10 Charts That Show Why We Believe Generative AI Is Not a Bubble

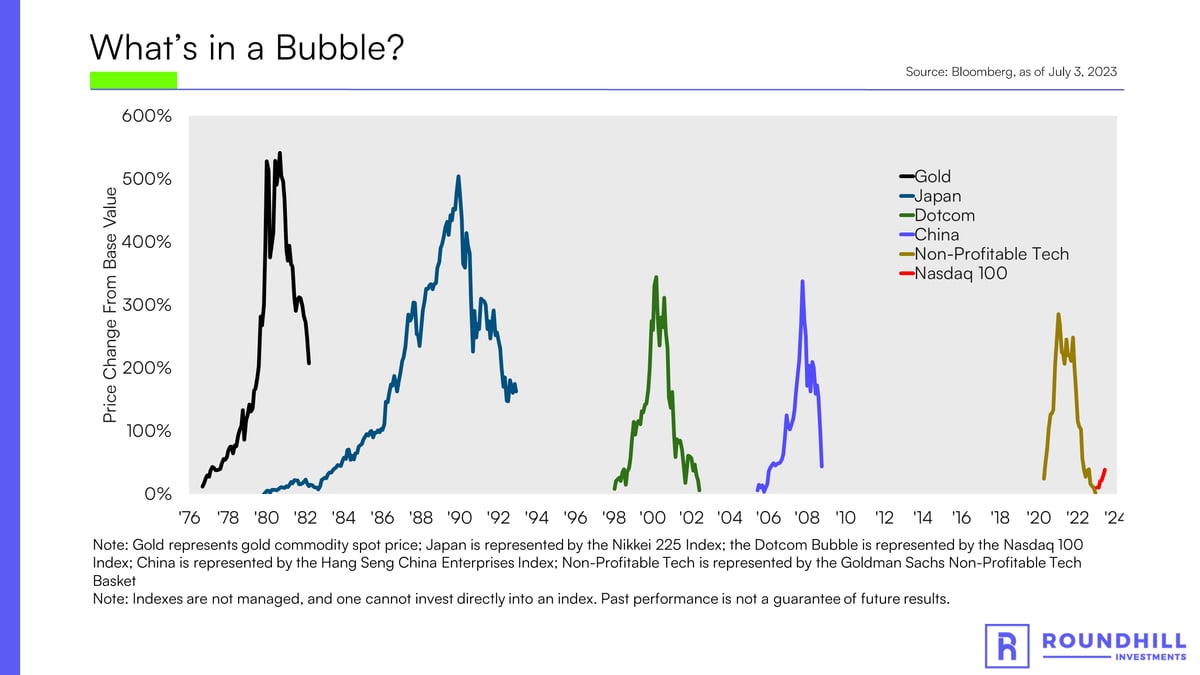

A market narrative has emerged that generative artificial intelligence (generative AI or GAI) stocks are in a bubble akin to that of the dotcom era. Our latest blog post dives into our view that the market narrative is incorrect and that generative AI is nowhere near the dotcom mania.

We assess the current market environment for evidence of a bubble across five criteria:

- Market Narratives – what is the market saying and why is it incorrect?

- Irrational Exuberance – have share price changes matched the level of euphoria of the dotcom era?

- High Valuations – are valuations as high as they were in the dotcom bubble?

- Weak Fundamentals – how do fundamentals of AI leaders compare to the dotcom leaders?

- Hot IPO Market – how does the IPO market today compare to the dotcom bubble era?

In the following 10 charts, we lay out our thesis:

Source: Bloomberg, as of July 3, 2023

Source: Bloomberg, as of July 3, 2023

Source: Bloomberg, as of July 3, 2023

Source: Bloomberg, Roundhill Investments, as of July 3, 2023

Source: Bloomberg, as of July 3, 2023

Note: Cisco and Nvidia chosen as representative leaders of technology hardware sectors in the dotcom era and the recent market rally, respectively; Cisco date range chosen to reflect share price and forward P/E multiple rally from June 1998 low through March 2000 peak; Nvidia forward P/E aligned from share price and forward P/E low in October 2022.

Source: Bloomberg, July 3, 2023

Note: Data for “MAN” companies as of June 30, 2023; data for “Four Horsemen” as of January 30, 1999.

Source: Bloomberg, July 3, 2023

Source: Bloomberg, as of June 30, 2023

Source: Bloomberg, as of June 30, 2023

Source: Bloomberg, as of June 22, 2023

So is AI a Bubble?

Our analysis of potential irrational exuberance, high valuations, weak fundamentals and the IPO market suggest that AI is not yet in a bubble. Comparisons of the current market to the dotcom era simply ignore the actual underlying data points that would signal a bubble.

- Narratives ❌

- Irrational Exuberance ❌

- High Valuations ❌

- Weak Fundamentals ❌

- Increased Number of IPOs ❌

In summary, we take the view that Generative AI is not in a bubble and the comparisons to the dotcom era are unfounded.

How to Invest in Generative AI’s Economic Transformation

Considering that generative AI is not yet showing signs of a bubble, how can you invest in the potential $7 trillion economic transformation4 from generative AI? The Roundhill Generative AI & Technology (CHAT) is the first and only ETF providing targeted exposure to generative AI. For more information on the fund, including access to the latest holdings and full prospectus, visit https://www.roundhillinvestments.com/etf/chat/.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/. Read the prospectus or summary prospectus carefully before investing.

Artificial Intelligence Company Risk. Companies involved in, or exposed to, artificial intelligence related businesses may have limited product lines, markets, financial resources or personnel. These companies face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing the consumer base of their respective products and services.

Technology Sector Risk. The Fund will invest substantially in companies in the information technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Small-Capitalization Investing. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities of small capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole.

Micro-Capitalization Investing. Micro-capitalization companies often have limited product lines, narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including companies which are considered small- or mid-capitalization.

Concentration Risk. The Fund will be concentrated in securities of issuers having their principal business activities in the technology group of industries. To the extent that the Fund concentrates in a group of industries, it will be subject to the risk that economic, political, or other conditions that have a negative effect on that group of industries will negatively impact them to a greater extent than if its assets were invested in a wider variety of industries.

The CHAT ETF is distributed by Foreside Fund Services, LLC

¹Generative artificial intelligence (generative AI or GAI) is a type of artificial intelligence that is designed to create new content, such as images, videos, or music. Unlike traditional AI, which is focused on recognizing and analyzing existing data, generative AI is focused on creating new data. This has the potential to revolutionize many industries, from entertainment and media to healthcare and education.

2The S&P 500 Index is an index tracking 500 of the largest companies listed on U.S. stock exchanges.

3The Nasdaq 100 Index is an index tracking 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

4Goldman Sachs Global Investment Research, March 26, 2023

.png?width=80&height=80&name=RH_Symbol-PrimaryBllue%20(2).png)