Roundhill 0DTE Covered Call ETF Suite Frequently Asked Questions

Why do the Funds use a “synthetic” long position?

Roundhill’s suite of zero-days-to-expiry (“0DTE”) options income ETFs construct a “synthetic” long position by purchasing deep in-the-money call options to replicate a long position in the underlying Index. The Funds use this synthetic long position instead of a “physical” long position for several reasons, including cash management as well as margin and collateral purposes.

This strategy is similar to a “long combo” whereby a call is bought, and a put is sold, at the same strike price. However, Roundhill’s calls are purchased very deep in the money, at a strike price whereby the put price would have an effective value of zero.

What are the risks associated with the “synthetic” long position?

Roundhill’s suite of 0DTE options income ETFs generally purchase long call positions struck at ~10-20% the value of the spot reference price at the time of purchase. For example, if the S&P 500 Index is trading at a level of 5,000, the Fund might purchase an S&P 500 Index call option with a strike price of 500.

By purchasing calls with strike prices extremely far “in the money”, the call positions aim to function similar to purchasing the underlying Index*. Consequently, the call positions do not exhibit “Greeks” (i.e. vega, theta, gamma) in the same way an option closer to the money would. Specifically, the long calls should approximately track the underlying Index 1:1.

As a base case, the Funds plan to roll these calls as they approach expiry. Insofar as a black swan drawdown were to occur (i.e. a 50% decline in the S&P 500), the Fund would actively restrike the options to maintain this goal of 1:1 tracking.

*Investors cannot invest directly in an index.

How do the Funds prevent “NAV Erosion”?

An ETF’s Net Asset Value will decline as distributions are paid out of the Fund. This is because assets, in the form of cash, are leaving the Fund as they are paid out to shareholders, as discussed in our Blog “Behind the Curtain: ETF Distributions”. This is true for all ETFs, regardless of their distribution rate and/or distribution frequency.

For example, consider an ETF that does not invest in options or any other securities, but instead is invested 100% in U.S. Dollars. If the Fund has Net Assets of $100,000,000 and it pays a distribution of $10,000,000, net assets are now $90,000,000. The NAV per share will decline accordingly.

For all ETFs, we encourage investors to focus on total return, which incorporates a complete picture of the performance of an ETF’s strategy.

How are ETF distributions calculated?

ETF distribution calculations are proprietary and determined by the Fund’s Investment Adviser utilizing a variety of inputs, including gross option premium collected each day. Each distribution typically corresponds to the Fund's options trading activity from two calendar weeks prior to the declaration date. Distributions are based on a given week’s option trading activity. If there is a shortened trading week, distributions would correspond with the fewer number of trading days.

Are “Return of Capital” distributions a positive or negative?

“Return of Capital” distributions are neither inherently positive nor negative. Return of Capital is simply a tax characterization applied to distributions when it is determined that they are in excess of a Fund’s Net Investment Income for a given fiscal year. However, investors should critically consider the sustainability of “Return of Capital” distributions for any ETF strategy which does not produce positive total returns.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the ETF please call 1-877-220-7649 or visit the website at https://www.roundhillinvestments.com/etf/. Read the prospectus or summary prospectus carefully before investing.

All investing involves risk, including the risk of loss of principal. There is no guarantee the investment strategy will be successful. For a detailed list of fund risks see the prospectus.

Covered Call Strategy Risk. A covered call strategy involves writing (selling) covered call options in return for the receipt of premiums. The seller of the option gives up the opportunity to benefit from price increases in the underlying instrument above the exercise price of the options, but continues to bear the risk of underlying instrument price declines. The premiums received from the options may not be sufficient to offset any losses sustained from underlying instrument price declines. Exchanges may suspend the trading of options during periods of abnormal market volatility. Suspension of trading may mean that an option seller is unable to sell options at a time that may be desirable or advantageous to do so.

Additionally, the Fund is a “synthetic” covered call strategy, meaning that it derives its long exposure to the Innovation-100 Index from options that utilize the Innovation-100 Index as the reference asset. This synthetic exposure increases the likelihood that the Fund’s returns may not always precisely align with the returns of the Innovation-100 Index.

Options Risk. The use of options involves investment strategies and risks different from those associated with ordinary portfolio securities transactions and depends on the ability of the Fund’s portfolio managers to forecast market movements correctly. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, or in interest or currency exchange rates, including the anticipated volatility, which in turn are affected by fiscal and monetary policies and by national and international political and economic events. The effective use of options also depends on the Fund’s ability to terminate option positions at times deemed desirable to do so. There is no assurance that the Fund will be able to effect closing transactions at any particular time or at an acceptable price. In addition, there may at times be an imperfect correlation between the movement in values of options and their underlying securities and there may at times not be a liquid secondary market for certain options. Lastly, the trading of options is subject to transaction costs that may impact the Fund’s returns.

FLEX Options Risk. Trading FLEX Options involves risks different from, or possibly greater than, the risks associated with investing directly in securities. The Fund may experience losses from specific FLEX Option positions and certain FLEX Option positions may expire worthless. The FLEX Options are listed on an exchange; however, no one can guarantee that a liquid secondary trading market will exist for the FLEX Options.

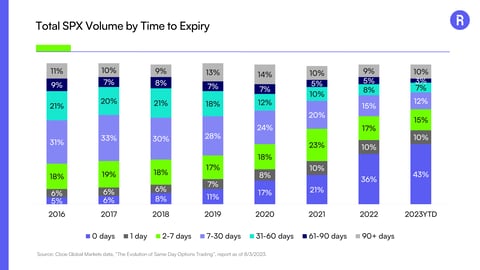

0DTE Options Risk. The Fund’s use of zero days to expiration, known as “0DTE” options, presents additional risks. Due to the short time until their expiration, 0DTE options are more sensitive to sudden price movements and market volatility than options with more time until expiration. Because of this, the timing of trades utilizing 0DTE options becomes more critical. Although the Fund intends to enter into 0DTE options trades on market open, or shortly thereafter, even a slight delay in the execution of these trades can significantly impact the outcome of the trade. Such options may also suffer from low liquidity, making it more difficult for the Fund to enter into its positions each morning at desired prices. The bid-ask spreads on 0DTE options can be wider than with traditional options, increasing the Fund’s transaction costs and negatively affecting its returns. Additionally, the proliferation of 0DTE options is relatively new and may therefore be subject to rule changes and operational frictions. To the extent that the OCC enacts new rules relating to 0DTE options that make it impractical or impossible for the Fund to utilize 0DTE options to effectuate its investment strategy, it may instead utilize options with the shortest remaining maturity available or it may utilize swap agreements to provide the desired exposure.

New Fund Risk. The fund is new and has a limited operating history.

Derivatives Risk. The use of derivative instruments (i.e. options contracts) involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments.

Distribution Tax Risk. The Fund currently expects to make distributions on a weekly basis. These distributions may exceed the Fund’s income and gains for the Fund’s taxable year. Distributions in excess of the Fund’s current and accumulated earnings and profits will be treated as a return of capital.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.

Glossary

Net Asset Value (NAV): Determined by subtracting the liabilities from the portfolio value of the fund's securities, and dividing that figure by the number of outstanding shares. NAV is a per share value.

Options: An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date.

Covered Call Strategy: A covered call strategy involves writing (selling) covered call options in return for the receipt of premiums. The seller of the option gives up the opportunity to benefit from price increases in the underlying instrument above the exercise price of the options, but continues to bear the risk of underlying instrument price declines.

Out-of-the-Money Options: Out-of-the-money options are options whose strike price is above the market price of the underlying asset.

0DTE Options: 0DTE (zero days to expiration) are options that are set to expire at the end of the trading day on which they are written.

Strike: Price at which the option holder may buy or sell the underlying security, as defined in the terms of the option contract.

.png?width=80&height=80&name=RH_Symbol-PrimaryBllue%20(2).png)