DeFi Gaming - An Entry Point for Web3 and Metaverse Adoption

The contents of this article are not intended as a recommendation to buy or sell any securities.

Introduction to Decentralized Finance

There is broad consensus among technologists and investors alike that a decentralized successor state to the current internet is being built. Dubbed Web3, the next iteration of the internet will be enabled by improvements in bandwidth speeds, the mass commercialization of VR and AR technology, and a shift from traditional finance to decentralized applications built on the blockchain. The anonymized, consensus-driven, democratic nature of blockchains has appealed to market participants who have become frustrated with long settlement times, limited market hours, and the necessity of numerous intermediaries, all of which exacerbate risk.

Underlying decentralized finance (DeFi) is the Ethereum protocol, enabling smart contracts between buyers and sellers. These contracts are self-executing, based on the fulfillment of mutually agreed upon conditions written into the contract itself. Unlike legacy online payments systems, smart contracts are irreversible, mitigating the risk of chargebacks. Furthermore, the automated nature of the contracts eliminates ambiguity regarding fulfillment, which is a binary outcome. Within public blockchains, transactions can be verified by everyone on the ledger on-demand, an important element of trust and security.

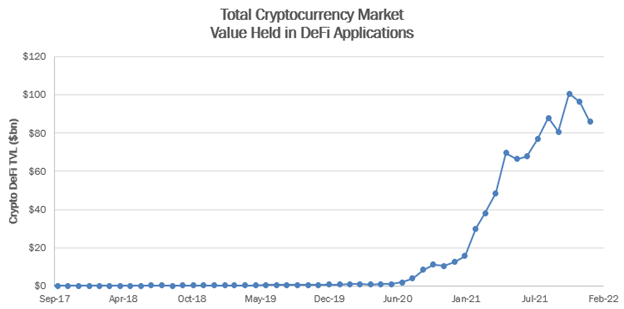

According to Bloomberg and DeFi Pulse, the value of assets used in decentralized finance topped $100 billion in October 2021, growing from $11 billion a year earlier.1 Lending on cryptocurrency platforms and exchange transactions have so far led the bulk of this growth, amounting to $51 billion and $30 billion in market value, respectively. While this growth is striking, it remains a fraction of the $85 trillion global economy, which is facing disruption through decentralization. One potential accelerator is play-to-earn gaming, an interactive segment of DeFi marked by the convergence of cryptocurrency, NFTs, and the blockchain. These new games, which were popularized just this past year, allow players to earn income while playing, either in the form of cryptocurrency or unique NFTs. Allowing average gamers to reap benefits through their game time has flipped the script on the freemium model, in which the game developer receives most of the economics. Importantly, as the metaverse comes to fruition throughout the coming decades, these games may enable a multi-trillion dollar creator economy, making it financially viable for millions of users to create a digital presence.

Source: DeFi Pulse, as of January 2022.

Gaming Transition to Play-to-Earn

While the economics generally flowed from the player to the publisher before play-to-earn, there are parallels to the model that began in 2010. Pioneered by Valve, in-game items on titles within the publisher’s Steam platform could be traded user-to-user within games. These included cosmetic items, weapons, and loot crates, which had to be opened using keys bought from Valve themselves. Many of these items were received through playing time, with players logging the most hours receiving the highest frequency of drops. Eventually, trading was enabled within the Steam client, allowing for interoperability between different games. The ability for players to trade amongst themselves led to a gray market where players traded fiat off Steam, using services like PayPal, for items within the platform.

Using traditional payment systems opened the door for fraud on both sides of the transaction, as in all instances, one user had to make the first trade. For example, the buyer of a digital good, trusting the reputation of the seller, might have sent cash before receiving their items, only to have the seller never uphold their end of the bargain. In another example, the buyer could have gone first, sending cash for the items received but then filing a “chargeback” with the payment service, claiming they never received the items.

Cryptocurrency mitigated some of these issues, though at the time was an imperfect fix. While Bitcoin could not be charged back, purchasing Bitcoin from fiat was subject to high exchange fees, long transaction times, and volatility, which could cause the loss of principal for traders basing their profit and loss in fiat currency. Today, exchange fees have come down significantly due to the presence of competing exchanges, tokens built on new blockchains have shorter transaction times, and volatility can be limited through the use of stablecoins.

Earning with the Blockchain

Decentralized games (GameFi) built on blockchains are the natural evolution of the creator economy for gamers. Using smart contracts, completing certain objectives within the game automatically provides the player with NFTs that can take many different forms. For example, in the most popular play-to-earn title Axie Infinity, players collect creatures called “Axies,” which can battle with other players’ creatures or be bred and showcased to the world. In another popular title, Alien Worlds, players collect NFTs with six different levels of rarity, including land parcels, tools, and weapons, with the ultimate goal of earning the game’s unique cryptocurrency “Trilium.”

Source: DappRadar, as of December 2021.

Virtual real estate represents another outgrowth of GameFi that has the potential to become a multi-billion dollar market this decade. While virtual property is not new, as platforms like Second Life have facilitated the sale of millions in land for decades, the authentication of ownership via the blockchain is an innovation. Via NFTs, users can buy, sell, or even rent parcels of land via any exchange that facilitates digital real estate transactions. Currently, these include marketplaces like OpenSea, Decentraland, and The Sandbox, which handle large amounts of volume per day. Properties in Decentraland keep shattering records, with the latest set in November 2021 at a purchase price of $2.43 million, or 618,000 MANA, the token that powers the platform. This sale showcases corporate interest in virtual land, as the space will be developed to “facilitate fashion shows and commerce” within the budding digital fashion industry.

Traditional game publishers have had varied attitudes towards incorporating NFTs. Last December, Ubisoft announced their foray into the technology, dubbing their own NFTs as “Digits.” A new platform called “Quartz” was also announced, where players can purchase, collect, and trade their Digits. Ubisoft’s undertaking was met by negative reception from gamers, who decried the monetization of existing franchises. The company unlisted the trailer for the project on YouTube, though remains committed to integrating NFTs with their titles. This caused other large publishers such as EA to walk back on their NFT plans. EA CEO Andrew Wilson stated on the company’s earnings call last November that NFTs “will be an important part of the games industry in the future.” However, on their call in February, the gaming giant backtracked on its plans, stating “it’s not something we’re driving hard against.”

The difference between legacy models and play-to-earn is that these NFTs are unique to the player and verifiable on the blockchain. Players can choose to retain the items or sell them for cryptocurrency, which can be easily converted to fiat money or another crypto on an exchange. This has implications for emerging economies, where players may be able to earn more in games than with traditional employment. For example, the model has become popular in the Philippines, particularly within communities that lost work due to the pandemic, as showcased in a recent documentary by Emfarsis.2

Crypto Staking

At a high level, staking involves receiving rewards for holding certain cryptocurrency assets, made possible by the proof of stake mechanism. There are two types of decentralized consensus mechanisms for blockchains — proof of work (PoW) and proof of stake (PoS). Under proof of work, transactions are validated via sheer computing power, by solving complex algorithms. This method has served as the basis for Bitcoin, Ethereum, and other early blockchains, though its viability is curtailed by excess electricity consumption, which has negative effects on the environment. As a result, many new blockchains are relying on proof of stake, where owners offer their tokens as collateral to validate new transactions. This limits computational power and energy use, though relies on coin owners becoming “stakers.” Ethereum 2.0 is an upgrade to the Ethereum network that changes its blockchain from PoW to PoS, and is currently being launched over several phases.

Certain GameFi apps rely on staking as a rewards mechanism for players. For example, Axie Infinity Shards (AXS) serve as the governance token for the game, eventually allowing community members to direct control of the game’s Community Treasury. Players willing to lock up their AXS tokens are eligible for rewards, based on the schedule laid out by the platform’s whitepaper. However, staking rewards do not have to be in the native token of the platform, as demonstrated by the Myobu GameFi project.3 On Myobu, users can lock native tokens into the staking pool for a fixed period of time, and earn rewards in Ethereum. Users are incentivized to lock for up to 52 weeks, which earns three times as many rewards. By denominating rewards in a different currency, the platform claims that downward pressure from selling Myobu Coin is mitigated, as sales on the rewarded Ethereum could easily be absorbed.

GameFi in the Metaverse

The metaverse will be populated by countless experiences, each capable of hosting hundreds of thousands of concurrent players. These players will be able to teleport from experience to experience, with an economy permeated by the blockchain. While it remains uncertain whether the metaverse will utilize a single, fungible token or many individual ones, crypto is vastly preferable to fiat, which has cumbersome settlement times and transaction fees. The global nature of the metaverse requires crypto, otherwise users would spend much time exchanging currencies, paying foreign transaction fees to financial intermediaries.

The most popular GameFi applications currently facilitate active player counts in the many tens of thousands, such as in the case of Axie Infinity. Across the roughly 1,200 blockchain games in GameFi, 80 to 100 million transactions are facilitated daily, with 70 new games added monthly.4 Serving as the backbone of DeFi, the Ethereum blockchain may also lend itself to transactions in the metaverse, which will require even more scale. Unlike games like Roblox and Fortnite which utilize their own native tokens, crypto earned from GameFi can be traded for any other cryptocurrency, or it can be sold for fiat money.

Many of the experiences in the metaverse are likely to be set up as decentralized autonomous organizations (DAOs). DAOs are blockchain based groups that democratically rely on the consensus of blockchain network stakeholders, with voting power allocated based on token ownership..5 These are special kinds of tokens known as governance tokens, which in addition to voting rights may also entitle the holder to a pro rata portion of the project’s cash flows. Smart contracts define the rules of the entire organization, ensuring decisions are made collectively and within the limits of the protocol. The metaverse will likely be populated by both play-to-earn experiences created by large private firms, as well as democratically-managed DAOs.

GameFi for Web3 Adoption

The new iteration of the internet will be marked by blockchain-based systems and methods, in a move towards decentralization. Allowing users to benefit monetarily from their use of a Web3 site could look very similar to how users earn crypto in play-to-earn games. In November, reports surfaced that social media giant Reddit was looking to convert users’ karma into a native token based on the Ethereum standard.6 Users earn karma on Reddit by posting comments and threads to the site’s various subreddits, which can then be “upvoted” or “downvoted,” adding to or removing karma from their account. Under the proposal, the tokens received by users may then be able to purchase NFTs from an in-house platform, ushering in a creator-led digital economy.

As more industries are gamified, participate-to-earn is likely to become the prevalent model across Web3. For example, users may be paid in crypto to read a news article, participate in a survey, or create insightful content. These transactions will be wrapped by smart contracts, removing any ambiguity over what the payout should be for a successful task completed. Furthermore, transactions on the blockchain are safer than legacy payment processing systems. Blockchains are secured by cryptographic algorithms that rely on consensus, and any hacker would need to take over the majority of the network’s hashing power, an extremely unlikely occurrence for large chains like Ethereum.

The economic shift from corporations to creators is a key component of the transition to Web3. The creator economy will see users compensated for their contributions with crypto, based on automatically executing smart contracts. Blockchains will serve as the settlement layer for those participating in various decentralized applications across ecommerce, finance, and gaming, to name a few. Within gaming, players can generate income in the form of crypto and NFTs, marking a large shift in the industry paradigm away from developers and publishers. Gaming has the potential to thus serve as an entry point for broader Web3 ideals, leveraging billions of existing gamers across the globe.

2https://www.youtube.com/watch?v=Yo-BrASMHU4

5https://www.gemini.com/cryptopedia/what-is-metaverse-crypto-nft-game-blockchain

6https://cointelegraph.com/news/reddit-to-reportedly-tokenize-karma-points-and-onboard-500m-new-users