WeeklyPay™ Goes for Gold

Many different reasons have been offered for Gold’s surge in 2025…

- The potential for the U.S. dollar losing its status as a global reserve currency,

- The ongoing trend of deglobalization among the world’s biggest trading powers,

- Growing amounts of debt and deficits

- Inflationary pressures

- Rising geopolitical tensions around the globe

- Now, the U.S. government shutdown

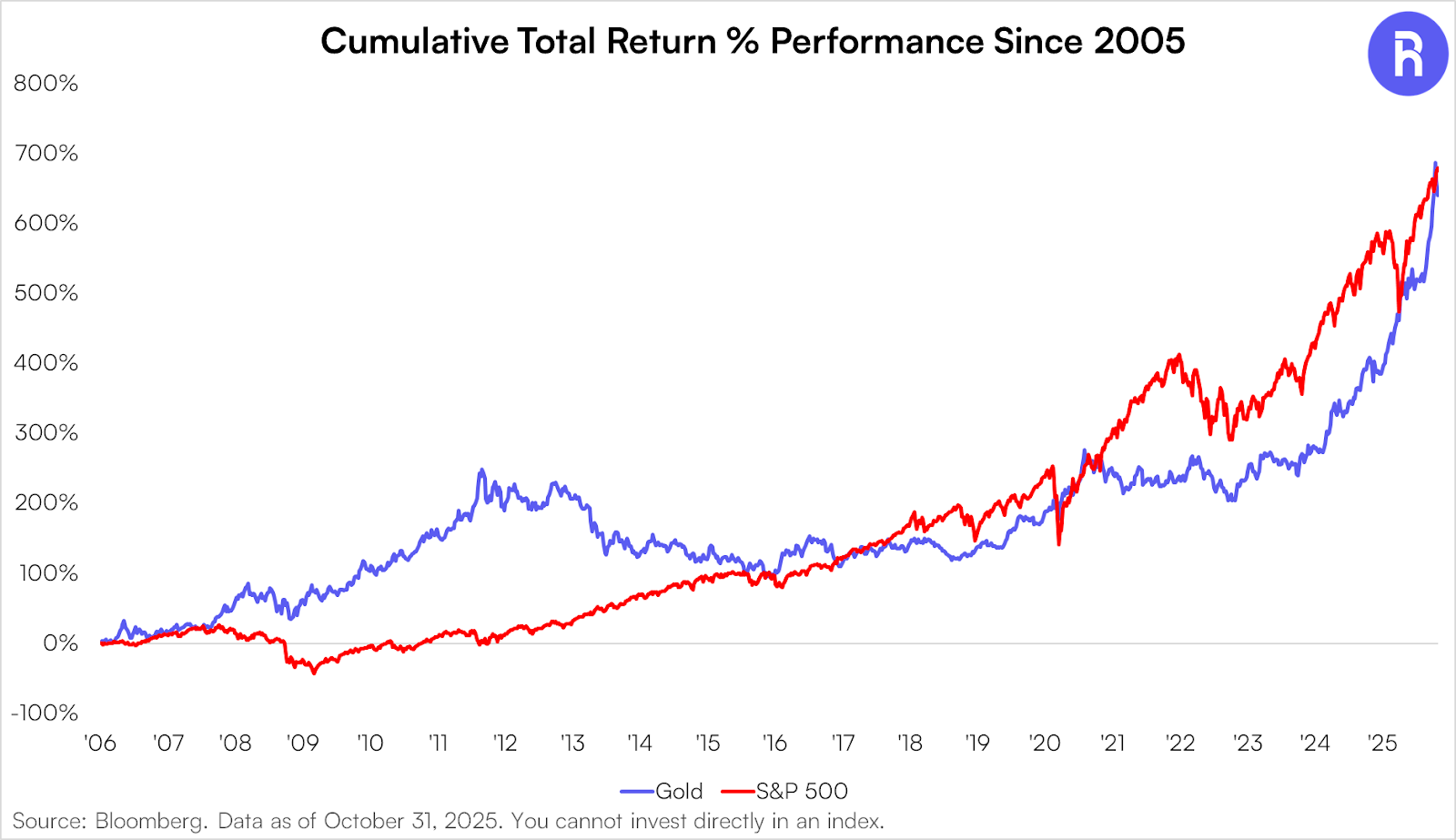

Despite the recent focus on why gold’s strong returns, the yellow metal has been a strong performer for some time. Since the start of the 2020s, even without paying a dividend, gold has outperformed the S&P 500’s total return by roughly 32%, registering an annualized 18.1% return compared to 15.5% return for stocks.

In fact, gold’s strength extends well beyond its recent momentum. Over the past two decades, from 12/31/2005 through 10/31/2025, Gold delivered an annualized return of 10.9%, roughly in line with S&P 500’s 11.1% annualized total return.

Gold: A Currency Story?

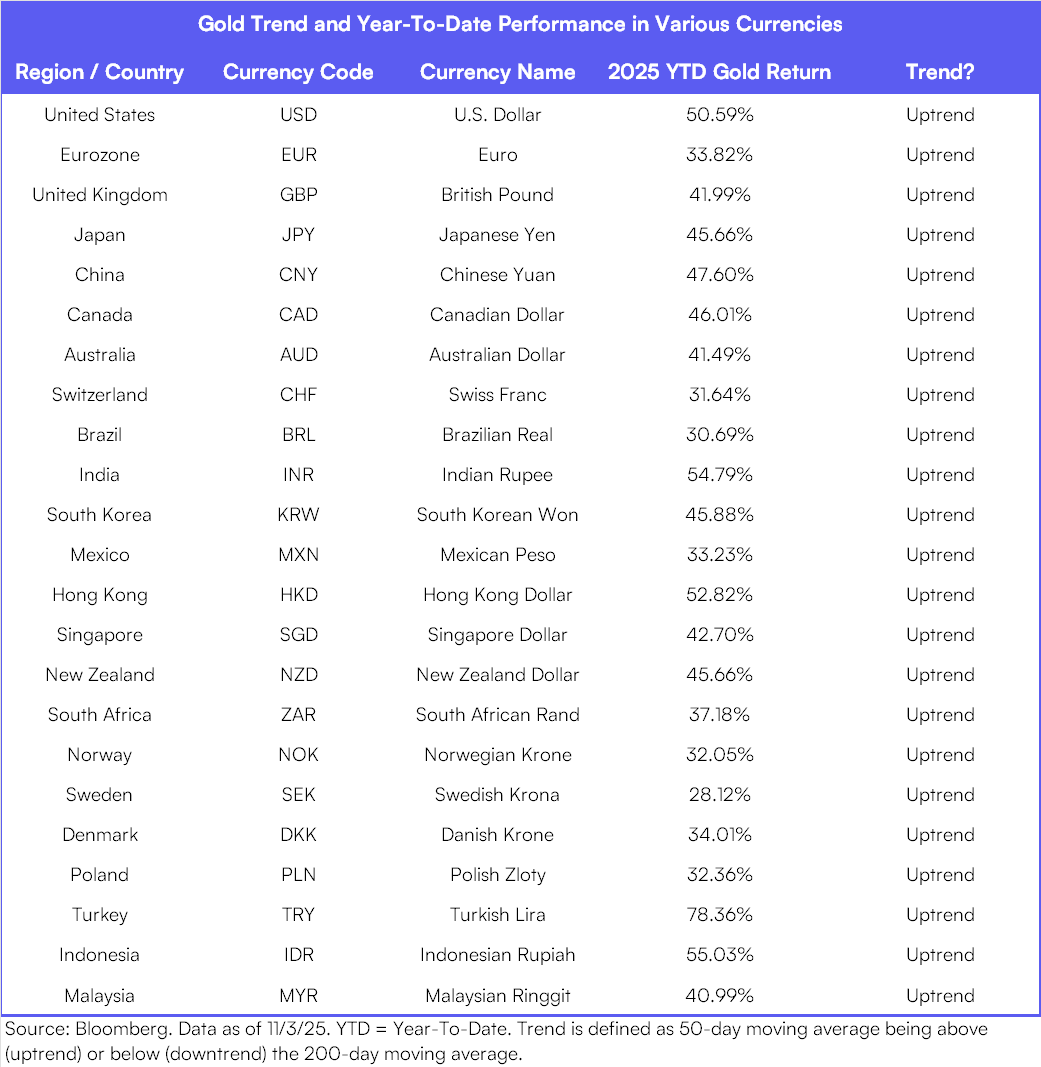

Gold’s strength is not limited to a certain currency. Regardless of the currency it is priced in, gold trades in a decisive uptrend. This strong trend backdrop has supported robust double digit returns for gold in virtually every currency available for pricing in Bloomberg. The bottom line is that gold’s strength is being confirmed around the world.

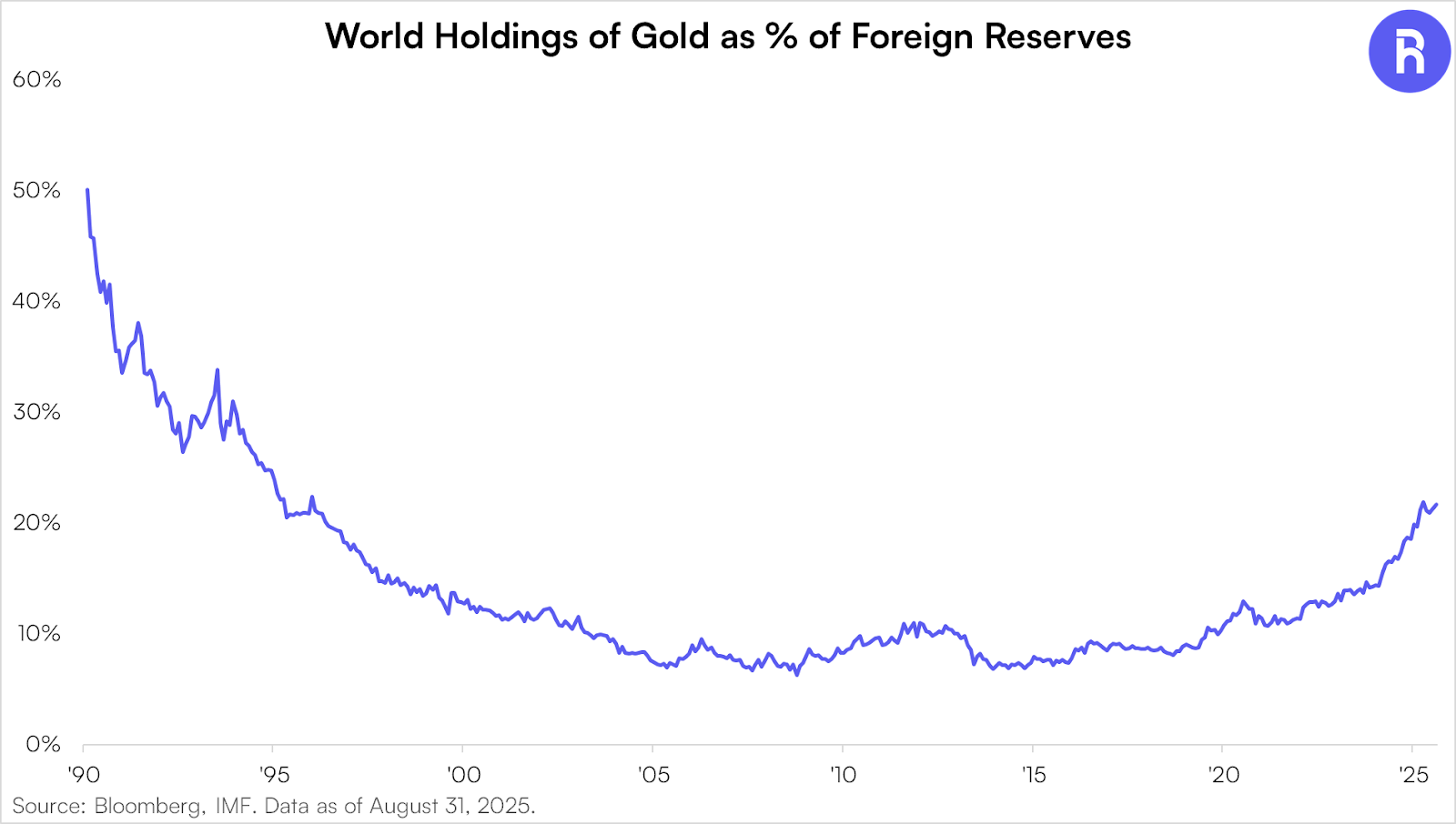

There appears to be a structural tailwind underpinning gold’s strength: central banks around the world are increasing their holdings of gold as a safe haven. Gold now makes up ~23% of total foreign reserves, a level that has not been reached since the mid 1990s. The reasons can vary depending on the monetary and fiscal backdrop, but at the minimum, gold seems to be in a structural phase of accumulation by central banks.

Gold Sets the Price. Miners Amplify the Move.

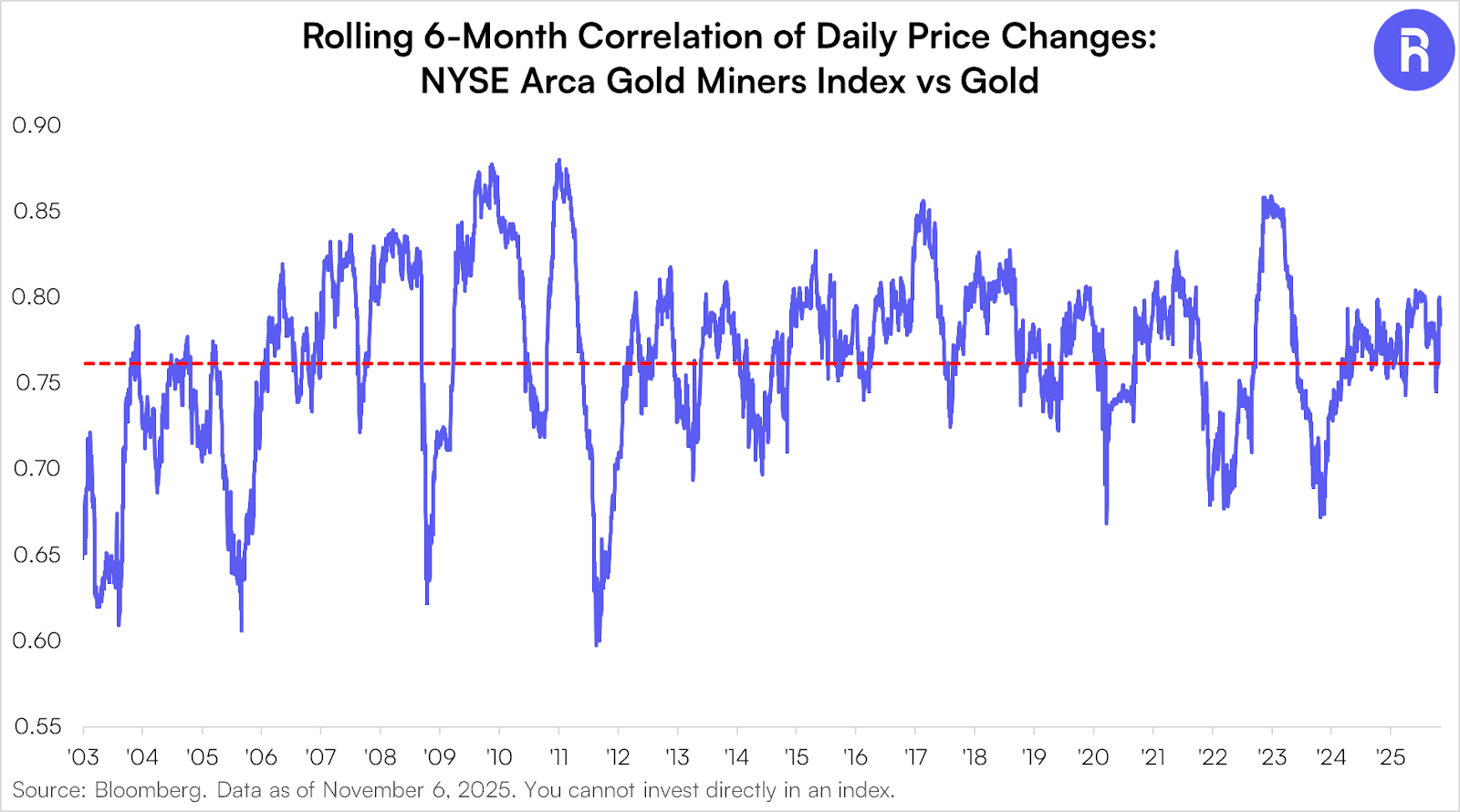

If gold represents the store of value, gold miners represent operating leverage plus exposure to the yellow metal. Miners have historically moved with gold prices (as evidenced by its long-term correlation with gold below), making them a potential way to further express bullish views on the metal.

Gold miner stocks have decisively outperformed the S&P 500 in 2025. Through November 5, the Gold Miners index is up 109.44% on a total return basis. Over the same time period, the S&P 500 has moved up +16.76%, a difference of 92.68%. Gold miners have even outpaced AI leader Nvidia in 2025 (NVDA = +45.40% YTD).

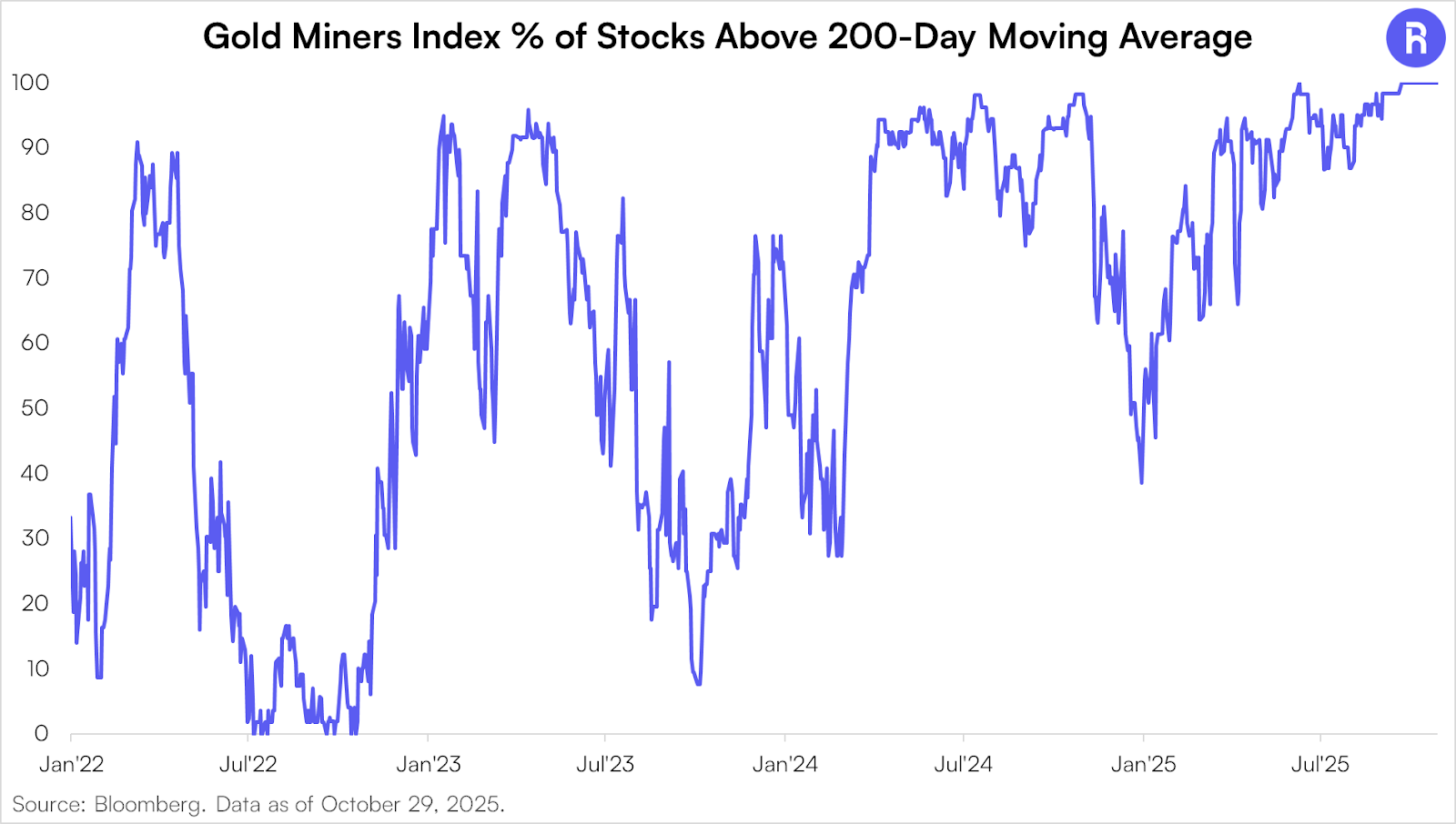

Gold miners have backed off from their recent 2025 highs, but are consolidating from a position of strength. 100% of the stocks in the NYSE Arca Gold Miner Index (~50 holdings) are trading above their respective 200-day moving average. In our view, this is a signal of broad participation and strong underlying trends.

WeeklyPay™ Goes for Gold

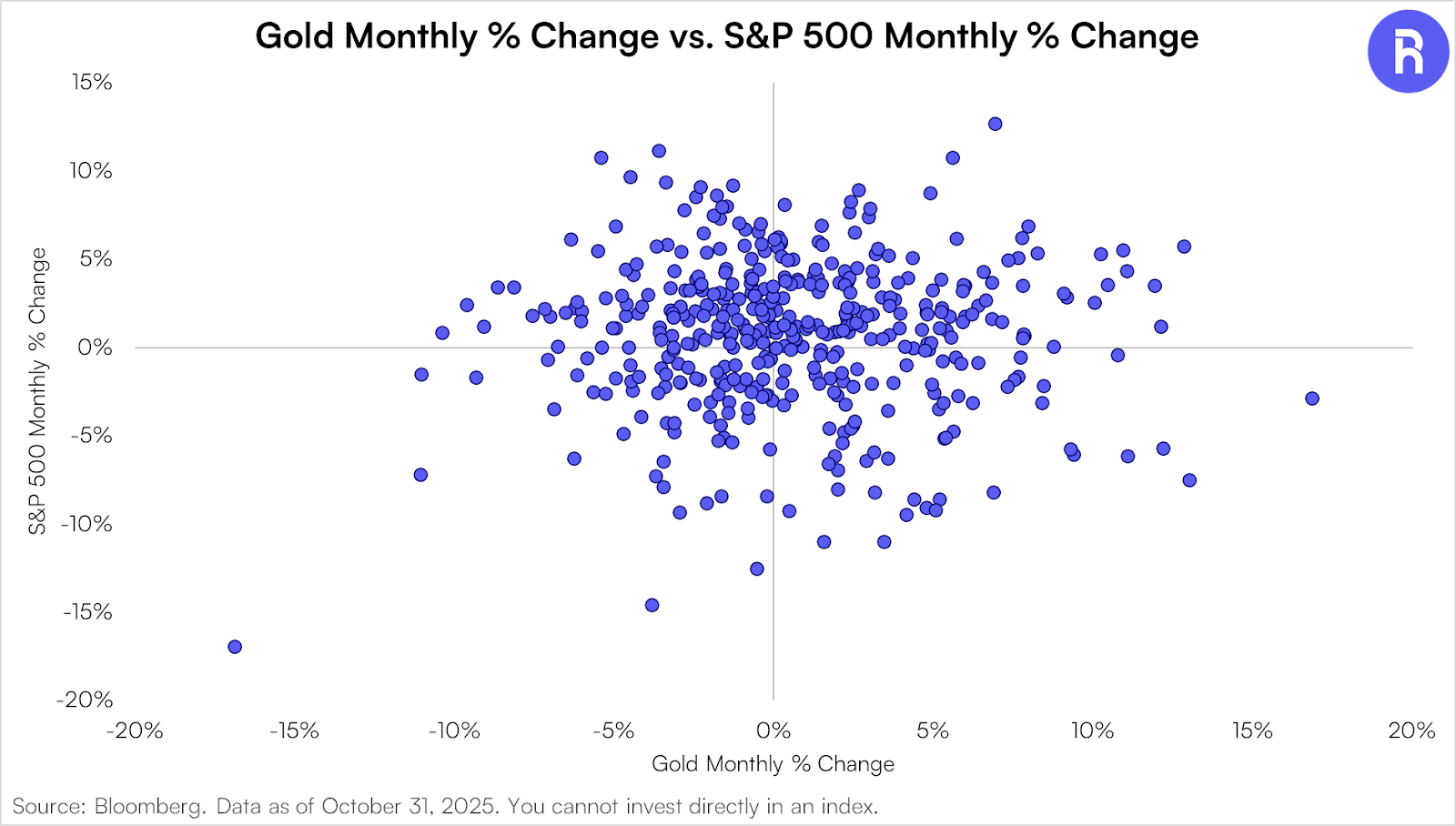

From a portfolio perspective, gold can be attractive to investors for its diversification potential. Based on monthly returns since 1990, gold does not share a strong positive or negative relationship with the S&P 500. Both financial assets tend to move independently of one another on a month to month basis, bolstering its case as a compelling option for portfolio diversification.

Because gold miners can move closely with gold prices rather than the broader stock market, they offer similar diversification benefits relative to traditional stock allocations, particularly as core equity portfolios continue to grow more concentrated in the Technology sector.

A popular criticism of gold, made famous by Warren Buffett, is that “it won’t do anything between now and then except look at you.” Likewise, gold miners are not widely known for providing consistent income to shareholders. As a result, investors seeking exposure to gold or gold miners have historically had only one main pathway to generate cash flow from these assets: covered call strategies, which can often cap upside for investors who are bullish on the underlying assets.

The Roundhill Gold WeeklyPay™ ETF (GLDW) and the Roundhill Gold Miners WeeklyPay™ ETF (GDXW) take the WeeklyPay™ framework into the gold markets, aiming to deliver consistent weekly income without relying on covered-call strategies that can cap upside. GLDW and GDXW target amplified exposure to gold and gold miners respectively, aligning with investors who are constructively bullish on the space.

Gold can be a cornerstone of portfolios seeking diversification, inflation protection, and resilience amid persistent geopolitical uncertainty and record sovereign debt levels. Now investors can pair that exposure with weekly distribution potential and amplified market exposure through GLDW and GDXW.

Learn more about GLDW and GDXW.

Explore the WeeklyPay™ ETF Suite: https://www.roundhillinvestments.com/weeklypay-etfs

Glossary:

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002. The index is calculated and maintained by the American Stock Exchange

Gold performance measured using GOLDS Comdty in Bloomberg.

International reserves are liquid assets held by a country's central bank or other monetary authority in order to implement monetary policies effecting the country's currency exchange rate and ensuring the payment of its imports. The assets include foreign currency and foreign denominated bonds, gold reserves, SDRs (special drawing rights) and the IMF reserve position.

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus or summary prospectus, if available, with this and other information about the Fund, please call 1-855-561-5728 or visit our website at https://www.roundhillinvestments.com/etf/. Read the prospectus or summary prospectus carefully before investing.

The Funds are not suitable for all investors. They are only suitable for knowledgeable investors who understand how the Funds operate and for those investors who actively monitor and manage their investments. Investors who do not understand a Fund’s strategy and the returns that it seeks to provide, or do not intend to actively monitor and manage their investment in a Fund, should not invest in a Fund.

There is no assurance that a Fund will achieve its weekly leveraged investment objective. Additionally, an investment in a Fund could lose money, including the full principal value of his/her investment within a single week. An investor for whom these stipulations are not acceptable should not invest in a Fund.

There is no guarantee that these Funds will successfully provide returns that correspond to approximately 1.2 times (120%) the calendar week total return of the assets they track.

The Funds will provide exposure to the weekly total returns of the asset they track. Accordingly, the Funds are not an appropriate investment for investors seeking exposure to the daily total return of the assets they track.

The Funds are classified as “non-diversified” under the Investment Company Act of 1940 (the “1940 Act”).

It is critical that investors understand the following:

- An investment in the Fund is not an investment in the underlying asset.

- Each Fund’s strategy is subject to all potential losses of the tracked asset. If the tracked asset shares decrease in value, the Fund may lose all of its value if shares of the tracked asset decrease by 83.33 percent over the course of any calendar week.

Issuer Specific Risks. Issuer-specific attributes may cause an investment held by the Fund to be more volatile than the market generally. The value of an individual security or particular type of security may be more volatile than the market as a whole and may perform differently from the value of the market as a whole.

Derivatives Risk. The use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments.

Distribution Tax Risk. The Fund currently expects to make distributions on a weekly basis. Such frequent distributions may expose investors to increased tax liabilities. However, these distributions may exceed the Fund’s income and gains for the Fund’s taxable year. Distributions in excess of the Fund’s current and accumulated earnings and profits will be treated as a return of capital. A return of capital distribution generally will not be taxable but will reduce the shareholder’s cost basis and will result in a higher capital gain or lower capital loss when those Fund Shares on which the distribution was received are sold. Once a Fund shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain if the Fund shareholder holds Fund Shares as capital assets.

Leverage Risk. The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. An investment in the Fund is exposed to the risk that a decline in the weekly performance of shares of the security indicated by the Fund’s name will be magnified.

Swap Agreements Risk. The Fund will utilize swap agreements to derive its exposure to shares of the security indicated by the Fund’s name. Swap agreements may involve greater risks than direct investment in securities as they may be leveraged and are subject to credit risk, counterparty risk and valuation risk. A swap agreement could result in losses if the underlying reference or asset does not perform as anticipated. In addition, many swaps trade over-the-counter and may be considered illiquid. It may not be possible for the Fund to liquidate a swap position at an advantageous time or price, which may result in significant losses.

FLEX Options Risk. Trading FLEX Options involves risks different from, or possibly greater than, the risks associated with investing directly in securities. The Fund may experience losses from specific FLEX Option positions and certain FLEX Option positions may expire worthless. The FLEX Options are listed on an exchange; however, no one can guarantee that a liquid secondary trading market will exist for the FLEX Options.

Concentration Risk. The Fund is susceptible to an increased risk of loss, including losses due to adverse events that affect the Fund’s investments more than the market as a whole, to the extent that the Fund’s investments are concentrated in investments that provide exposure to of the security indicated by the Fund’s name and the industry to which it is assigned.

Active Management Risk. The Fund is actively-managed and its performance reflects investment decisions that the Adviser and/or Sub-Adviser makes for the Fund. Such judgments about the Fund’s investments may prove to be incorrect. If the investments selected and the strategies employed by the Fund fail to produce the intended results, the Fund could underperform as compared to other funds with similar investment objectives and/or strategies, or could have negative returns.

New Fund Risk. The Fund is new and has a limited operating history.

Non-Diversification Risk. As a "non-diversified" fund, the Fund may hold a smaller number of portfolio securities than many other funds.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.