The BIG Picture - More of the Same Means More Magnificence… For Now

Investors came into October hoping that the start of the fourth quarter would bring them some seasonal cheer, but last month proved to be another tough one for markets.

The Hamas attacks on Israel in early October and Israel’s response did little to minimize the market’s uneasiness even as investors have become accustomed to shrugging off geopolitical events in recent years.

Economic data continued to offer something for everyone with pending home sales remaining weak, but job growth remaining relatively robust. Inflation has shown progress in moderating, but the bond market is now contending with a supply and demand problem fueled by massive deficits and debt. Furthermore, the bear steepening has continued, which has moved the yield curve closer to positive territory.

On the positive side, companies have beaten tepid earnings expectations. Through the end of October, S&P 500 firms have beaten EPS estimates by 7.86% on average on year-over-year growth of 2.60%. However, revenue growth has been harder to come by with topline only increasing 1.62% in a sign that companies are having a tougher time in an uneasy operating environment.

In light of these developments, Bank of America Research highlighted how earnings beats have been rewarded with average gains of 1.00% in the last week of October, a meaningful improvement compared to 0.20% in the weeks prior , but are below historical average of 1.50%, indicating crowded positioning in companies posting beats. Simply put, it’s gotten harder for investors to win even if they pick the right companies.

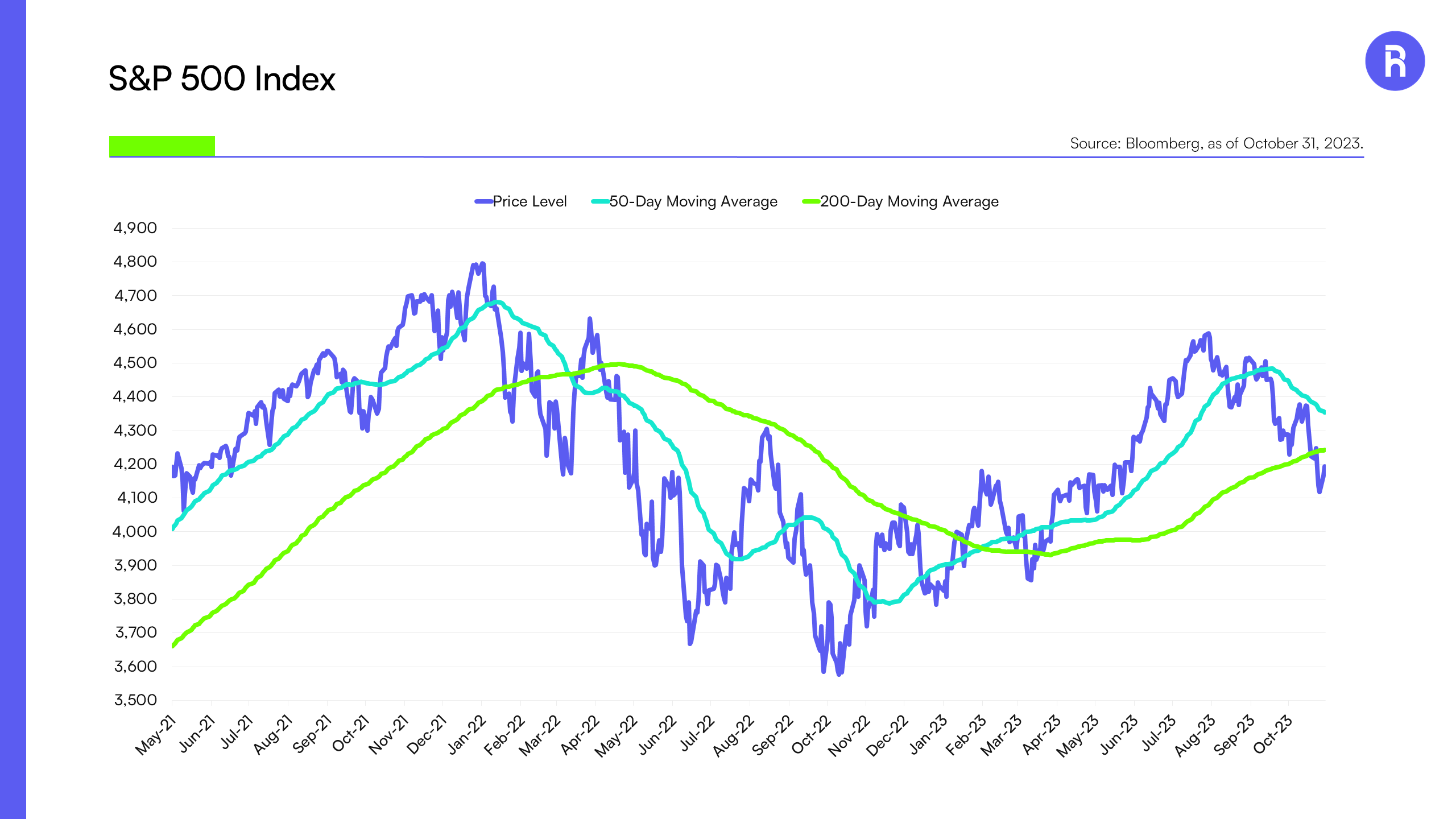

Major averages and well followed companies like Apple dipped below their 200-day moving averages. The S&P 500 briefly fell below a key level of 4,200, which we noted as a bearish signal last month. This action reinforces the fat and flat trading environment we have experienced since 2021. A 50% Fibonacci retracement now stands at 4,053.

Fat and Flat Staying Fat and Flat

Source: Bloomberg, as of October 31, 2023.

Seasonality suggests that with a negative August, September, and October, markets may be poised for a bounce in the final two months of 2023. However, we believe that investors should prepare for more of the same – conflicting economic data, steepening yield curve, and limited equity market leadership. In other words, nothing has changed to disrupt the fat and flat environment.

For now, we believe that the Magnificent Seven stocks will remain a pocket of perceived safety for investors. If you exclude them from the S&P 500, the market would actually be negative on the year. The seven tech giants have offered growth in an otherwise challenging environment. A valid concern is valuation – the Magnificent Seven are trading at high P/Es and it is becoming more difficult to make an argument that they will continue to outperform at the same pace.

Looking further out, investors will likely seek out traditional safe havens, particularly Dividend growers. Dividend growth companies like the Dividend Monarchs (or Dividend Kings) offer high quality exposure and trade at attractive price multiples. Considering they have raised their dividends for 50+ consecutive years, they have demonstrated the ability to reward shareholders through good times and bad. If you believe winter is coming then it may be time to take some profits on the Magnificent Seven and reposition toward the Monarchs.

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (855) 561-5728. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the Primary Exchange official closing price. Brokerage commissions will reduce returns.

Carefully consider the investment objectives, risks, charges and expenses of Roundhill ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Funds investments may be non-diversified, meaning its assets may be concentrated in fewer individual holdings than a diversified fund and, therefore, more exposed to individual stock volatility than diversified funds. Investments in foreign securities involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more develop countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

NERD, BETZ, METV, BYTE, MEME, WEED, CHAT, BIGB, BIGT, LNGG, LUXX, and KNGS are distributed by Foreside Fund Services, LLC. DEEP is distributed by Quasar Distributors, LLC.