The Magnificent Seven: Durable in a Disrupted World

“You can check out any time you like, but you can never leave.” — The Eagles, Hotel California

These lyrics hit differently in 2025. For investors navigating a market clouded by uncertainty including tariffs, inflation, and a potential policy pivot, the Magnificent Seven continue to command attention. Despite a rough start to the year, their dominance of earnings power, operational quality, and economic relevance remains unshaken. Through the lens of the Roundhill Magnificent Seven ETF (MAGS), we examine whether these giants might become the new defensives as the wall of worry grows.

Performance & Positioning

After an eye-popping 64% total return in 2024, MAGS has pulled back by 4.6% YTD. This retreat reflects increasing skepticism around valuations, sector concentration, and the growing impact of global trade disruptions. Yet, flows into MAGS remain relatively resilient compared to other high-growth ETFs, suggesting institutional investors are trimming, but not abandoning, core exposure.

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (855) 561-5728. For more information, including current holdings and standardized performance: https://www.roundhillinvestments.com/etf/mags/

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (855) 561-5728. For more information, including current holdings and standardized performance: https://www.roundhillinvestments.com/etf/mags/

Earnings & Valuations: Stretched, But Supported

The fundamental picture remains strong:

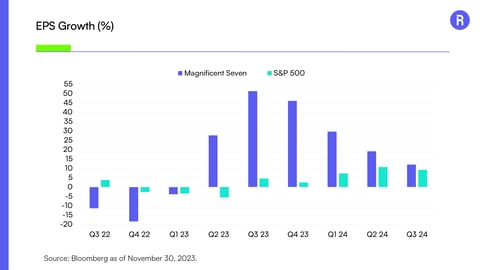

- Q4 2024 aggregate net income for the Magnificent Seven totaled $152.5 billion, up nearly 31% year-over-year.

- Operating margins approached 28.5%, ten points higher than the S&P 500’s 17.6%.

Valuations have corrected from extremes, but remain elevated:

- Forward price/earnings (P/E) for MAGS is ~25x vs. the S&P 500 at ~20x.

- Forward price/sales (P/S) at ~6.3x underscores rich growth expectations.

These are high numbers—but not unjustified given the cash-generating firepower and return on invested capital (ROIC) superiority of the group.

Technical Perspective: MAGS in Focus

Technically, MAGS has support just under $50 at its 200-day moving average, a level closely watched by investors. In the short-term, MAGS has further support at the 50-day moving average and the $45 level, a significant level from which MAGS broke out in September 2024. Relative strength versus the equal-weighted S&P 500 has stabilized and has not made a relative low since mid-April. In our view, this suggests a pause rather than a breakdown in long-term leadership for the Magnificent Seven.

- Momentum remains intact over a 12-month horizon, and the fund is up 70% since early November 2023.

- MAGS stabilizing above $45 after a turbulent first quarter is an important first step for the group. From a longer-term perspective, further relative performance improvement and continuing to trade above the April 2025 price lows would be positives for the Magnificent Seven.

The Bear Case for Traditional Defensives

In theory, utilities and consumer staples should shine amid volatility. But in practice, they face structural headwinds:

- Utilities are heavily indebted and acutely vulnerable to rising real yields.

- Staples are battling margin pressure, shelf-space competition, and lower pricing power in an age of AI-driven digital consumption.

- Both sectors are less exposed to secular growth including cloud computing, automation, and AI, making their earnings growth potential far less compelling.

Meanwhile, the Magnificent Seven offer:

- Durable earnings power with balance sheet strength: The Magnificent Seven stocks combine high free cash flow, low debt, and dominant competitive positions—traits that support resilience across economic cycles.

- Exposure to secular growth and AI leadership: These companies sit at the center of transformative trends like artificial intelligence, cloud computing, and digital consumption, making them long-term growth engines even amid macro uncertainty.

In short: the old defensives are levered, yield-sensitive, and growth-starved. The new defensives are rich in cash, high in quality, and tied to the arteries of global productivity.

Conclusion: Expensive, but Essential

It’s fair to argue that the Magnificent Seven got ahead of themselves. But the selloff has brought valuations closer to equilibrium with the broader market. More importantly, these companies aren’t speculative bets on future adoption. They are the infrastructure of the real economy and in some cases, staples within global consumers’ lives.

As global trade frictions intensify, exposure to enterprise demand, artificial intelligence, cloud computing, and automation may prove more durable than soda sales or regulated electricity.

MAGS offers diversified exposure to this rare blend of growth, quality, and macro relevance. In a world where clarity is scarce, the Magnificent Seven remain, ironically, the most grounded in real earnings and economic activity.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/MAGS. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. The Fund expects to have concentrated (i.e., invest more than 25% of its net assets) investment exposure in one or more of the Technology Industries at any given time, which may vary over time. Further, the Fund expects to obtain such investment exposure by transacting primarily with a limited number of financial intermediaries conducting business in the same industry or group of related industries. As a result, the Fund is more vulnerable to adverse market, economic, regulatory, political or other developments affecting those industries or groups of related industries than a fund that invests its assets in a more diversified manner. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.

Glossary:

The price-to-earnings (P/E) ratio measures a company's share price relative to its earnings per share (EPS). Often called the price or earnings multiple, the P/E ratio helps assess the relative value of a company's stock. It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market.

The price-to-sales (P/S) ratio is a valuation ratio that compares a company’s stock price to its revenues. It is an indicator of the value that financial markets have placed on each dollar of a company’s sales or revenues.

Return on invested capital (ROIC) is a measurement of a company's efficiency in using its capital to generate profits. It is calculated by dividing net operating profit after tax (NOPAT) by invested capital.