The Metaverse in 2023: From Bubble to Building

The metaverse rapidly moved from the fringes of technology and science fiction into common discourse in 2020 and 2021. But 2022 marked a significant reset of expectations and valuations around just what the metaverse is, when it will arrive, how big it will be and the valuation of perceived metaverse leaders.

In 2023, we’ve entered a more muted environment, where companies are optimizing their operations for profitability and long-term investment projects such as the metaverse are getting re-assessed.So what is the outlook for the metaverse and its promise of a multi-trillion dollar economic transformation in 2023 given this more muted operating environment?

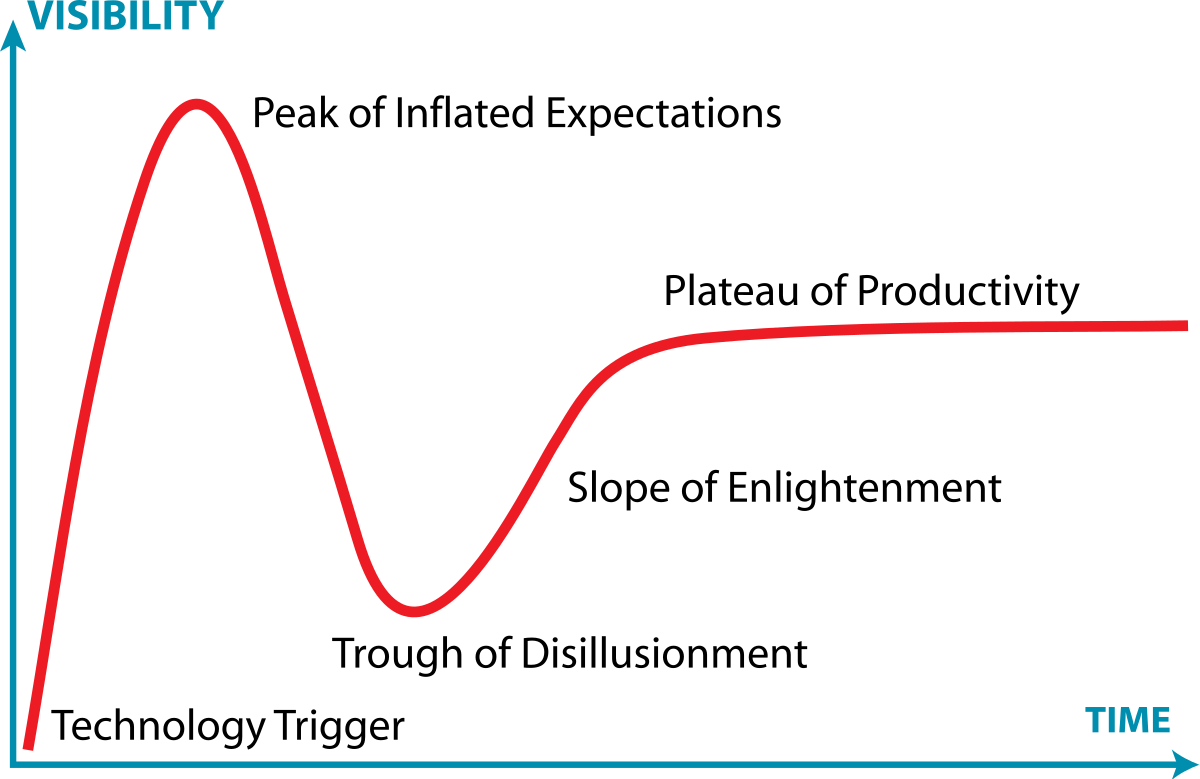

The Hype Cycle

Source: Gartner, 2022

The Gartner Hype Cycle can be an imprecise yet efficient tool for analyzing the trajectory of technology trends and the metaverse is just the latest to follow it. As Roblox went public and Facebook changed its name to Meta in 2021, expectations around the metaverse went vertical and everyone was talking about it.

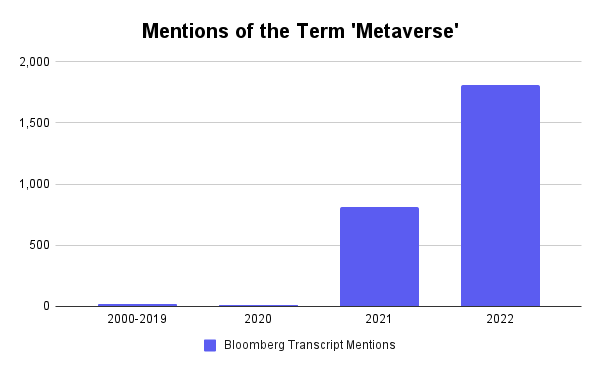

In the two decades prior to 2020, the term “metaverse” was mentioned 19 times in company transcripts, an average of about once per year, based on our analysis of Bloomberg data. In 2020, the number of mentions increased to 7. And then, the Facebook effect…

The term metaverse was mentioned 813 times in 2021 as Facebook changed its name to Meta. And that number climbed to over 1,800 in 2022. It’s clear that this marked the peak of inflated expectations, and the drawdown in valuations for metaverse companies in 2022 likely reflected this reset of expectations.

Source: Bloomberg, Roundhill Investments

The metaverse is no longer some fringe technology dream, it is something that every company is latching on to and thinking about. But now that it’s a known commodity and the hype cycle has been flushed out, where does it go from here?

From Growth at Any Cost to Profitable Investments

As technology companies optimize their organizations to focus on profitable investments in 2023, the pace of metaverse development is slowing down as companies align the cadence of investments with the timing of potential returns from metaverse platforms. Meta CEO Mark Zuckerberg has called 2023 “the year of efficiency.”

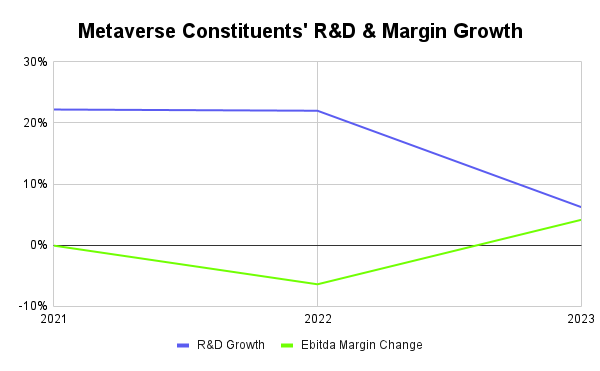

For example, companies in the Ball Metaverse Index, the index that powers the Roundhill Ball Metaverse ETF, are expected to grow their research and development spending just 6.2% in 2023 vs. an R&D Compound Annual Growth Rate (CAGR) of 22.1% for 2020 through 2022, based on consensus estimates, as they reign in spending growth. The group’s Ebitda - earnings before interest, taxes, depreciation and amortization - margin is expected to expand 414 basis points (bps, or 1/100th of a percent) in 2023 vs. a decline of 643 bps in 2022 as they focus on efficiencies, cost cuts and optimizing their operations.

Source: Bloomberg, Roundhill Investments

In this environment, where investments are slowing and the focus on margins is a priority over growth, we are seeing a shifting in the timing it takes to reach the vision of the metaverse but many remain committed to this vision. These changes are evidence that the path to get there is not linear, it will be bumpy and fluctuate based on the macro environment but the north star to which companies are building hasn’t changed.

This is also occurring at a time where post-pandemic behaviors are normalizing, as evidenced by the video game market. Video games are serving as the entry point for many into the metaverse - these are real-time 3D-enabled virtual worlds that support large numbers of concurrent users. And these “proto-metaverse gaming platforms” are feeling the impact of macroeconomic pressures.

It’s clear that gamers are spending less time playing games, focusing their time and monetary investment into a smaller subset of large, blockbuster titles amid the impact of global inflation and crimped consumer budgets. For metaverse platforms, this means that the competitive environment has gotten significantly tougher to engage and retain users. This can make it tougher for them to grow monetization and engagement throughout the year, until the macro environment settles down.

For example, Roblox has seen its user base continue to grow, but the daily time spent per user on the platform and the spending per user has trailed off in 2022. Roblox had just 17.6 million daily active users in 2019 but with the pandemic accelerating trends, it ended 2022 with 56 million DAU. Average bookings per DAU reached nearly $60 in 2021 vs. $39.40 in 2019, but slipped back to about $51 in 2022. Similarly, time spent per day per user fell 3% in 2022 after growing 20% from 2019 through 2021.

The Long View

Longer-term, companies will continue to invest in the core technologies, protocols and platforms underpinning the metaverse and the view for a multi-trillion dollar transformation caused by the metaverse hasn’t budged. But the timing of when the metaverse truly arrives and the pacing of investments to get there may now be a bit slower.

%20Estimates.png?width=600&height=371&name=Metaverse%20Total%20Addressable%20Market%20Size%20($%20Billions)%20Estimates.png)

Source: McKinsey, Citi, Goldman Sachs, Morgan Stanley, KPMG, Roundhill Investments

Large investment banks and consulting firms still see a multi-trillion dollar transformation ahead, even as spending on the metaverse gets pared in 2023. KPMG and Citi see as much as $13 trillion of economic value created by the metaverse in a decade, while even the most conservative estimate calls for $4 trillion of value add.

The Roundhill Ball Metaverse ETF consists of companies leveraged to the future development of the metaverse, a potential multi-trillion economic transformation. For information about the fund and how to invest, visit https://www.roundhillinvestments.com/etf/metv/, or find out more in our latest article, How to Invest in the Metaverse.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the METV Metaverse ETF please call 1-855-561-5728 or visit the website at https://www.roundhillinvestments.com/etf/METV. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Metaverse Companies and other companies that rely heavily on technology are particularly vulnerable to research and development costs, substantial capital requirements, product and services obsolescence, government regulation, and domestic and international competition, including competition from foreign competitors with lower production costs. Stocks of such companies, especially smaller, less-seasoned companies, may be more volatile than the overall market. Metaverse Companies may face dramatic and unpredictable changes in growth rates. Metaverse Companies may be targets of hacking and theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more developed countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks.

As an ETF, the fund may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments. The Fund may invest in securities issued in initial public offerings. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. The Fund is a recently organized investment company with no operating history. The Fund invests in equity securities of SPACs, which raise assets to seek potential acquisition opportunities. Unless and until an acquisition is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Because SPACs have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. There is no guarantee that the SPACs in which the Fund invests will complete an acquisition or that any acquisitions that are completed will be profitable. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial business combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a business combination even though a majority of its public stockholders do not support such a combination. Some SPACs may pursue acquisitions only within certain industries or regions, which may increase the volatility of their prices.

Foreside Fund Services, LLC: Distributor.

*Neither Roundhill Investments nor METV Metaverse ETF are affiliated with these financial services firms. Their listing should not be viewed as a recommendation or endorsement.