Esports Viewership vs. Sports in 2020

There’s a lot of buzz around esports these days. In particular, headlines around the viewership numbers that major events are drawing. As major esports events continue to report steadily rising viewership going into 2021, the exact numbers have become increasingly important for organizations, sponsors, and the media to take note of.

One thing that many esports fans take note of is the viewership when compared to that of traditional sporting events. In short, it’s surprisingly higher. A lot higher.

But the reality is, when comparing viewership numbers for esports with those of traditional sports, it’s not always a perfect apples-to-apples comparison. There are several reasons for this, and while creating a perfect formula for comparing individual data points would be challenging at best, we’re hopeful that this piece and the framework it provides can help the general public better understand trends in viewership data by focusing on higher level data.

Source: Newzoo - 2020 Global Esports Market Report

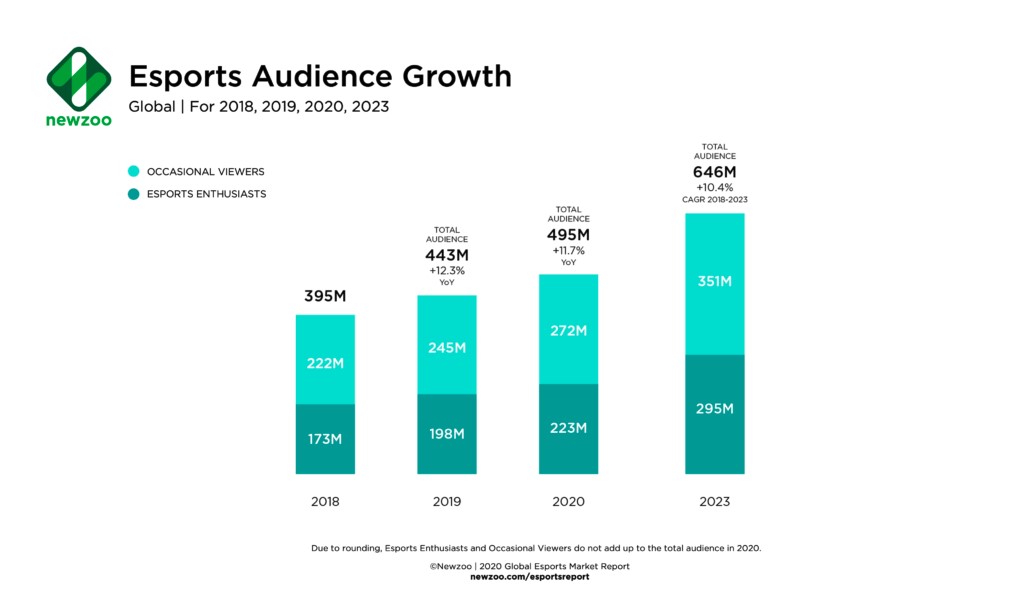

According to Newzoo’s 2020 Global Esports Market Report, the total esports audience will grow to 495.0 million people in 2020, a year-on-year growth of +11.7%.

Newzoo segments esports viewership into “occasional viewers” (people who watch professional esports content less than once a month) and “esports enthusiasts” (people who watch professional esports content more than once a month), which can be an important differentiation for those seeking to invest in esports given the often published viewership comparisons to traditional sports. In 2020, there will be 223 million esports enthusiasts in the audience, along with 272 million occasional viewers.

Newzoo estimates that by 2023, the number of esports viewers globally will grow to 646 million, with “occasional viewers” and “esports enthusiasts” growing from 245 million to 351 million and 198 million to 295 million, respectively, between 2019 and 2023.

Another important consideration is the regional breakdown of esports viewers. While roughly 50% of viewers considered “esports enthusiasts” by Newzoo are located in Asia Pacific, North America, Europe, and the rest of the world each represent more around 10% of the total number. Unlike many traditional sports – with soccer, or football, as it’s more broadly known, as a notable exception – the audience for esports is truly global.

This all being said, many would argue that the above analysis is a bit unfair. After all, “esports” isn’t a single game. “Esports” encompasses competitive play in countless titles across a number of genres, from Multiplayer Online Battle Arenas (“MOBAs”) to Real-Time Strategy (“RTS”) and everything in between. Taken a step further, the audience by game title can vary, similarly to traditional sports. While Dota 2 tilts to an Asian audience, Counter-Strike: Global Offensive has a prominent EU base. However, one could easily counter that this only broadens the potential Total Addressable Market (“TAM”) and longevity of the esports phenomenon.

Related: How to Invest in Esports - Digging Down into the NERD Index

What is Esports?

While the exact definition for esports will vary depending on who you ask, most would agree with the following: esports is playing video games competitively. As alluded to above, this includes countless different titles, a number of genres, multiple types of gaming devices, and varied structures to competitive play.

History of Esports

Esports, by definition, had to start after video games were “invented”. The first “esports event” was likely held in 1972 at Stanford University, where players competed in a decade old game called Spacewar. Later, esports crowned its first celebrity in Billy Mitchell, who at one point held records in arcade games Pac-Man and Donkey Kong (years later, Billy’s activities would retroactively become esports’ first major scandal).

Advances in technology accelerated the growth in esports, from the NES (Nintendo Entertainment System) in the mid-80s to the proliferation of PC gaming which, with a little help from the Internet, allowed gamers to compete without being in the same location.

The rise in PC gaming saw the advent of the first esports leagues, as well as esports events that look a lot more like today’s events than they did at Stanford in 1972. One event, for a popular game called Quake, caught the public’s attention when eventual victor Dennis “Thresh” Fong took home a Ferrari 328 GTS.

Technological advances continued to move the industry forward, culminating in the introduction of video streaming technology (not to be confused with game streaming) which has had a tremendous impact on esports, and gaming more broadly, leading us to today’s manifestation of the competitive gaming industry.

History of “traditional” sports

“Traditional” sports have a much longer history, hence the claim on being the “traditional” ones. Nearly every ancient culture enjoyed some form of “sport.” Perhaps best known is the sporting history of Ancient Greece, which gave birth to the bi-annual sporting festival commonly known as the Olympic Games. You know the ones. The games themselves have evolved over time, with some pastimes showing stronger staying power than others. For example, wrestling has existed in some form or another for 5,000 years, while others developed comparatively later, like soccer (2,000 years ago) and basketball (130 years ago).

Many of the recent technological advances that have helped enable the rapid growth in esports have also affected traditional sports, as well (think goal cams).

Five differences between Esports and Sports

While it’s impossible to highlight all of the differences between esports and sports, there are some key differences worth noting:

- Esports are a digitally native phenomenon.

- The “game” is intellectual property that belongs to a company.

- Streaming offers an alternative for talented gamers to competitive play.

- Fan-bases are not traditionally location-specific (Activision is trying to change this).

- Most esports titles monetize their fan-base at a lower rate than traditional sports.

Esports Prize Pools

For many big esports titles, the prize pool dollars are meaningful - and above that of various traditional sports. Dota 2’s flagship event, The International, has long-held and annually broken the record for largest single-event esports prize pool, most recently totaling $34.3 million (and growing) in 2020. This beats all other esports and sports events, including even the Super Bowl, where each winning player sees a little over $118,000.

Tencent-backed Epic Games’ recent hit title Fortnite’s World Cup had a final event prize pool of $30 million. While this isn’t quite the total prize pool of The International, the Fortnite World Cup had the biggest single-player payout of all time. The first prize winner of the Solo Finals became $3 million richer.

There’s real money on the line at esports events. And lots of it. This has made the competition even more high stakes, bringing in even more viewers.

Esports Viewership

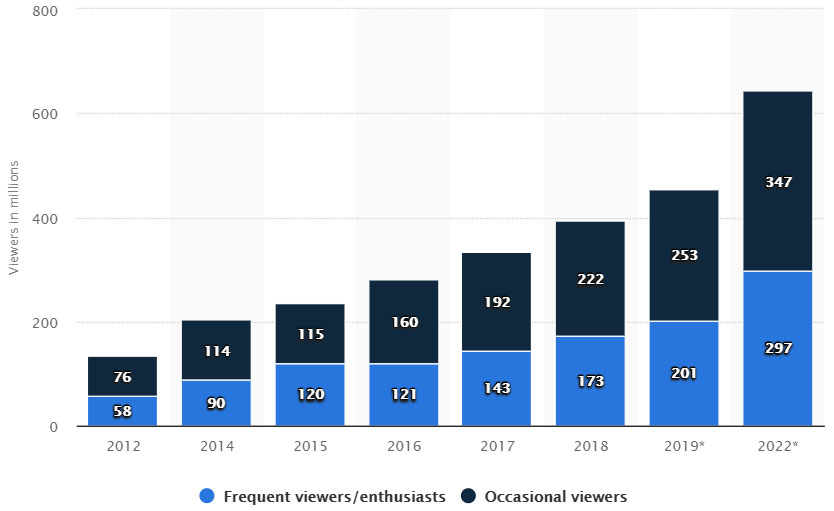

Viewership has been growing rapidly. In 2012, total esports viewership was 134 million (76 million occasional viewers and 58 million esports enthusiasts). By 2018, that number had grown to 395 million (222 million occasional viewers and 173 million esports enthusiasts). From 2012 to 2018, total viewership grew by 195%.

Source: Statista

Fortnite’s first big foray into competitive esports saw some incredible viewership numbers. The Fortnite World Cup Solo Finals in the summer of 2019 had a total hours watched mark of 1.8 million despite it being just under five hours of actual gameplay. This is a common statistic used for measuring the popularity of esports, since unlike traditional sports, esports viewers tend to come in and drop out throughout the duration of the event. These surprising numbers put Fortnite at the top of the Twitch charts, a popular streaming platform where many esports events are broadcast live.

But esports is a fast-growing, ever-changing industry and League of Legends didn’t have a long time to celebrate. Fortnite didn’t have more than a few months to claim their viewership spot.

Dota 2’s largest esports event of the year, The International, saw an incredible 1.1 million peak concurrent viewers on Twitch during the finals. This made it the most watched esports event of all time. But that also didn’t even last a full season.

The League of Legends World Championship in 2019 was a record-breaking esports event, boasting over 100 million viewers. Most of these fans tuned in via streaming services like Twitch and YouTube. In comparison, the Super Bowl that same year had 100.7 million viewers across the NFL’s digital properties and CBS. The 2019 League of Legends World Championship cemented the game as the most viewed esport of all time, breaking streaming records on Twitch thanks to 1.7 million peak concurrent viewers on that one platform alone.

2020 is looking to be another successful year for esports like League of Legends. In fact, the first day of LoL Worlds 2020 had 1.1 million viewers (excluding television viewers and Chinese streaming sites). The NFL 2020 season opener game had a little over 19 million viewers. Of course, it’s hard to compare the two when the data is offered in such different ways.

Esports events and streams are often measured by their peak concurrent viewership counts and hours watched total, whereas traditional sporting events only offer their total viewership numbers. Esports viewers are also split between many different streaming platforms, including Twitch, YouTube, and other official channels for the event. Getting even more specific, some people view the game on unofficial channels on Twitch, like streamers who are broadcasting the game to do live reactions to the event. This doesn’t allow for a proper comparison in popularity, since many esports viewers are not officially accounted for.

Still, it seems that esports - while growing at an incredibly rapid pace - are nowhere near the numbers traditional sports are pulling in around the world.

Projected Viewership for Esports

Esports viewership is expected to grow to 646 million by 2023 (351 million occasional viewers and 295 million esports enthusiasts). This represents a 10.3% CAGR from 2018-2023.

Which titles will catch the most eyeballs? Well, that is anybody’s guess. Fortnite didn’t exist in 2016. Nor did the Overwatch League, or the Call of Duty World League in its new form. The esports industry, much like the gaming industry more broadly, is a hit-driven industry. This makes it increasingly important for those looking for exposure to consider a broader based approach in the absence of specialized knowledge or views.

Sports Viewership

Traditional sports viewership is still larger than esports. This may remain the case, even accounting for esports’ recent growth trajectory in comparison to that of traditional sports. Indeed, the sports industry is one of the few types of programming that can still command millions of viewers at a time on linear television.

Soccer remains the most popular sport in the world, with an estimated 4 billion fans globally. Perhaps surprising to many US-based readers, Cricket is second with an estimated 2.5 billion fans globally. American football doesn’t even crack the top-10! Check out this full list.

Source: World Atlas

While some analyses of audience data comparing esports to traditional sports suffer from differing approaches to the measurement, estimates for overall fans seems to offer a more apples-to-apples comparison (though surely different surveys will use varying estimation techniques).

Projected Viewership for Sports

As with any projection, it’s difficult to say where sports viewership goes from here. It’s hard to imagine powerhouses like soccer or cricket experiencing a fall from grace. Overall trends will likely not tell the whole story, either. Thus, while a more in-depth analysis would be required to break-down expectations for the traditional sports industry, there is certainly room for esports to continue earning a higher proportion of the overall eyeballs moving forward.

Esports vs Sports Viewership

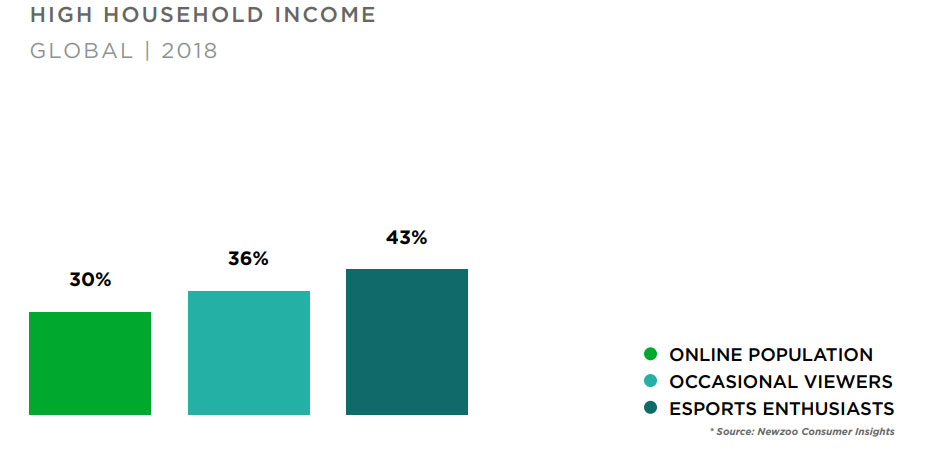

Demographic changes need to be considered. Esports are relatively more popular with younger consumers, many of whom grew up playing video games and who have an innate understanding for gameplay that previous generations do not. Moreover, esports viewers (specifically, enthusiasts) are more likely to maintain full-time employment than the overall online population (67% vs 53%) and have high household incomes (43% vs. 30%).

Source: Newzoo - 2019 Global Esports Market Report

Regional considerations should be made, too. For sports popular in the Asia Pacific region, the tide of fans may already be well underway. Does it continue? Or has it reached a steady-state? In other regions, those tied to the traditional sports ecosystem would be wise to closely follow local adoption of esports. In fact, many have.

Technological advances may once again play a hand in shaping the future of esports and sports viewership. Advancements in mobile technology have already made it so that 5 billion people globally have a mobile phone, with over half of the devices being smartphones. The introduction of 5G connectivity, widely expected to take place in the next few years, will increase people’s ability to access content that requires an internet connection.

The Future of Esports

The esports industry appears to be entering an exciting stage of its development. Financial investments into leagues and teams have left large parts of the ecosystem extremely well capitalized. The proliferation of game-streaming has placed it squarely into the mainstream, with well-known streamer Ninja recently appearing on the cover of ESPN The Magazine. The roll-out of 5G gives mobile esports a ton of potential. Will the franchise league model work? Will top-players bargain for better economics with teams given the value of their streaming careers? Will we get a new genre, a la Battle Royale in the late twenty-teens? I just don’t know, but I am excited for whatever comes next.

Conclusion

There are a lot of ways to measure viewership, and unfortunately, it’s not always clear how best to compare two numbers. Making matters worse, esports and traditional sports are just not the same. Different origins, growth trajectories, demographics, viewing mediums, and countless other factors make it difficult to compare the two, and even more difficult to predict the future. Traditional sports still garner more viewers than do esports.

But it might only be a matter of time until that’s not the case. Although it’s yet to see which video game will reach those numbers first.