What are LEAPS?

What are LEAPS?

Long-Term Equity Anticipation Securities, which is typically shortened to LEAPS, are long-dated options contracts, usually with expirations longer than 1 year in tenor.

For all intents and purposes, they are regular options (calls or puts) but with extended time value, allowing investors to express long-term directional views without rolling short-term options repeatedly.

What Does “Long-Term Appreciation Security” Actually Mean?

Despite the acronym, LEAPS aren’t actually “securities” in the conventional sense. The name was coined by the Chicago Board Options Exchange (CBOE) in 1990 to describe long-term listed options, as they are designed to help investors participate in a stock’s potential appreciation over time.

In practice, a LEAPS call option allows investors to control exposure to an underlying stock for a fraction of the cost of buying the shares outright, essentially providing long-term leveraged exposure. A LEAPS put, on the other hand, can serve as a long-term hedge against downside risk in a portfolio.

Why Investors Use LEAPS

Investors and traders turn to LEAPS for a variety of strategic reasons:

- Long Term Leverage: LEAPS calls allow investors to benefit from potential price appreciation without committing full capital upfront. This can amplify returns if the underlying stock moves higher over time.

- Portfolio Hedging: Long-dated put options can serve as “insurance” against prolonged market downturns or specific company risks.

- Lower Time Decay: Because LEAPS have distant expirations, they lose value from time decay (theta) much more slowly than shorter-dated options.

- Flexibility for Structured Strategies: Institutional investors often use LEAPS to build synthetic long or short positions, or as the core component of dynamic leverage or covered call frameworks.

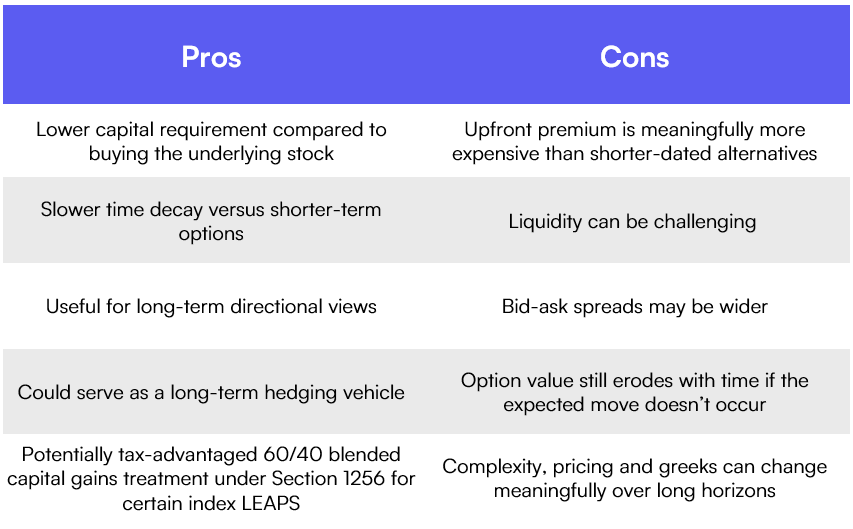

The Pros and Cons of LEAPS

LEAPS in Today’s Market

LEAPS could play well into today’s market, particularly as retail and institutional investors alike are looking for capital-efficient exposure to long-term themes. They’ve also become a building block for innovative ETF structures that use derivatives to create leveraged, buffered, or income-oriented strategies, all while keeping exposures systematic and transparent.

Holistically, LEAPS allow investors to think long-term while staying nimble, whether used to amplify gains, manage risk, or build innovative investment strategies.

Disclosures

Carefully consider the investment objectives, risks, charges and expenses of Roundhill ETFs before investing. This and other information about each fund is contained in the Prospectus and Summary Prospectus. Please read the prospectus and summary prospectus carefully before investing as it explains the risks associated with investing in the ETFs. Each Fund prospectus can be found on the individual Fund page under https://www.roundhillinvestments.com/etf/.

All investing involves risk, including the risk of loss of principal. There is no guarantee an investment strategy will be successful.

Roundhill’s funds are distributed by Foreside Fund Services, LLC.

Glossary

Options: Financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price before or at expiration in exchange for paying a premium. They give the seller the obligation to buy or sell an underlying asset at a specified price before or at expiration in exchange for receiving a premium.

Call Options: A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined strike price before or at expiration. Investors typically buy calls when they expect the asset’s price to rise.

Put Options: A put option gives the buyer the right, but not the obligation, to sell an underlying asset at a predetermined strike price before or at expiration. Investors generally buy puts when they expect the asset’s price to fall or want downside protection.

Bid-Ask Spread: The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). It reflects the cost of trading and the liquidity of the market. Narrower spreads usually indicate more liquid markets.