Option Greeks Deep Dive - Theta: What Am I Paying For?

The Greeks

Options can be priced in a variety of ways: binomial trees, Monte Carlo simulations, and, possibly the most well-known, the Black-Scholes model. It is the Black-Scholes model that utilizes a series of financial variables, commonly referred to as the “Greeks” (denoted by the Greek alphabet), which measure an option’s price sensitivity. Most have heard of the main greeks: delta, vega, gamma, theta, and rho.

When looking at option selling strategies, such as those employed in Roundhill’s covered call ETFs, theta is a crucial greek to understand.

What is Theta?

Theta measures an option’s sensitivity to time and is most frequently displayed as the rate of decline of an option’s value on a day-over-day basis. For example, an investor is interested in selling a 2-week tenor, out-of-the-money XYZ call option that yields $2.20 in premium with a theta of $0.15. $2.20 is the total time value of the option, but theta values today as being worth $0.15 of that option’s total time value. If they were to wait and sell the option tomorrow, holding all other economic factors constant, the option would be worth $2.05, as $0.15 of the theta has decayed.

However theta does not decay linearly; it accelerates. Consider that same XYZ call option: what if the option had two days until expiry instead of two weeks? Is the theta of the 2-day option greater or less than $0.15? It will be greater than $0.15. As expiry approaches, there is less time for XYZ to rally and consequently for that option to trade in-the-money, meaning that a single day is much more valuable to a 2-day option than a 2-week option.

Source: Bloomberg as of 1/14/2025.

Theta Decay Strategies

What does it mean to be long or short theta? All greeks are directional, based on put vs call and buyer vs seller. A buyer of an option is always short theta, regardless of whether it is a put or call. They will lose value as time decays (passes). Meanwhile, an option seller is always long theta, as they will gain value as time decays. Theta decay strategies take a long theta position by selling options to collect premium and generate return as time passes.

But how do traders know which options to sell to generate the highest premium? As previously mentioned, theta decay accelerates over the tenor of the trade, which indicates where the most premium lies.

Looking at another example: An investor wants to implement a short theta strategy in their personal account and is considering a few options to sell:

|

Option |

Bid |

|

2-month tenor XYZ 600 Call |

$4.00 |

|

6-month tenor XYZ 600 Call |

$10.00 |

|

12-month tenor XYZ 600 Call |

$17.00 |

At a cursory glance, the 12-month option brings in the most premium on day one. However, if the 2-month and 6-month options are rolled (i.e. when the option expires, another option is traded of similar tenor) and their premiums annualized, it is actually the shortest-dated options which yield the highest annual premiums.

|

Option |

Bid |

Annualized Premium |

|

2-month tenor XYZ 600 Call |

$4.00 |

$24.00 |

|

6-month tenor XYZ 600 Call |

$10.00 |

$20.00 |

|

12-month tenor XYZ 600 Call |

$17.00 |

$17.00 |

This is because the theta value of each day in the 2-month tenor option is much higher than the theta of the 12-month tenor option. This phenomenon is graphically illustrated below using SPX option prices.

Source: Bloomberg as of 1/14/2025.

Why Should I Care?

Theta decay strategies can provide investors with consistent income and generally reduce risk if used as part of a broader portfolio. When managed correctly, they can decrease both a portfolio’s delta to the market and overall volatility.

How can investors generate these returns? Investors can sell options in their personal account, posting margin for uncovered trades, and routinely monitor positions’ moneyness to ensure they maintain a positive profit. Or, they can invest in ETFs that manage long theta positions, which allow investors to generate a similar return profile without actively trading options themselves.

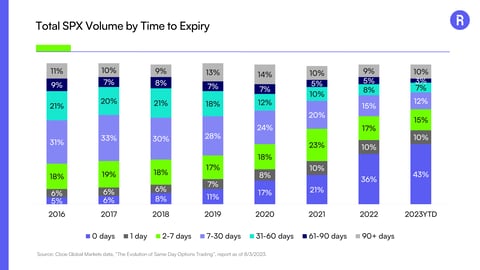

Last year, Roundhill launched the first-ever 0DTE covered call ETFs (XDTE, QDTE, and RDTE) with the goal of capturing the highest theta: annualizing expiration date theta for 252 trading days of the year.

Proceed with Caution

As with any form of leverage, there are risks associated with selling options. Selling uncovered options can open an investor up to unlimited downside risk, and weighing the cost of purchasing a long position to cover short calls or maintaining cash/margin to cover short puts is wise. When digging into theta decay ETFs, make sure to do your homework and look at basket composition.

For example, Roundhill’s 0DTE baskets are composed of short 0DTE calls paired with laddered, long-dated calls. This seeks to protect the short positions’s losses in the case of any significant moves higher in the underlying asset.

Interested in learning more? Explore our full product lineup.

*Source: Bloomberg as of 1/15/2025.

The Funds currently expect, but do not guarantee, to make distributions on a weekly basis. Distributions may exceed the Funds’ income and gains for the Funds’ taxable year. Distributions in excess of the Funds’ current and accumulated earnings and profits will be treated as a return of capital. Distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions might not continue to exist and there should be no expectation that this performance will be repeated in the future. Please see the Supplemental Tax Information section of the webpage for more information on the distribution composition including the estimated return of capital. Current distributions may include return of capital.

Per the Funds most recent 19a-1 notice, the estimated per share composition of the distribution includes return of capital (ROC) of 100% for XDTE, QDTE, RDTE.

A final determination of the tax character of distributions paid by the Funds will not be known until the completion of the Funds’ fiscal year and there can be no assurance as to the portions of each Fund’s distributions that will constitute return of capital and/or dividend income. The final determination of the tax character of distributions paid by the Funds will be reported to shareholders on their Form 1099-DIV.

Please consult your tax advisor for proper treatment on your tax return.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website here: XDTE, QDTE, RDTE. Read the prospectus or summary prospectus carefully before investing.

Click here for the QDTE prospectus.

Click here for the XDTE prospectus.

Click here for the RDTE prospectus.

All investing involves risk, including the risk of loss of principal. There is no guarantee the investment strategy will be successful. The funds faces numerous risks, including options risk, liquidity risk, market risk, cost of futures investment risk, clearing broker risk, commodity regulatory risk, futures contract risk, active management risk, active market risk, clearing broker risk, credit risk, derivatives risk, legislation and litigation risk, operational risk, trading issues risk, valuation risk and non-diversification risk. For a detailed list of fund risks see the prospectus.

Covered Call Strategy Risk. A covered call strategy involves writing (selling) covered call options in return for the receipt of premiums. The seller of the option gives up the opportunity to benefit from price increases in the underlying instrument above the exercise price of the options, but continues to bear the risk of underlying instrument price declines. The premiums received from the options may not be sufficient to offset any losses sustained from underlying instrument price declines, over time. As a result, the risks associated with writing covered call options may be similar to the risks associated with writing put options. Exchanges may suspend the trading of options during periods of abnormal market volatility. Suspension of trading may mean that an option seller is unable to sell options at a time that may be desirable or advantageous to do.

Flex Options Risk. The Fund will utilize FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (OCC). In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices. The values of FLEX Options do not increase or decrease at the same rate as the reference asset and may vary due to factors other than the price of reference asset.

0DTE Options Risk.*** The Fund’s use of zero days to expiration, known as “0DTE” options, presents additional risks. Due to the short time until their expiration, 0DTE options are more sensitive to sudden price movements and market volatility than options with more time until expiration. Because of this, the timing of trades utilizing 0DTE options becomes more critical. Although the Fund intends to enter into 0DTE options trades on market open, or shortly thereafter, even a slight delay in the execution of these trades can significantly impact the outcome of the trade. Such options may also suffer from low liquidity, making it more difficult for the Fund to enter into its positions each morning at desired prices. The bid-ask spreads on 0DTE options can be wider than with traditional options, increasing the Fund’s transaction costs and negatively affecting its returns. Additionally, the proliferation of 0DTE options is relatively new and may therefore be subject to rule changes and operational frictions. To the extent that the OCC enacts new rules relating to 0DTE options that make it impractical or impossible for the Fund to utilize 0DTE options to effectuate its investment strategy, it may instead utilize options with the shortest remaining maturity available or it may utilize swap agreements to provide the desired exposure.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.

Glossary

Monte Carlo Simulation is a computational technique that uses random sampling to estimate the probability of various outcomes.

Binomial Trees are graphical representations of possible intrinsic values that an option may take at different nodes or time periods.

The Black-Scholes Model is a mathematical model for estimating the theoretical value of derivatives based on other investment instruments, taking the impact of time and other risk factors into account.

Delta measures an option’s price sensitivity to moves in the underlying asset.

Gamma measures the rate of change of delta.

Vega measures an option’s price sensitivity to changes in volatility.

Theta measures an option’s price sensitivity to time.

Rho measures an option’s price sensitivity to change in interest rates