Cannabis Investing - Five Trends to Know

As the cannabis industry continues to expand, so too have the opportunities for investors looking to capitalize on this growth. In just the past ten years, the number of states and territories that have fully legalized the substance has jumped from two — Colorado and Washington — to nearly two dozen. While federal law still considers cannabis use and possession to be unlawful, states have been given leeway to pursue their own legalization pathways via a series of Congressional actions. This has been especially important post-COVID where many state treasuries have been faced with revenue shortfalls. The Brookings Institution estimates that in 2022, state and local income tax collections will decline by $40 billion, sales tax collections by $46 billion, and state corporate tax collections by $14 billion due to pandemic related disruptions.1 States that have a regulated cannabis market have already reaped billions of dollars in aggregate benefits, making the substance’s legalization a matter of fiscal prudence.2

In addition to the legalization picture, potential investors have other reasons to be excited about the nascent industry. The international cannabis market is projected to grow even faster than in the U.S., as only six countries have legalized recreational use. Public opinion towards cannabis has improved substantially since the 1990s, and more than two thirds of Americans now favor legalization, as do most Europeans. The industry is made up of a wide array of companies within two major categories – plant-touching businesses which handle cannabis directly, and ancillary businesses which provide products and services that support the industry.3 Investors can choose between many public corporations within these categories to express a particular view, or a broad swathe of them to diversify their investment. Many of these companies are trading at conservative valuations, as the deteriorating macroenvironment has led to depressed multiples for companies with low or negative profitability, presenting a potentially great investment opportunity.

1. Recreational Legalization

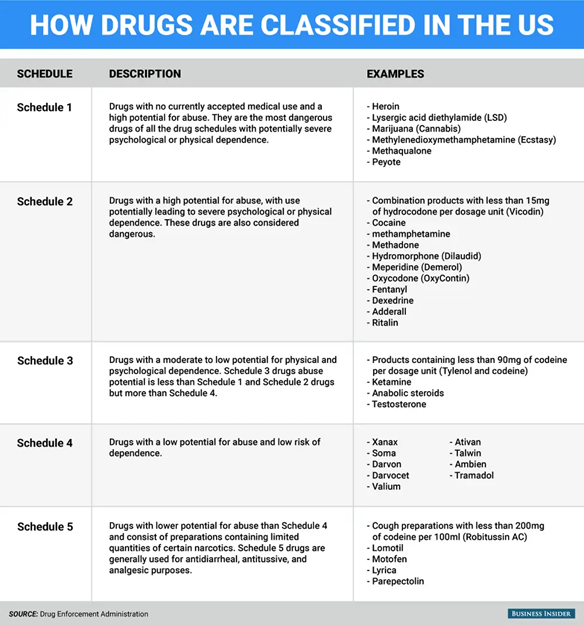

Since the Controlled Substances Act (CSA) of 1970 was signed into law, cannabis has been listed as a “Schedule I” controlled substance in the United States. This classification includes drugs that, according to the law, have a high potential for abuse, no accepted medical use in treatment, and a lack of accepted safety under medical supervision. While cannabis has remained on this schedule for over fifty years, the legalization story has been much more complicated than the implied blanket ban. In 1972, the National Commission on Marihuana and Drug Abuse issued a 1,182-page report to Congress, recommending that “the possession of marijuana for personal use no longer be an offense,” and for the “distribution of small amounts of marijuana for no remuneration, or insignificant remuneration, no longer be an offense.”4 This report, which was issued just two years after the drug was classified under Schedule I, set the early groundwork for decriminalization in the United States.

Figure 1: DEA Drug Scheduling in the United States

Source: Business Insider, as of May 2016.

In 1973, Oregon became the first state to decriminalize cannabis for recreational use, reducing the penalty for up to one ounce of possession to a $100 fine.5 The 1970s would see ten other states decriminalize, ending with Nebraska in 1978. From there, no other state would pursue decriminalization until 2001, partially due to the “War on Drugs” which saw an expanded focus in the 1980s under the presidency of Ronald Reagan. The Comprehensive Crime Control Act of 1984, which saw the U.S. criminal code overhauled for the first time in decades, established mandatory prison sentences for drug-related crimes. This was followed up by the Anti-Drug Abuse Act in 1986, codifying penalties based on the amount of the drug involved. A subsequent amendment to this act established a “three strikes policy,” which led to life imprisonment for repeat drug offenders.6

In 1996, California became the first state to legalize the medical use of cannabis with the ballot measure Proposition 215. From here, various states pursued medical cannabis initiatives either through state legislature or ballot measures, defying federal enforcement. DEA raids in California which targeted marijuana distribution would persist for over a decade. 2001 finally saw a return to recreational decriminalization, after Nevada’s state legislature overwhelmingly approved the measure.7 In the years that followed, reform efforts gained momentum, as both states and major cities implemented decriminalization policies.

Finally, a milestone was reached in 2012, as Colorado and Washington became the first states to fully legalize cannabis for recreational use, in a period known as the “Green Rush.” The Cole Memorandum in 2013 attempted to clarify the government’s role in marijuana-related offenses, stating that the Justice Department would not enforce prohibition in states that have “legalized marijuana in some form.” In 2018, the United States Farm Bill legalized the cultivation of hemp containing minimal amounts of THC. In 2019, various legislation related to cannabis banking, descheduling, and expungement of convictions passed the House, but none have currently made it through the Senate.

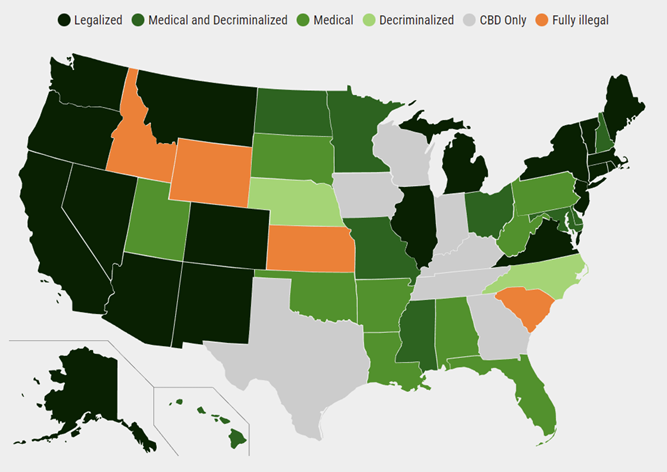

As of June 2022, 19 states, two territories (Northern Mariana Islands and Guam), and the District of Columbia have fully legalized the adult use of cannabis for recreational purposes.8 A further 10 states permit its medical use and have decriminalized the substance, a step just short of legalization. Another 17 states allow for limited use of cannabis, either via medical use only, CBD use only, or more narrow use cases. In total, only four states — Idaho, Wyoming, Kansas, and South Carolina — still fully restrict the drug. All 19 fully legal states and Washington D.C. permit the recreational use of cannabis for adults 21 years and older, in line with the age limit for alcohol purchases. While states have leeway to regulate cannabis within their borders, state-licensed businesses cannot work with traditional financial institutions due to federal laws. The Secure and Fair Enforcement (SAFE) Banking Act would remove this prohibition, but the legislation has yet to clear the Senate, despite being advanced by the House six times, either as an amendment or as stand-alone legislation.9

Figure 2: Legal Status of Cannabis by U.S. State (June 2022)

Source: DISA, as of June 2022.

2. Expanding Markets

About 75.3% of Americans are aged 20 and over, or about 249.6 million adults, based on U.S. census data which utilizes five-year wide brackets. Using this slightly wider estimate which includes 20 year olds, there are about 109.1 million residents, or 43.7% of the population, who can consume cannabis in one of the 19 legal states and Washington D.C. While this may be the case, not all these states have started recreational sales. In New York for example, which made recreational cannabis legal in 2021, the first dispensaries are expected to open in late 2022 or early 2023. With a population of about 15.2 million adults aged 21 and over, the state has the fourth highest total addressable market in the U.S., with 5.9% of the population.

Other large states that have legalized cannabis but have not begun sales include Connecticut, New Jersey, Virginia, Rhode Island, and New Mexico. These six states, which are all expected to see their first sales by 2024 or sooner, comprise 13.1% of the population. The lack of operational dispensaries immediately after legalization is due to the license allocation process. For example, New York is granting priority to those who have been convicted of a marijuana related offense or have a family member who has been.10 In Virginia, a social-equity program is being developed which ensures that Black Virginians, who were more than twice as likely to be prosecuted for marijuana related offenses, could compete in the new market.11

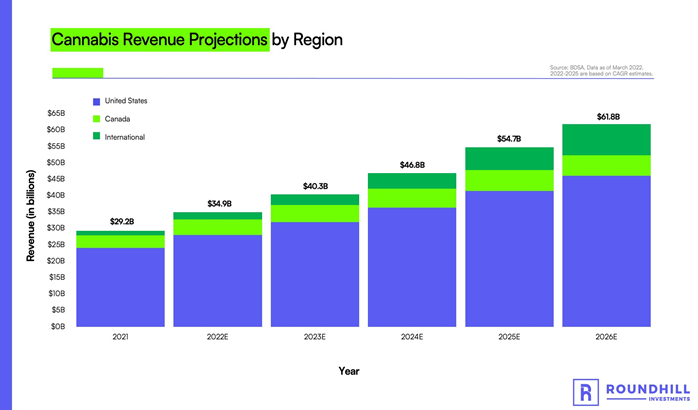

Beyond the opportunity in the United States, where over half of the population still lives in unregulated markets, international markets outside of the U.S. and Canada are forecasted to have the fastest growth. Cannabis market research firm BDSA projects a 16% compound annual growth rate (CAGR) for the global market between 2021 and 2026. This period may see the U.S. grow from $24 billion in cannabis sales in 2021 to $46 billion by 2026, a CAGR of approximately 14%, while international markets may grow from $1.4 billion to $9.5 billion, a CAGR of approximately 46%. The research firm states that the bulk of this spending will be driven by Germany and Mexico, with France and the UK also expected to contribute significantly as well. Domestic growth will be driven by the number of non-legal states dwindling amid “unprecedented bipartisan support at the state level.”12 While international sales in 2021 only amounted to 5% of the global total, BDSA projects this share will triple to 15% by 2026.

Figure 3: Cannabis Revenue Projections by Region

Source: BDSA, as of March 2022.

The recreational use of cannabis is illegal in the vast majority of countries. Just six – Canada, Uruguay, Georgia, Malta, Mexico, and South Africa – have legalized cannabis for possession and consumption, with all but Uruguay (which legalized in 2013) having made it permissible in the last five years. Malta became the first European nation to legalize the substance in 2021, having done so by an Act of Parliament.13 The small nation, with a population of about 516,000, allows for the possession, consumption, and cultivation of cannabis, though sales must be handled through nonprofit organizations. Only Canada and Uruguay have permitted for-profit sales but buying in Uruguay is limited to residents of the South American nation.

3. Public Acceptance

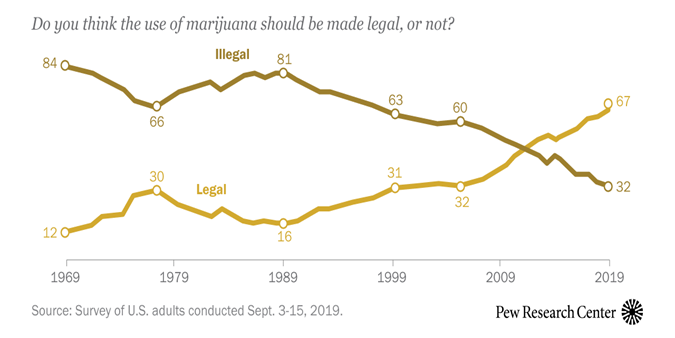

The United States has seen public opinion regarding the legal use of cannabis shift dramatically over the last 50 years. In 1969, Gallup polls indicated that just 12% of Americans supported the legalization of cannabis. However, a new Pew Research Center survey published in 2019 showcased that more than two-thirds of Americans support legalization, a figure which has increased steadily since 1989.14 An overwhelming majority of adults (91%) believe the substance should be legal either for recreational use or medical use, with less than one in ten preferring to keep it illegal under all circumstances. Among global markets, the United States leads the pack in the perception of legal cannabis.

Figure 4: U.S. Public Opinion on Legalizing Cannabis, 1969 – 2019

Source: Pew Research Center, as of September 2019.

The same study displays similar divides along party lines and generations that have been present for years, though support among all groups has been increasing. Both Democratic leaning and Republican leaning voters believe cannabis use should be legal, with 78% of Democrats and 55% of Republicans surveyed in favor. Among generations, only the Silent Generation, or those born between 1928 and 1945, do not favor legalization, with only 35% in favor. The majority of Boomers (63%), Gen Xers (65%), and Millennials (76%) supported the measure. Given that these cohorts are becoming a larger share of the U.S. voter base, and most supporters of either political party support legalization, it seems likely that momentum will continue for more states to legalize.

Voter support may lead to more cannabis-friendly Congressmen and Senators getting elected and implementing legislation to support the industry. Even if all 50 states legalize cannabis, since it is illegal on the federal level, there would remain pervasive risks to plant-touching companies. Banking restrictions remain the largest obstacle for cannabis operators in the United States, as national banks cannot accept their deposits, loan them money, help them issue equity or debt, or service them in general. While the federal government tolerates industry activity within individual states, the Cole Memorandum warns that the Department of Justice would prevent “the diversion of marijuana from states where it is legal under state law in some form to other states,” enshrining the government’s role in regulating interstate commerce.15

4. Industry Diversification

The growth of legal cannabis has led to the proliferation of a wide variety of businesses supporting the industry. There are two broad categories that all cannabis companies fall into — plant-touching and ancillary.16 Since cannabis remains illegal at the federal level, plant-touching companies have come up with unique ways to operate nationally, while abiding within the regulatory framework. Ancillary companies are not bound by these restrictions, as they manufacture the products and provide the services that support the industry, without dealing with the plant itself.

Plant-touching businesses are licensed by the state(s) in which they operate, and handle cannabis directly. Due to federal law, cannabis grown in one state must remain there for sale. Larger companies within the U.S. usually structure themselves as “multi-state operators” (MSOs), a business structure which involves multiple legal entities in several states. This is a complex model as each state operates as its own standalone market, with unique localized regulations.17 For example, products that are legal in one state may not be legal in other states. There are seven states that have legalized CBD oil for medicinal use that does not exceed a certain THC threshold, but do not allow for other medical or recreational use of the plant. Furthermore, MSOs face unique banking issues in the states they operate in, and must open separate accounts for each licensed operation, even if they fall under the same parent.18

The largest MSOs are vertically integrated, controlling the entire operation from cannabis cultivation to packaging and dispensary distribution. Most of these companies trade on Canadian exchanges, since state-legal cannabis businesses cannot be listed on national U.S. exchanges like NYSE and Nasdaq (an issue attempting to be solved by the newly introduced CLIMB Act). One such example is Cresco Labs, which is listed on the Canadian Securities Exchange (CSE: CL) and trades in U.S. over-the-counter markets under the ticker “CRLBF.” The company is headquartered in Chicago and operates in 10 states, through 21 production facilities and 50 owned dispensaries.20 According to the company, Cresco’s portfolio of brands are “aligned to distinct audiences, need states and occasions.” This type of granular segmentation allows MSOs to target a growing customer base that has grown accustomed to product variety. Other vertically integrated plant-touching MSOs include Curaleaf, Green Thumb Industries, and Trulieve, all which feature a primary Canadian listing and secondary OTC U.S. listing.

Ancillary cannabis businesses supply their products and services to MSOs, but do not actually handle the plant themselves. Some subsectors within this category include packaging and labeling companies, nutrient suppliers, capital goods manufacturers, and real estate investment trusts (REITS). Many of these companies do not exclusively service the cannabis industry, given they are not bound by federal banking regulations. As such, most which serve the U.S. market are listed directly on a domestic exchange such as NYSE or Nasdaq. One example of a publicly traded ancillary name is GrowGeneration (NASDAQ: GRWG), which sells cultivation products such as grow lights, hydroponics systems, and nutrient sets to both recreational and commercial growers. GrowGeneration has benefited from the rapid growth of the cannabis industry, as annual revenues have grown from $8 million in 2016 to $423 million in 2021, a 5 year CAGR of 121%. Despite this growth, the company now trades at a market capitalization of $269 million as of July 7, 2022, despite having less than $40 million in long term debt.21

5. Compelling Valuations

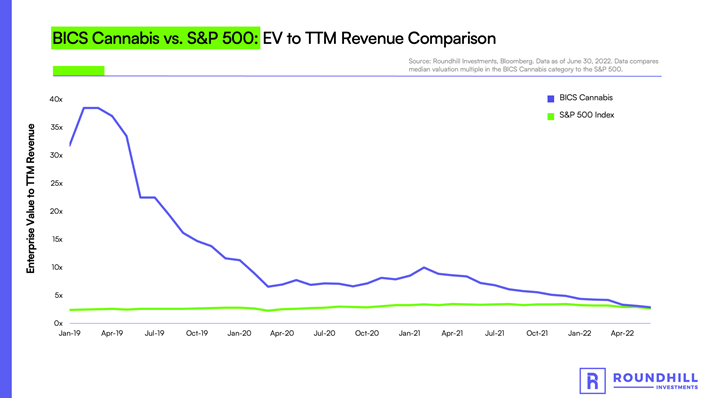

As with GrowGeneration, many cannabis companies have seen extreme valuation compression since mid-2021, when interest rates started rising as the Fed committed to tightening financial conditions to squash inflation. This has led to a market-wide repricing of companies with low or negative profitability as investors prioritize cash flows over future growth potential. Given that cannabis’ prospects are mostly forward looking, multiples for companies within the industry have fallen dramatically. The Bloomberg Industry Classification Standard (BICS) for cannabis contains 204 active publicly traded companies worldwide. The median enterprise value to trailing revenue multiple for these companies has fallen from 31.7x in January 2019 to 2.8x as of June 2022. During this same period, the median company in the S&P 500 has seen a slight increase in this valuation metric from 2.4x to 2.7x.

Figure 5: Valuation Comparison Between Median S&P 500 and BICS Cannabis Company

Source: Roundhill Investments, Bloomberg, as of June 30, 2022.

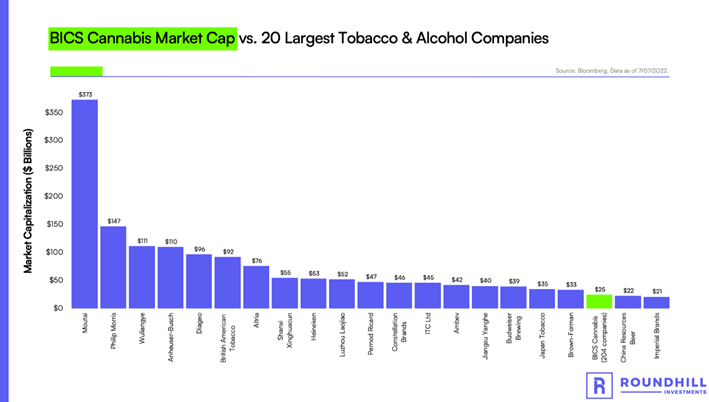

The largest company within the BICS Cannabis classification is Curaleaf, with a market capitalization of $3.7 billion as of July 7, 2022. This is approximately 15% of the total valuation for the entire sector, which stood at just $25 billion. If this sum were its own company, it would rank 19th when compared with the 20 largest publicly traded tobacco and alcohol stocks. While some of the giants like Philip Morris and British American Tobacco have said that cannabis is a part of their future, they remain significantly underinvested when compared with the largest MSOs, which have a fraction of their valuation. Furthermore, while regulatory momentum for the cannabis industry is positive, there has been heightened scrutiny on tobacco. The Biden administration is currently weighing a rule to establish a maximum nicotine level on cigarettes and other finished tobacco products in an attempt to make them less addictive. This may serve as a tailwind to lift cannabis valuations from their depressed levels, as plant-touching companies may get acquired as tobacco manufacturers attempt to diversify their revenues.

Figure 6: Cannabis Industry Market Cap vs. Largest Tobacco & Alcohol Companies

Source: Roundhill Investments, Bloomberg, as of June 30, 2022.

2https://www.mpp.org/issues/legalization/cannabis-tax-revenue-states-regulate-cannabis-adult-use/

3https://www.leafly.com/news/industry/cannabis-business-models-101

5https://www.oregonlive.com/marijuana/2014/11/legal_marijuana_in_oregon_a_lo.html

6https://www.pbs.org/wgbh/pages/frontline/shows/dope/etc/cron.html

8https://disa.com/map-of-marijuana-legality-by-state

9https://norml.org/act/keep-safe-banking-in-the-america-competes-act/

10https://www.nytimes.com/2022/04/27/style/nj-ny-marijuana-sales.html

14https://www.pewresearch.org/fact-tank/2019/11/14/americans-support-marijuana-legalization/

15https://scholarship.law.vanderbilt.edu/faculty-publications/1223

16https://www.leafly.com/news/industry/cannabis-business-models-101

17https://taxpracticenews.com/cannabis-multi-state-operators-and-nexus/

18https://fincann.com/blog/cannabis-mso-banking/

20https://investors.crescolabs.com/investors/overview/default.aspx

21Sourced from Bloomberg data