the impact of poor performance from individual companies and provides a more balanced investment approach.

ETFs are managed by professional fund managers conducting thorough, ongoing research into the cannabis market, the evolving legal landscape, and the performance of particular companies. When you choose to invest in an ETF, you benefit from extensive market insight, allowing you to participate in the industry's growth without some risks associated with investing in individual stocks. ETFs are a cost-effective way of investing in this rapidly growing and evolving industry.

Roundhill’s Cannabis ETF “Weed” offers concentrated exposure to the largest U.S. cannabis companies. The fund is solely composed of the 5 U.S.-based “Tier 1” Multi-State Operators (MSOs), companies that are large enough to tackle the challenges of operating in different states with different legal frameworks.

We believe investors in the Roundhill Cannabis ETF are well-placed to potentially benefit from the industry's predicted growth.

The importance of diversifying your investment

Diversification is essential to mitigate some of the risks associated with investing. In new, emerging markets such as legal cannabis, the risks are greater, but so too are the potential rewards.

Regulatory uncertainties and evolving public expectations around the cannabis industry add to the potential volatility of the sector. As the market is emerging, some of the leading players today may be in different positions in a decade. Diversifying your investments through a cannabis ETF can reduce that volatility, with different holdings within the ETF responding differently to industry developments.

A diversified ETF exposes you to different elements of the evolving cannabis industry, both plant-touching and ancillary. A strong performance in another could offset the potential underperformance in one area. Diversification can reduce short-term volatility while giving you the best platform for long-term growth.

What are the risks of investing in Cannabis stocks?

While investing in this exciting, rapidly growing market may deliver substantial returns, as with other forms of investment, it carries some risks.

- Legal Risks: While moves to liberalize cannabis production and use have been the trend over recent years, there is always the potential that this may stall or even reverse. Although this seems unlikely, it is worth noting that social and political attitudes can and do change.

- Cannabis Market Volatility: Currently, the cannabis market is largely in its infancy. This contributes to considerable volatility, which will likely continue for some time. Cannabis companies can be susceptible to industry and regulatory news. By investing in a cannabis ETF, you can mitigate some of this volatility, spreading your investment over a range of key companies within the sector.

- Supply vs Demand: As the regulatory landscape changes, new growers are entering the market. In some instances, this has created a fear of oversupply, leading to an oversaturation of the market. Fluctuations in the supply of cannabis products can contribute to the overall volatility of the sector.

The Future of The Cannabis Market

The cannabis market is widely predicted to grow and develop over the coming years. The ongoing trend toward legalization is gradually making it easier for companies to enter the market simultaneously as it expands the market size. Changes at a Federal Level in the U.S. will likely positively impact the market, not only in North America but worldwide.

Growing public acceptance and, in many cases, enthusiasm for medicinal and recreational cannabis products are also contributing to the impressive growth across the industry. It’s the reason why the value of the worldwide legal cannabis market is projected to increase by a compound annual growth rate of 26.3% and to reach $91.5 billion by 2028.

Conclusion

Time to invest in the Roundhill Cannabis ETF (Weed)

Investing in cannabis is a growth opportunity in both senses of the word.

The combination of an evolving legal landscape and impressive market growth makes cannabis an attractive proposition for investors. However, investing in individual companies at this stage could carry an oversized risk for ordinary investors. Instead, investing in a diversified ETF, such as the Roundhill Cannabis ETF “Weed,” exposes you to some of the industry’s most significant and well-resourced players. WEED offers precise exposure to the five leading U.S. MSOs in one ETF.

We believe that continued legalization by U.S. states and foreign governments globally results in an attractive growth profile for the cannabis sector.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the WEED Cannabis ETF please call 1-855-561-5728 or visit the website at https://www.roundhillinvestments.com/etf/weed/. Read the prospectus or summary prospectus carefully before investing.

The statements and forecasts above are subject to significant business, economic, and competitive uncertainties. Accordingly, there can be no assurance that such statements, estimates and projections will be realized, and no representations are made as to the accuracy or completeness of such statements and forecasts. Such statements and forecasts are not indicative of future investment performance. ETF characteristics and allocations are subject to change at any time.

Investing involves risk, including possible loss of principal.

Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer or a lesser number of issuers than if it was a diversified fund. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a lesser number of issuers than a fund that invests more widely. This may increase the Fund’s volatility and cause the performance of a relatively small number of issuers to have a greater impact on the Fund’s performance.

Companies involved in the cannabis industry face intense competition, may have limited access to the services of banks, may have substantial burdens on company resources due to litigation, complaints or enforcement actions, and are heavily dependent on receiving necessary permits and authorizations to engage in medical cannabis research or to otherwise cultivate, possess or distribute cannabis. Since the cultivation, possession, and distribution of cannabis can be illegal under United States federal law under certain circumstances, federally regulated banking institutions may be unwilling to make financial services available to growers and sellers of cannabis.

Cannabis-related companies are subject to various laws and regulations that may differ at the state/local and federal level. Laws and regulations related to the possession, use (medical or recreational), sale, transport and cultivation of marijuana vary throughout the world, and the Fund will only invest in non-U.S. Cannabis Companies if such companies are operating legally in the relevant jurisdiction. These laws and regulations may (i) significantly affect a cannabis-related company’s ability to secure financing, (ii) impact the market for marijuana industry sales and services, and (iii) set limitations on marijuana use, production, transportation, and storage.

In addition, cannabis-related companies are subject to the risks associated with the greater agricultural industry, including changes to or trends that affect commodity prices, labor costs, weather conditions, and laws and regulations related to environmental protection, health and safety. Cannabis-related companies may also be subject to risks associated with the biotechnology and pharmaceutical industries. These risks include increased government regulation, the use and enforcement of intellectual property rights and patents, technological change and obsolescence, product liability lawsuits, and the risk that research and development may not necessarily lead to commercially successful products.

As an ETF, the fund may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

The Fund is a recently organized investment company with no operating history. Please see the prospectus for details of these and other risks.

Fund is distributed by Foreside Fund Services, LLC.

Foreside Fund Services and Roundhill Investments are unaffiliated companies.

*Neither Roundhill Investments nor WEED Cannabis ETF are affiliated with these financial services firms. Their listing should not be viewed as a recommendation or endorsement.