Roundhill Roundup: The Degen Economy

0DTE Options. Meme Coins. Parlay Bets.

What do these three have in common?

The growth of 0DTE (zero days to expiration) options trading, the rise of meme coins, and the popularity of parlay bets are all emblematic of a broader trend in the financial and betting markets towards high-risk, high-reward strategies. At first glance, these reflect a shift in behavior toward a desire for more rapid or larger gains despite the potential for greater losses. In today’s world, information flows faster than ever, so anyone looking for a quick reward or dopamine hit can get it from trading and betting apps on their phone.

0DTE Options

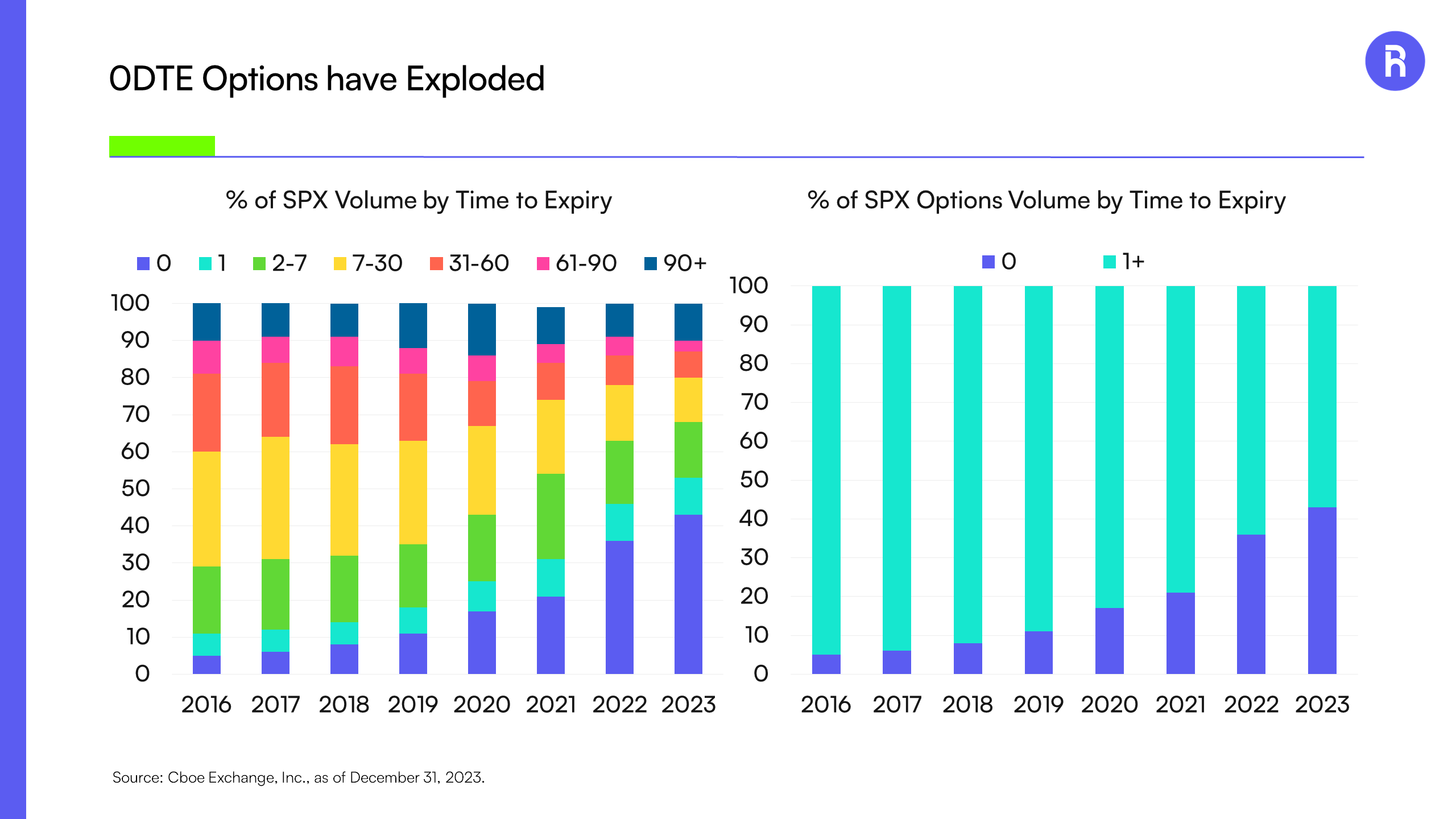

0DTE options are contracts that expire within the trading day they are bought. In recent years, the options trading landscape has meaningfully evolved, particularly with a surge in short-dated options transactions. This trend is largely fueled by the introduction of more frequent expiry options, seeking to enable investors to navigate events with greater precision. Additionally, the demographic of options traders has expanded, resulting in a noticeable increase in trading volumes across the board, from institutions to retail participants.

Investors have flocked toward them for the potential of high returns from small market movements due to their low cost and high leverage. However, 0DTE options carry significant risk as their value can fluctuate wildly, and predicting short-term market movements accurately is challenging. Some say that investing in 0DTE options is really just gambling due to their speculative nature and the high risk of loss. However, like certain casino bets they offer the potential for sizable upside with limited upfront cost and just like throwing down chips on the craps table one wins or loses by the end of the day or night.

However, unlike the speculative frenzy observed during the meme-stock wave of 2020-2021, the current upswing in S&P 500 0DTE trading showcases a more disciplined approach. Over 95% of these trades are characterized by limited risk exposure, marking a departure from the high-risk strategies of the past. Investors are predominantly engaging in balanced trades, such as selling vertical spreads or constructing iron condors, to generate premium, with the average trade size being modest in comparison to the index level.

0DTE Options have Exploded

Source: Cboe Exchange, Inc., as of December 31, 2023.

Meme Coins

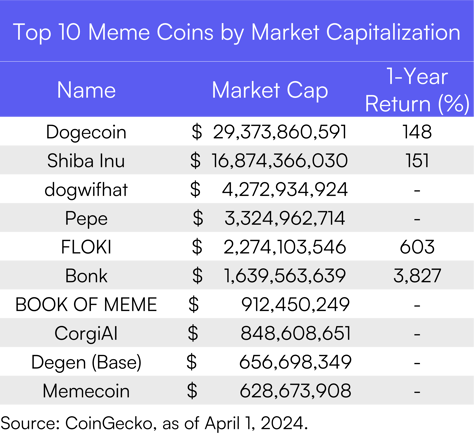

According to CoinGecko, the market cap of meme coins has surged to approximately $67 billion at time of this writing. This is roughly the size of shipping giant FedEx Corp (FDX). Meme coins are digital currencies inspired by internet memes or jokes. They are often characterized by rapid community-driven fluctuations in their value. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are developed for specific technological or financial functions, meme coins typically lack a foundational purpose or utility. Their market performance is highly volatile, driven mainly by speculative trading, distinguishing them significantly from more established crypto assets with tangible use cases and adoption. A recent example of outsized returns is the $72m market cap Doge Eat Doge coin, which is up 19,804% over the last 30 days.1

Some point to “investing” in meme coins to also be like gambling, but that view misses an important component of the proliferation of meme coins, which is the community aspect. Someone can invest in a meme coin because they or their network have an affinity for the coin without having to understand a lot about cryptocurrencies. The figure below highlights the top 10 meme coins according to CoinGecko. Notably, six of them do not display a one-year return because they are less than a year old.

Source: CoinGecko, as of April 1, 2024.

Parlay Bets

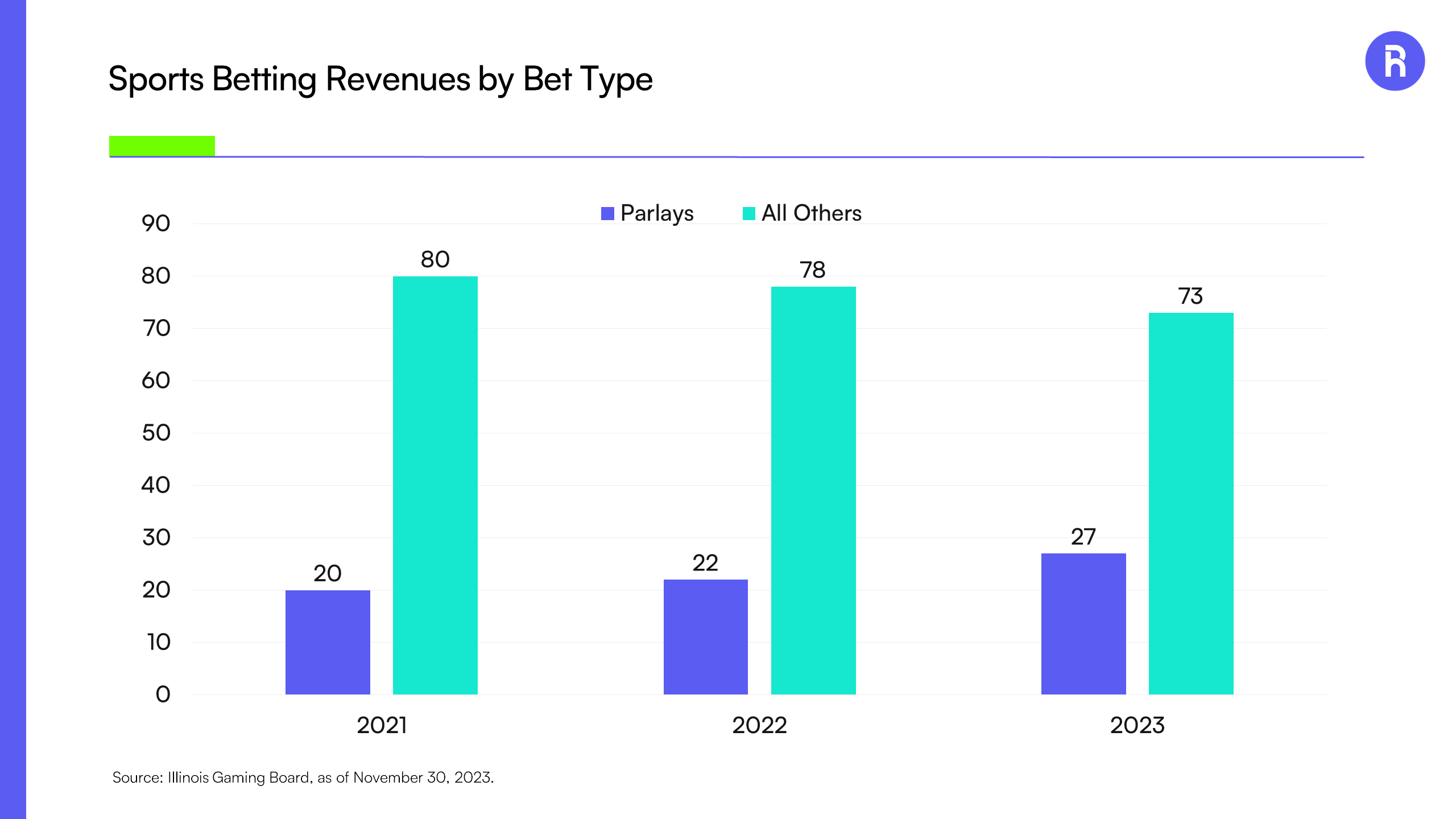

Parlay bets have risen in popularity over the last couple of years increasing from 20% of total sports betting revenue in 2021 to 27% in 2023. For those unfamiliar with sports betting, a parlay bet in sports betting combines multiple individual wagers into a single bet, requiring all components to win for the bet to pay off. What is exciting about parlays is their potential for high payouts on relatively small investments, as the odds of each selection are multiplied together. This compound effect can lead to significant returns if all parts of the bet come through, making parlays an attractive option for bettors seeking the thrill of a big win from a relatively small stake. For example, same game parlay bets offer instant excitement and the potential for high rewards from one event, providing a swift and intense dopamine surge.

Of course, the difficulty of hitting on all selections also increases the risk of loss simply because more than one bet is involved. However, there may be a flip side to parlays simply being riskier. One is that parlays allow bettors the ability to hedge their bets to manage risk, especially if the last leg of a parlay is pending. If the first few selections win, a bettor could place a bet against their final selection seek to ensure they walk away with some profit regardless of the outcome. This strategy helps to reduce the risk of walking away with nothing after a series of successful selections. In addition, experienced bettors use parlays strategically as part of a broader betting strategy, rather than relying on them as their primary method of betting. And lastly, since parlays can be made with relatively small stakes, bettors can limit their risk by wagering amounts they are comfortable losing. This affordability factor means that while the risk of losing the bet might be high, the financial risk can be controlled.

Parlay Bets have Increased over the Last Year

Source: Illinois Gaming Board, as of November 30, 2023.

Putting It All Together

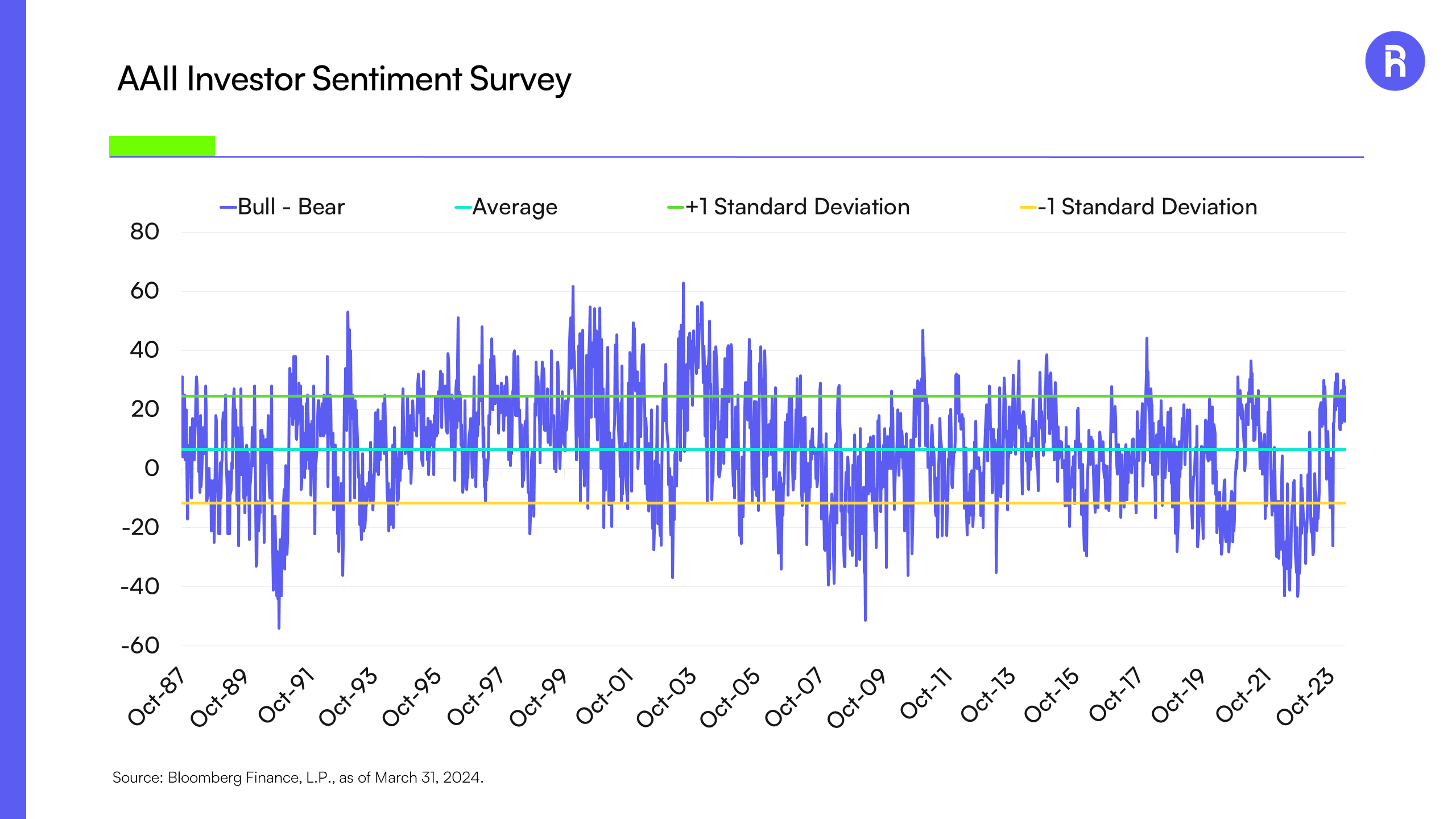

While it can be convenient to think that the U.S. stock market is now the world’s largest casino, we do not believe it to be true nor is it reasonable to conclude that markets must be poised for future negative returns. The long-standing AAII Investor Sentiment Survey asks individual investors weekly their thoughts on where the market is heading in the next six months. Investor sentiment fluctuates significantly over time as can be seen below. The blue line represents the difference between investors reporting bullish versus bearish sentiment. The orange line denotes the average sentiment, while the green and blue lines mark one standard deviation above and below the average, respectively. As of the most recent survey, 50% were bullish, 22% were bearish, and 28% were neutral. The spread between bulls and bears stood at 28%, which is elevated from the long-term average of 6% and above the one standard deviation of 25%.

Investors are Bullish, but Not at Extremes

Source: Bloomberg Finance, L.P., as of March 31, 2024.

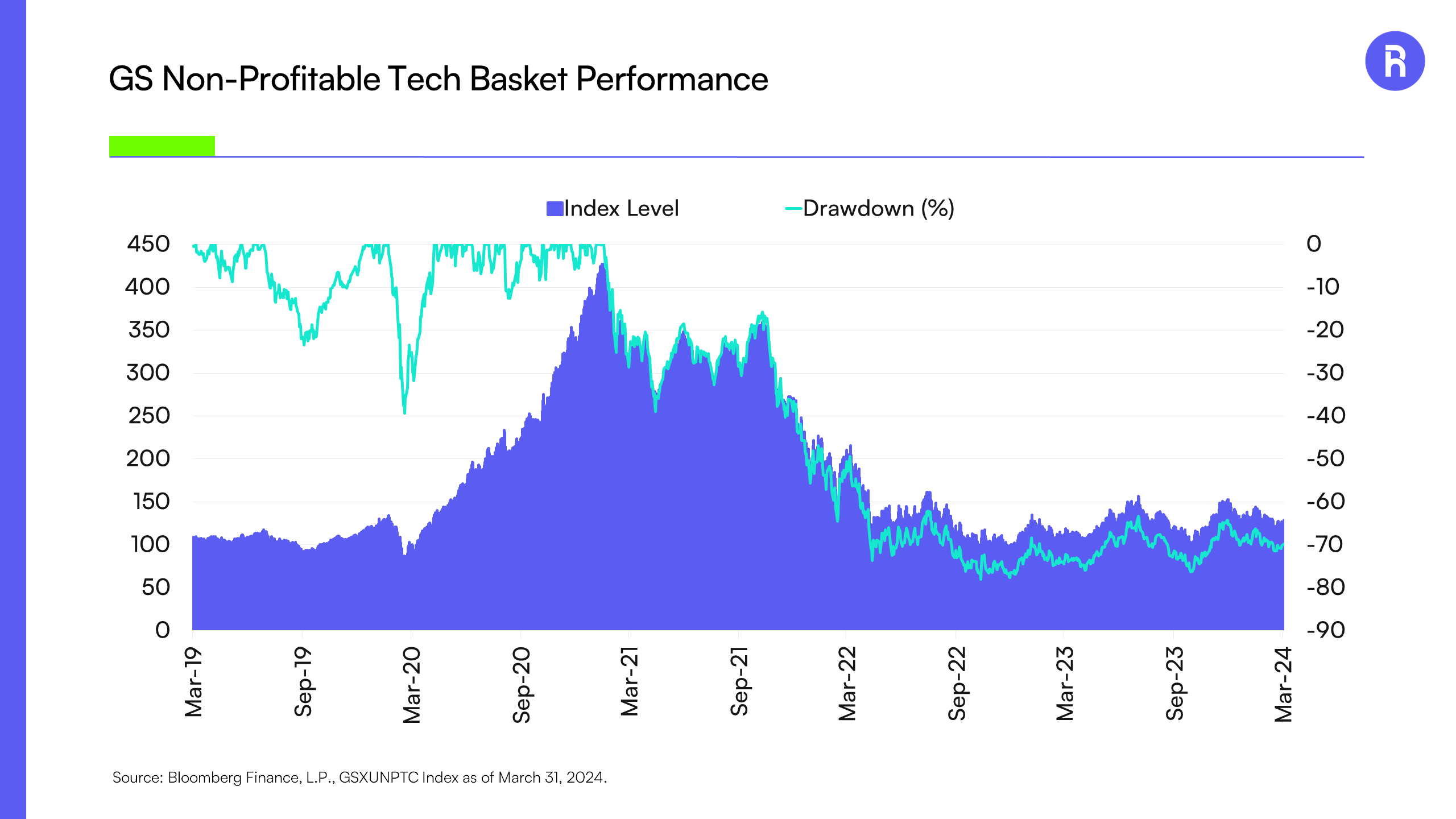

So while retail investors may be more bullish than bearish, not all parts of the market are reflecting euphoria. Just look at the softness of small caps and high beta stocks this year. One of the best places to look for signs of extreme behavior is the performance of non-profitable tech companies. Since peaking in 2021, they remain in 70% drawdown with investors favoring profitable firms like the Magnificent Seven stocks. When investors shy away from speculative bets on unprofitable entities in favor of fundamentally strong, profitable firms, it suggests a shift towards risk aversion and a preference for sustainable earnings growth.

Non-Profitable Tech Companies Remain in a Significant Drawdown

Source: Bloomberg Finance, L.P., GSXUNPTC Index as of March 31, 2024.

Some will point to the increase in 0DTE options, meme coins, and parlay bets as representing excess and sign of a gamification of investing, we would agree it is more nuanced than that. It may actually reflect a more discerning investment approach. While these trends certainly have some similarities to betting in a casino, it is unlike the TMT bubble or the meme stock craze where only the allure of quick buck and momentum ruled the day. To be clear, we do not believe that investors, traders, or bettors should risk more than they can lose or that they should not do their homework. In fact, we advocate that folks do so just as we believe the headlines that the “Degen Economy” may not be as negative as they seem.

1 Source: CoinGecko, as of April 1, 2024.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact 1-855-561-5728 or consult with the professional advisor of their choosing.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (855) 561-5728. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the Primary Exchange official closing price. Brokerage commissions will reduce returns.

Carefully consider the investment objectives, risks, charges and expenses of Roundhill ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Funds investments may be non-diversified, meaning its assets may be concentrated in fewer individual holdings than a diversified fund and, therefore, more exposed to individual stock volatility than diversified funds. Investments in foreign securities involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more develop countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

Use of Third-party Information: Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Roundhill Financial Inc. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Roundhill Financial Inc. or any other person. While such sources are believed to be reliable, Roundhill Financial Inc. does not assume any responsibility for the accuracy or completeness of such information. Roundhill Financial Inc. does not undertake any obligation to update the information contained herein as of any future date.

NERD, BETZ, METV, WEED, CHAT, BIGB, MAGS, LNGG, LUXX, KNGS, MAGX. MAGQ. QDTE. XDTE, and YBTC are distributed by Foreside Fund Services, LLC. DEEP is distributed by Quasar Distributors, LLC.