Apple is Set to Enter the Metaverse - What Does it Mean?

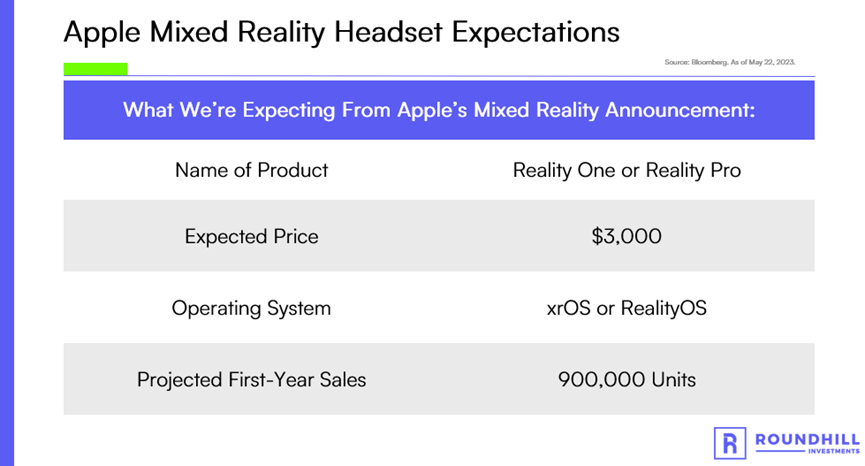

Apple is poised to make its long-awaited entry into mixed reality (MR) hardware and expand its vision for immersive experiences at its Worldwide Developers Conference on June 5. The company is expected to release its first MR headset and launch its new operating system for the device that is expected to support future MR experiences.

What Are the Experts Saying?

Anna Sweet, the CEO of Bad Robot Games, a member of the Ball Metaverse Research Partners’ Expert Council and formerly the head of content strategy for Oculus and platform growth lead at Valve, says:

“Creating a headset that people want to wear is a delicate balance of performance, style and comfort. Apple has continuously proven themselves the market leader in balancing these tradeoffs and delivering a stylish hardware offering that drives the market. But for a headset to truly achieve a meaningful market size, it needs to come with experiences that people want to use daily. In the WWDC announcement, the software is where we should all focus. In launching the first generation of content for the Oculus Rift, we purposefully created a broad ecosystem of developers and content to test what experiences resonated with users in this new medium. Apple will need a similar strategy, followed by fast iteration and continued investment in order to create a truly sticky platform.”

Apple Adds Credibility to Metaverse Outlook

We believe that Apple’s entry into the Metaverse with these new products helps to add credibility to the ultimate vision of the Metaverse and re-affirms that this long-term ambition remains intact.

Source: Bloomberg, as of May 22, 2023

Source: Bloomberg, as of May 22, 2023

Note: Forecasts are inherently limited and should not be relied upon when making investment decisions. There is no guarantee the sector will experience projected growth. In addition, there is no guarantee it will translate to positive fund performance.

With Meta Platforms highlighting its recent efforts in artificial intelligence, many have thought the company has moved on from what critics would dub a fleeting dance with the Metaverse. But as CEO Mark Zuckerberg said:

“A narrative has developed that we're somehow moving away from focusing on the Metaverse vision. So I just want to say upfront that that's not accurate. We've been focusing on both AI and the Metaverse for years now, and we will continue to focus on both.”

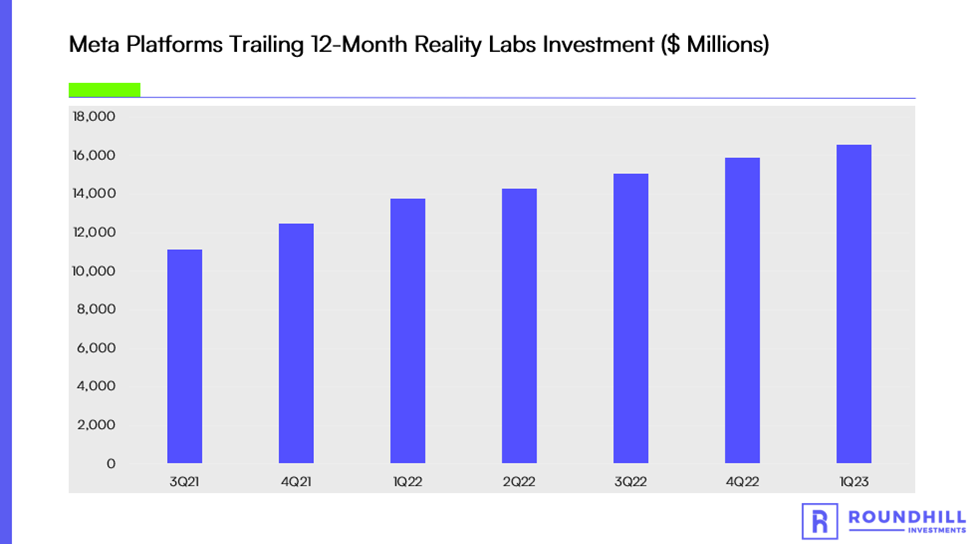

Meta is investing record amounts in the Metaverse via its Reality Labs segment and is projected to spend more than $15 billion on the initiative annually through 2024, according to consensus estimates.

Source: Company Filings, Bloomberg, Roundhill Investments, May 8, 2023

Source: Company Filings, Bloomberg, Roundhill Investments, May 8, 2023

Conclusion

We believe that the cadence of investments in and the time to reach the ultimate goal of the Metaverse have been slowed and pushed out relative to prior market expectations. But we still believe in the vision and promise of the Metaverse, experiences that are real-time 3D rendered, massive scale and experienced synchronously by an unlimited number of users.

Our analysis shows that the economic impact of the Metaverse could reach $10.7 trillion in a decade, comparable to other third-party estimates such as those from Citi and KPMG, according to those firms’ publications. We believe that the Metaverse is one of the key catalysts to increase the digital economy’s share of global GDP, just as prior platforms such as the Internet, mobile and cloud computing have done in the past.

How to Learn More and Invest

How can investors consider the Metaverse’s multi-trillion economic transformation? The Roundhill Ball Metaverse ETF (NYSE ARCA: METV) is currently the world’s largest ETF globally by assets tracking the Metaverse, according to Bloomberg. METV seeks to track, before fees and expenses, the performance of the Ball Metaverse Index.

The Ball Metaverse Index, maintained by Ball Metaverse Research Partners, seeks to track the performance of companies that engage in activities or provide products, services, technologies or technological capabilities to enable the Metaverse and benefit from its generated revenues. The Ball Metaverse Research Partners’ Expert Council, with decades of domain expertise in online games, financial technology, data networking and hardware, maintains the Ball Metaverse Index.

For additional information, including the latest fund holdings, a full prospectus and how to invest, visit https://www.roundhillinvestments.com/etf/metv/. Or, find out more in our latest article, How to Invest in the Metaverse.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the METV Metaverse ETF please call 1-855-561-5728 or visit the website at https://www.roundhillinvestments.com/etf/METV. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Metaverse Companies and other companies that rely heavily on technology are particularly vulnerable to research and development costs, substantial capital requirements, product and services obsolescence, government regulation, and domestic and international competition, including competition from foreign competitors with lower production costs. Stocks of such companies, especially smaller, less-seasoned companies, may be more volatile than the overall market. Metaverse Companies may face dramatic and unpredictable changes in growth rates. Metaverse Companies may be targets of hacking and theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more developed countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks.

As an ETF, the fund may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments. The Fund may invest in securities issued in initial public offerings. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. The Fund is a recently organized investment company with no operating history. The Fund invests in equity securities of SPACs, which raise assets to seek potential acquisition opportunities. Unless and until an acquisition is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Because SPACs have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. There is no guarantee that the SPACs in which the Fund invests will complete an acquisition or that any acquisitions that are completed will be profitable. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial business combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a business combination even though a majority of its public stockholders do not support such a combination. Some SPACs may pursue acquisitions only within certain industries or regions, which may increase the volatility of their prices.

Foreside Fund Services, LLC: Distributor.

*Neither Roundhill Investments nor METV Metaverse ETF are affiliated with these financial services firms. Their listing should not be viewed as a recommendation or endorsement.