Market Update: Is it Cuts or is it Trump?

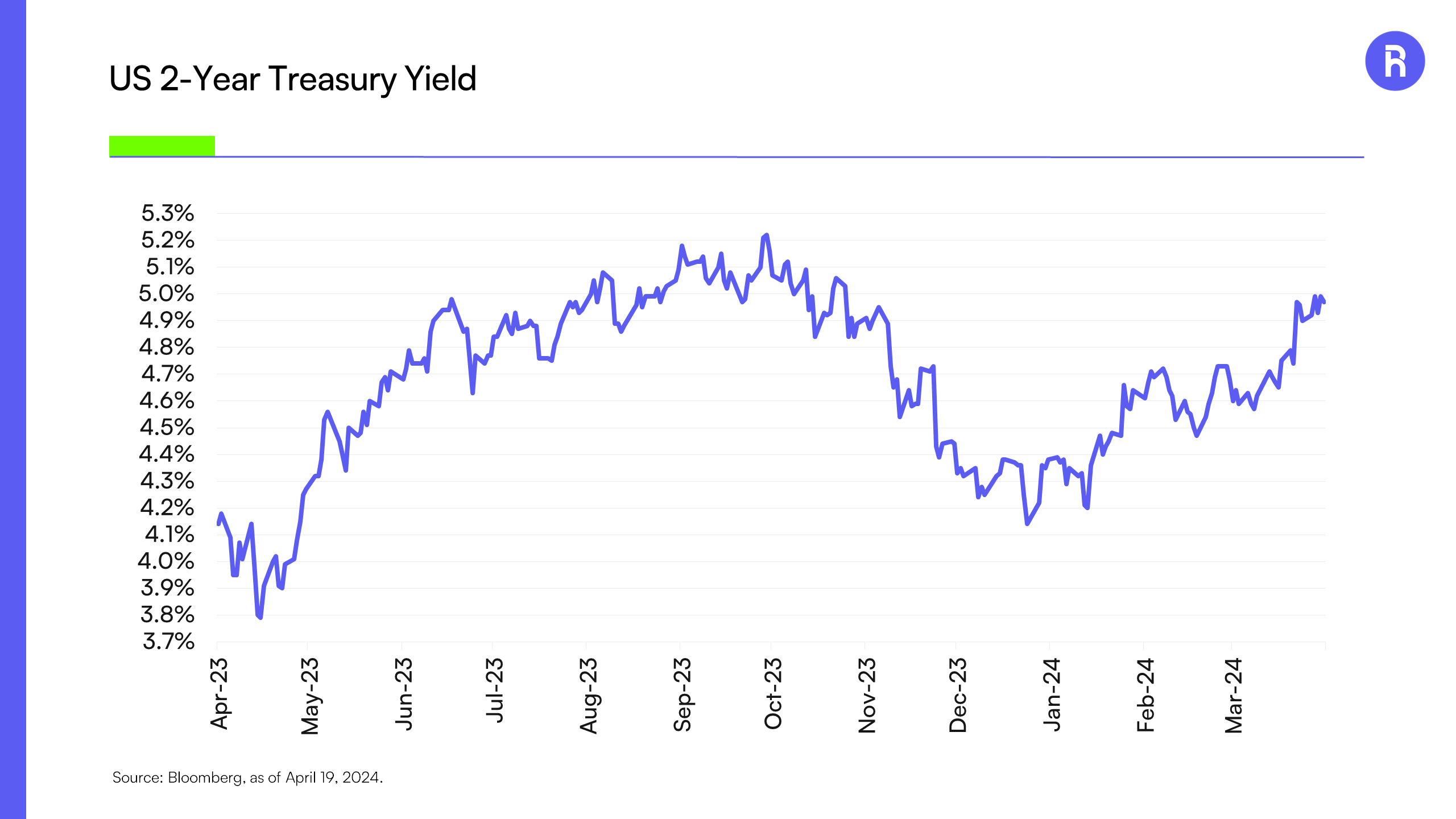

Bond yields are at their highest levels since November as investors are waking up to the fact that inflation is stalling well above the Fed’s 2% target. This puts the Fed in a challenging situation. What is different this time around is that the economy is on considerably stronger footing, especially the jobs market. In other words, the Fed does not need to cut rates to spur the economy. In fact, they need to ensure that inflation remains under control with some economists, such as the former U.S. Treasury Larry Summers even making a case that the Fed should be hiking rates if inflation remains higher than hoped. This makes it seem increasingly unlikely the Fed will cut in the coming months considering we had another month of higher than expected inflation with Headline CPI hitting a 6-month high of 3.5% year over year and Core CPI up to 3.8% year over year.

Yields are on the Rise

Source: Bloomberg, as of April 19, 2024.

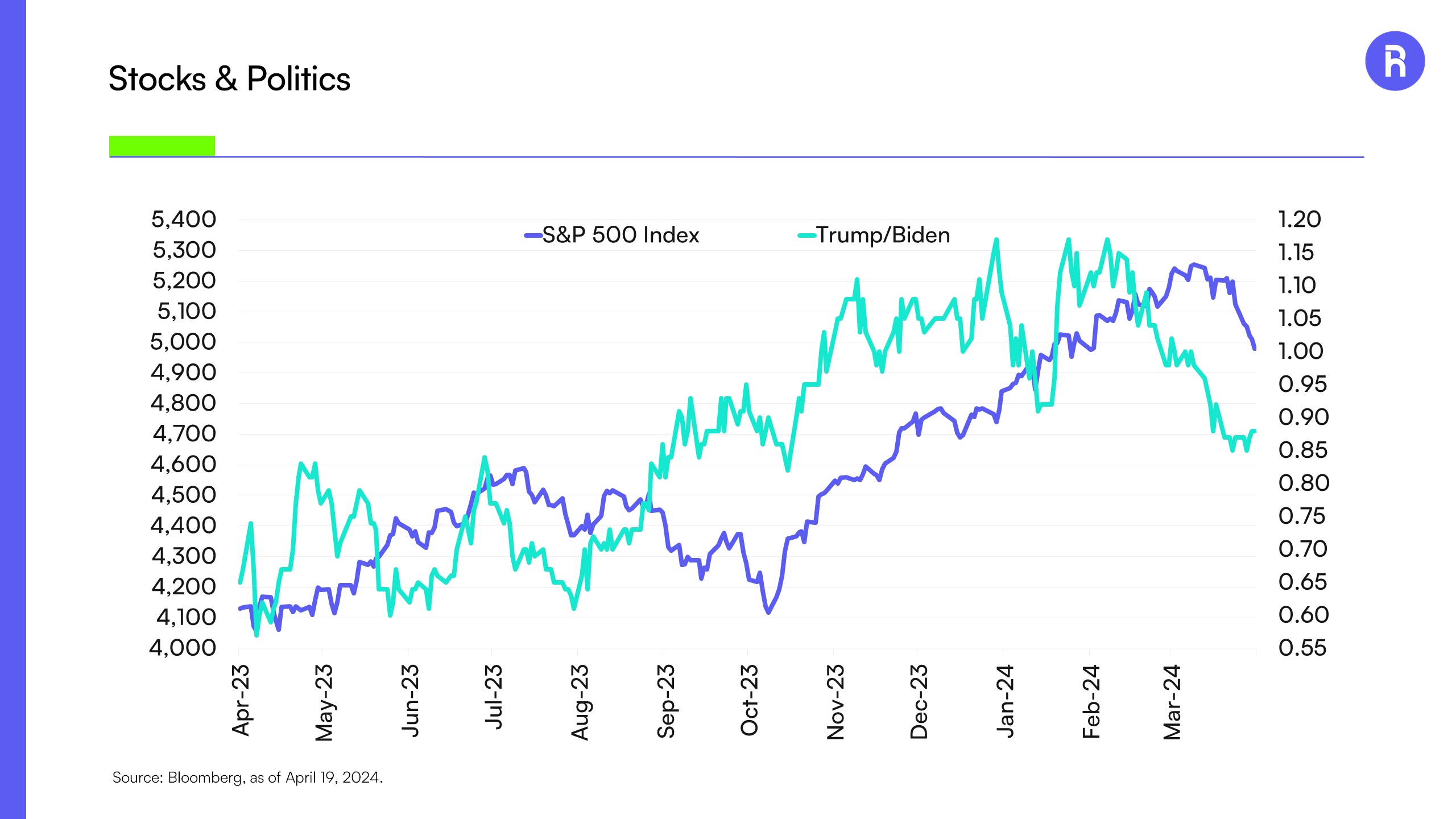

This move in rates coincides with markets taking a breather after an unexpectedly strong start to the year. But what if yields aren’t the whole story behind the recent pullback? What if the election is actually playing a role here?

After all, the market is supposed to be a discounting mechanism. As highlighted below, the flip in Biden and Trump’s respective odds of winning the U.S. Presidential election has recently coincided with the market’s decline. Since the start of the year, Trump’s lead in the betting markets aligned with the S&P 500’s rally. More recently, Trump’s legal issues may have dented his chances of winning even as Biden is wildly unpopular and Robert F. Kennedy Jr. is gaining ballot access potentially throwing a curveball into the election. Markets may have been taking comfort that Trump was in the driver’s seat and his presidency would be better for the big business. Regardless of one’s politics, the closer the election is the more investors need to pay attention to it. We would caution that this may be a spurious correlation, but it should not be ignored as this election season is teeing up to be a very competitive Presidential contest.

Trump’s Decline has Coincided with the Markets Selloff

Source: Bloomberg, PredictIt, as of April 19, 2024.

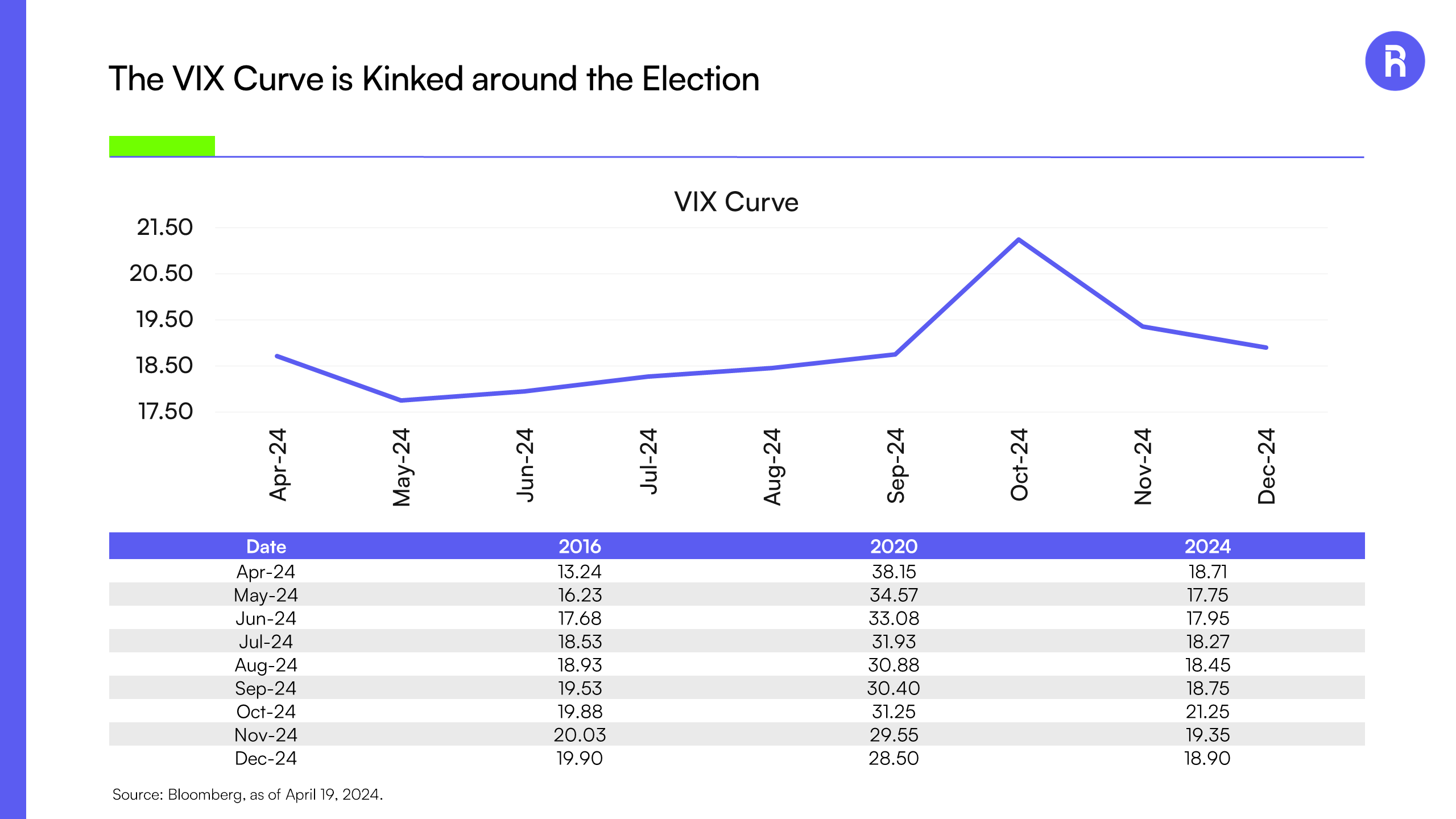

Another sign of the election starting to make its way into stocks is through the VIX curve. There is a notable kink around the time of the U.S. Presidential election. This likely means that investors are concerned about the outcome of the election and are anticipating an increase in volatility. Notably, we saw a kink in 2020, but it is much smaller than today’s curve. In 2016, there was not much to observe. Perhaps, this is due to investors anticipating in the spring of 2016 that Trump had a less likely shot at winning considering Hillary Clinton was polling higher at the time. In fact, Clinton was polling higher in the FiveThirtyEight 2016 election forecast based on national polls heading into the election that November. Regardless of the reasons, it appears that the election is not going unnoticed this time around.

The VIX Curve is Kinked around the Election

Source: Bloomberg, as of April 19, 2024.

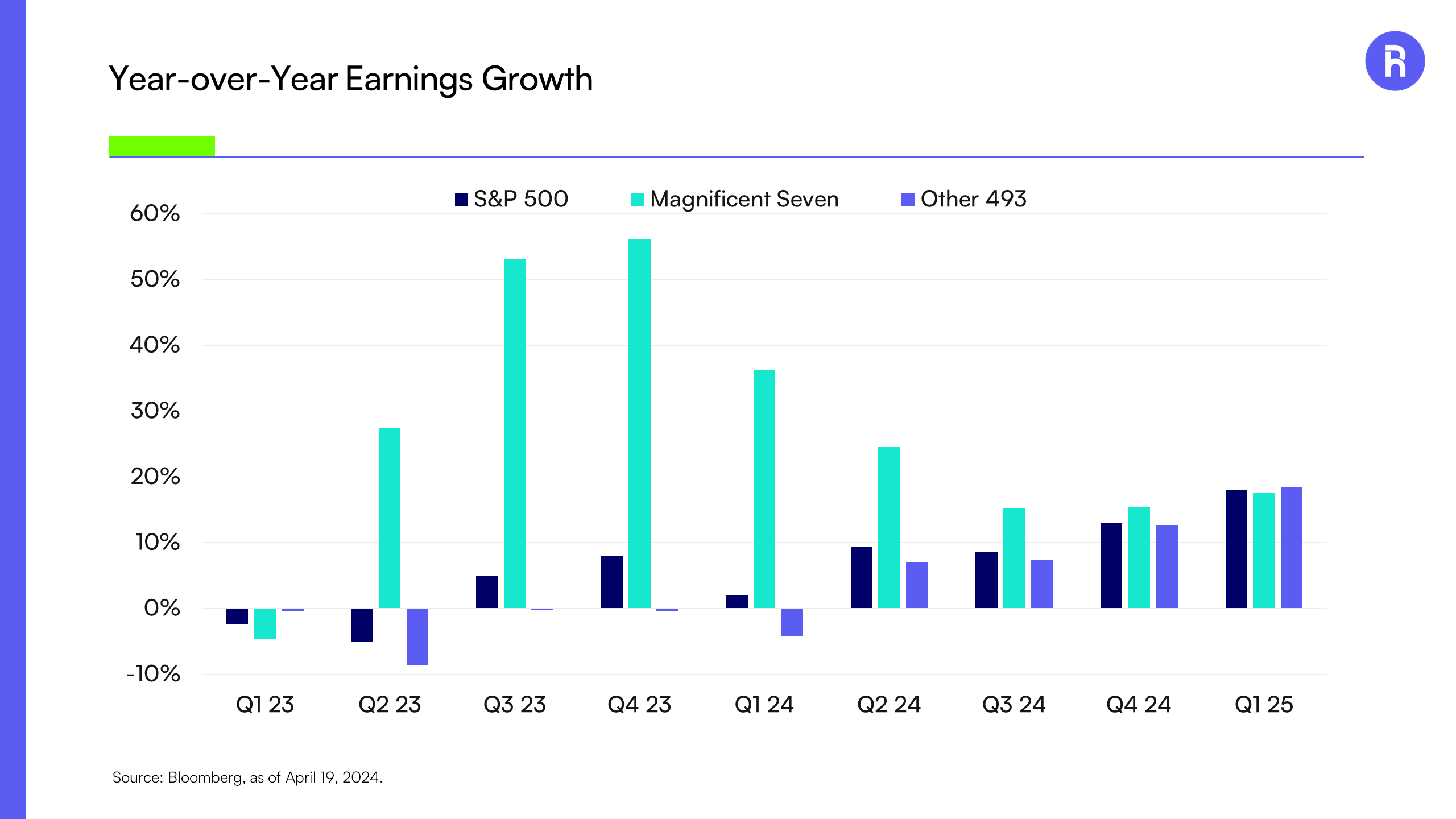

While we believe the election may be playing a greater role, investors still need to face earnings season. It is cliche to say that earnings seasons are important, but this quarter is “show me the money” time. Analysts project the S&P 500 Index to produce 1.93% in earnings growth this quarter.1 Once again, the Magnificent Seven stocks are leading the charge. They are forecasted to grow EPS by 36.29%, which is their fourth quarter of earnings growth. The remaining 493 are anticipated to see a 4.28% decline, which is worse than last quarter. So, in other words, we believe that without the Magnificent Seven the bullish case for stocks is dependent on rate cuts to spur markets higher.

Earnings Continue to Come from the Magnificent Seven

1Source: Bloomberg, as of April 19, 2024.

While we acknowledge there is never one cause of market moves, we would like to point out that there may be more than meets the eye with regards to recent market moves while the bull case for markets hinges on the Magnificent Seven earnings results. We believe they will deliver…for now.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact 1-855-561-5728 or consult with the professional advisor of their choosing.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Use of Third-party Information: Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Roundhill Financial Inc. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Roundhill Financial Inc. or any other person. While such sources are believed to be reliable, Roundhill Financial Inc. does not assume any responsibility for the accuracy or completeness of such information. Roundhill Financial Inc. does not undertake any obligation to update the information contained herein as of any future date.

NERD, BETZ, METV, WEED, CHAT, BIGB, MAGS, LNGG, LUXX, KNGS, MAGX. MAGQ. QDTE, XDTE, and YBTC are distributed by Foreside Fund Services, LLC. DEEP is distributed by Quasar Distributors, LLC.