The Next Generation of Income: Why 0DTE Strategies Are Replacing Yesterday’s Covered Calls

Introduction

In a market where financial headlines can reshape entire sectors within hours, old-school income strategies are starting to show their age. For decades, income-focused investors relied on traditional covered call models, selling longer-dated options over long stock positions to earn a little extra premium. It worked well enough when markets moved at a slower pace. But today’s market is anything but slow. These days, volatility is no longer an occasional shock, it’s a regular occurrence, and we believe income strategies should be adjusted to keep up with current market conditions.

Enter 0 days-till-expiration (0DTE) covered calls. 0DTE covered calls reset strikes every day, capitalizing on intraday price swings and fleeting volatility spikes. They also don’t hold any overnight short risk, leaving the strategy 100% long overnight to the underlying asset’s moves. When we compare a 0DTE vs a traditional covered call fund, they’re not just a faster cadence of selling options, they’re fundamentally different.

Traditional Covered Calls: A Strategy Built for Yesterday

Let’s take a closer look at what we’ll call “Gen 1” covered call strategies: selling a call option that expires in 1 week, 2 weeks, or even 1 month and collecting the premium. For a long time, this was a reliable way to generate income, especially in relatively calm markets. But that was before the days of CPI whiplash, FOMC-driven price swings, and retail-driven gamma squeezes.

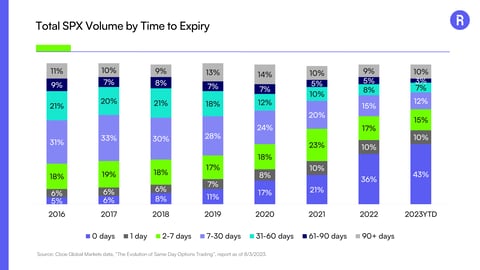

According to Cboe’s 2025 report, “0DTEs Decoded,” ~60% of S&P 500 options volume now comes from 0DTE contracts. The S&P 500 trades over 1.5mm contracts of 0DTE options every day - compare that to just five years ago in 2020 when that number was sub-350k contracts. This surge in volume demonstrates a substantial shift in investor sentiment towards trading daily options.

Volatility as a Feature, not a Bug

If there’s one thing 0DTE strategies are built for, it’s speed. These contracts reset strikes every morning and expire on the close, allowing traders to profit from intraday price swings without carrying overnight risk. That’s a significant shift from Gen 1 strategies, where holding positions overnight meant exposure to Fed speeches, earnings releases, and geopolitical events. By selling options in the morning, when volatility tends to trade higher and closing out positions before the day ends, traders seek to monetize the market’s short-term convulsions.

As you can see in the chart below, which plots 1-year implied volatility vs 1-month implied volatility, shorter-dated volatility has larger swings, as it remains in context with event-driven risk. This demonstrates why 0DTE’s approach is tactical, not passive.

0DTE strategies also allow the long stock position to remain uncapped overnight, when volatility is trading lower, which gives 0DTEs an additional long exposure that traditional covered call models do not have.

Time Decay: The Accelerator Effect

Here’s the math: Options lose value the fastest in their final hours. This high-theta zone is where 0DTE strategies live. Instead of waiting for a 30-day option to bleed out its time value, 0DTE traders are scooping up time decay every single day. Monthly strategies spread risk and premium across 30 days. But 0DTE strategies condense that risk, aiming to create more opportunities to collect premium with less exposure to unknowns.

In essence, the Gen 1 model waits to get paid the highest theta. 0DTE strategies seek to earn the highest theta every single day, and the compounding of that value over 252 trading days each year accumulates to a substantially larger value in premium collection. This phenomenon is illustrated in the chart below.

Adaptive Income: Trading the Market in Real-Time

One of the most compelling aspects of 0DTE strategies is their flexibility. Unlike traditional income strategies that hold through multiple market events, 0DTE positions can be recalibrated every morning. That’s critical in a market where headlines can send sectors soaring or tumbling in minutes. Instead of holding a single short call position through four separate economic reports, a 0DTE strategy can adjust exposure daily, aiming to seize new opportunities or mitigate fresh risks as they arise.

Our Conclusion: The Future Isn’t Passive — It’s Adaptive

0DTEs represent a new evolution in covered call ETFs. Traditional covered calls models were built for a market that no longer exists: one where volatility was a rare event and market-moving news trickled in slowly. Today, investors want strategies that can adapt quickly, and 0DTE options have been designed to take advantage of today’s fast-paced market.

They offer a new playbook for a new market, one where waiting 30 days for income is no longer necessary.

Glossary

Option: A financial contract giving the buyer the right, but not the obligation, to buy (call) or sell (put) an asset at a set price before or at a specific date.

Strike Price: The predetermined price at which an option holder can buy or sell the underlying asset.

0DTE (Zero-Days-to-Expiration): An option that expires today, or an option with a tenor of 0 days.

Covered Call: An options strategy where an investor owns the underlying stock and sells a call option on it, earning premium income while capping potential upside.

Implied Volatility (IV): The market’s expectation of future volatility in the price of an asset, derived from option prices; higher IV means more expensive options.

Theta: A measure of an option’s time decay — how much value an option loses each day as it approaches expiration, assuming all else remains constant.

S&P 500 Index: A benchmark index tracking the performance of 500 of the largest publicly traded U.S. companies, used to gauge the overall health of the U.S. stock market.

--

Disclosures

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent standardized and month-end performance, please click here: XDTE, QDTE, RDTE.

The Funds currently expect, but do not guarantee, to make distributions on a weekly basis. Distributions may exceed the Funds’ income and gains for the Funds’ taxable year. Distributions in excess of the Funds’ current and accumulated earnings and profits will be treated as a return of capital. Distribution rates caused by unusually favorable market conditions may not be sustainable. Such conditions might not continue to exist and there should be no expectation that this performance will be repeated in the future. Please see the Supplemental Tax Information section of the webpage for more information on the distribution composition including the estimated return of capital. Current distributions may include return of capital.

Per the Funds most recent 19a-1 notice, the estimated per share composition of the distribution includes return of capital (ROC) of 100% for XDTE, QDTE, and RDTE.

A final determination of the tax character of distributions paid by the Funds will not be known until the completion of the Funds’ fiscal year and there can be no assurance as to the portions of each Fund’s distributions that will constitute return of capital and/or dividend income. The final determination of the tax character of distributions paid by the Funds will be reported to shareholders on their Form 1099-DIV.

Please consult your tax advisor for proper treatment on your tax return.

*30-Day SEC Yield: Yield calculation that reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the "standardized yield".

This material must be preceded or accompanied by a prospectus.

Click here for the QDTE prospectus.

Click here for the XDTE prospectus.

Click here for the RDTE prospectus.

All investing involves risk, including the risk of loss of principal. There is no guarantee the investment strategy will be successful. The funds faces numerous risks, including options risk, liquidity risk, market risk, cost of futures investment risk, clearing broker risk, commodity regulatory risk, futures contract risk, active management risk, active market risk, clearing broker risk, credit risk, derivatives risk, legislation and litigation risk, operational risk, trading issues risk, valuation risk and non-diversification risk. For a detailed list of fund risks see the prospectus.

Covered Call Strategy Risk. A covered call strategy involves writing (selling) covered call options in return for the receipt of premiums. The seller of the option gives up the opportunity to benefit from price increases in the underlying instrument above the exercise price of the options, but continues to bear the risk of underlying instrument price declines. The premiums received from the options may not be sufficient to offset any losses sustained from underlying instrument price declines, over time. As a result, the risks associated with writing covered call options may be similar to the risks associated with writing put options. Exchanges may suspend the trading of options during periods of abnormal market volatility. Suspension of trading may mean that an option seller is unable to sell options at a time that may be desirable or advantageous to do.

Flex Options Risk. The Fund will utilize FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (OCC). In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices. The values of FLEX Options do not increase or decrease at the same rate as the reference asset and may vary due to factors other than the price of reference asset.

0DTE Options Risk.*** The Fund’s use of zero days to expiration, known as “0DTE” options, presents additional risks. Due to the short time until their expiration, 0DTE options are more sensitive to sudden price movements and market volatility than options with more time until expiration. Because of this, the timing of trades utilizing 0DTE options becomes more critical. Although the Fund intends to enter into 0DTE options trades on market open, or shortly thereafter, even a slight delay in the execution of these trades can significantly impact the outcome of the trade. Such options may also suffer from low liquidity, making it more difficult for the Fund to enter into its positions each morning at desired prices. The bid-ask spreads on 0DTE options can be wider than with traditional options, increasing the Fund’s transaction costs and negatively affecting its returns. Additionally, the proliferation of 0DTE options is relatively new and may therefore be subject to rule changes and operational frictions. To the extent that the OCC enacts new rules relating to 0DTE options that make it impractical or impossible for the Fund to utilize 0DTE options to effectuate its investment strategy, it may instead utilize options with the shortest remaining maturity available or it may utilize swap agreements to provide the desired exposure.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.