How to Invest in AI: The Complete Beginners Guide

Artificial Intelligence, commonly known as AI, is all set to transform our daily lives. As with previous industrial and technological revolutions, AI, specifically Generative AI, holds tremendous potential.

The surge in media attention on generative AI's potential has sparked substantial investments in research and development. This interest is fueled by AI's proficiency in problem-solving, enhancing productivity, and streamlining routine operational tasks

Much of the future is unmapped, but the prospects for generative AI are clear. That means there may also be opportunities for investors to benefit from the growth and development of AI over the coming years. Many investors are undoubtedly convinced of its potential.

Investors old enough to remember the tech bubbles of earlier decades may be understandably wary. Rapid growth often precedes a steep fall, but with AI still in its relative infancy, the potential for further growth looks robust.

This article offers an in-depth exploration of artificial intelligence (AI), examining what trends shape AI development, the potential for future growth, and strategies to invest in generative AI companies.

Introduction to AI

Artificial Intelligence encompasses the simulation of human intelligence processes by computer systems and other machines. It covers a vast spectrum of technologies and applications that are continuously evolving.

This field includes various applications such as speech recognition, and natural language processing.

What Is Generative AI?

Generative AI is an innovative form of machine learning that allows computers to generate new content, such as product designs, virtual worlds, music, art and text. Currently, the best-known generative AI tools are ChatGPT, which generates text on command, Bard, and Midjourney; an AI image generation tool.

Other generative AI tools currently available can mimic voice, create music, write code and complete other creative tasks. Generative AI is currently in the early stages of development, with many of the early tools likely to be superseded by later applications.

Large Language Models, or LLMs, are AI models trained on huge quantities of data to generate natural language responses to given prompts. They are used in generative AI applications to create coherent, relevant new text similar in style and tone to the input text. LLMs learn the statistical patterns and relationships between words and phrases in natural language text.

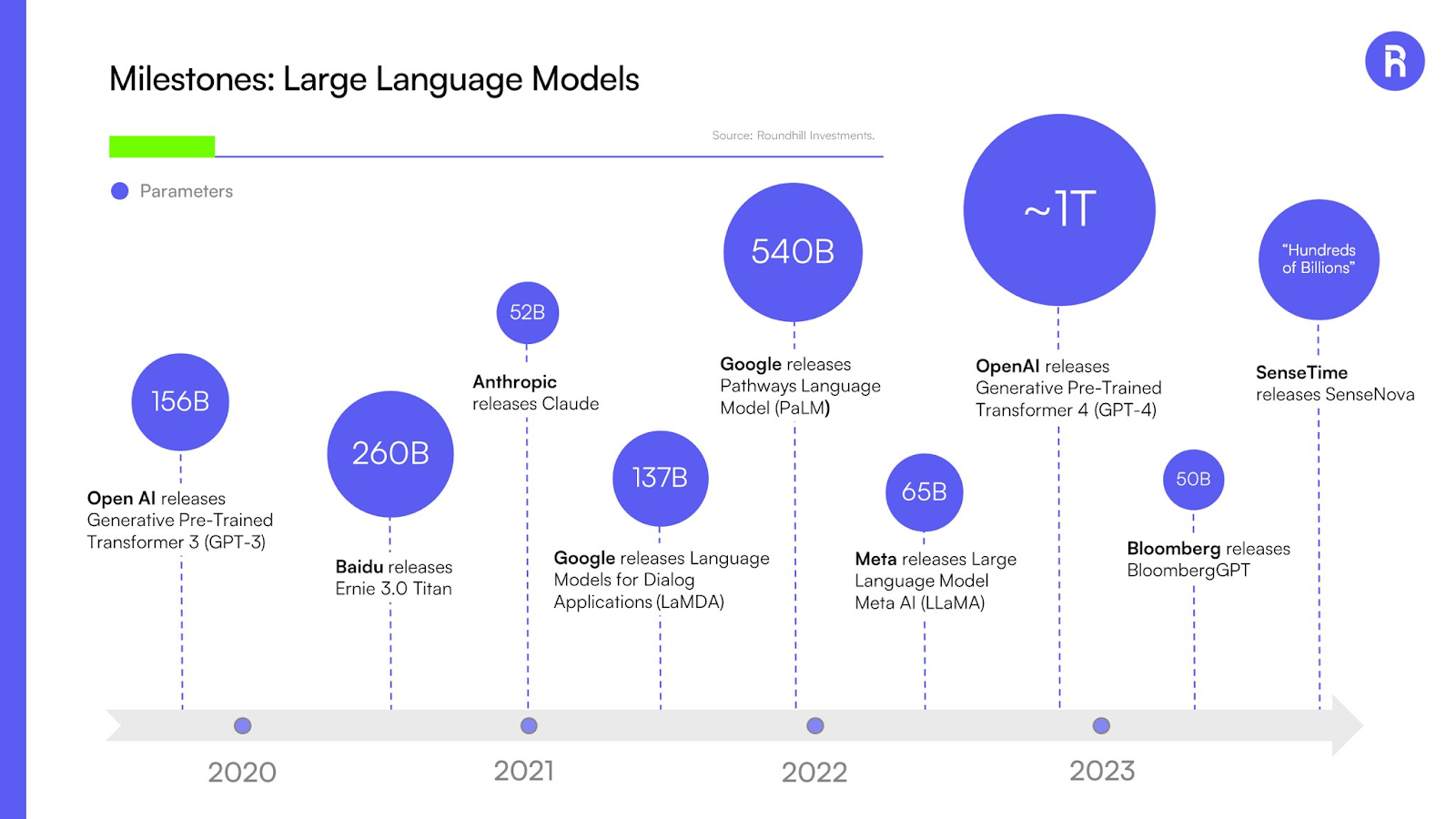

Some popular LLMs include the Generative Pre-Trained Transformer models (GPT) that power OpenAI’s ChatGPT and Microsoft’s Bing AI search. GPT-4 is the latest version of this model, with approximately 1 trillion parameters.

Google has launched several LLMs, including LaMDA and PaLM, with 137 billion and 540 billion parameters, respectively. It’s also invested in Anthropic, which has released the Claude model with 52 billion parameters.

Source: Roundhill Investments, May 10, 2023

Understanding the AI Investment Opportunity

AI development is moving quickly, making it challenging for ordinary investors to keep up. Identifying ‘disruptor’ trends that are likely to transform existing markets can be hugely profitable. Still, with so much competition, it can be difficult to spot companies likely to end up on top.

Often, it’s not the company that develops the innovative technology that ultimately wins out, but imitators who take that technology and find better ways to market it over time.

The impact of AI across industries is likely to be profound, not just in those areas that will directly use the technology.

Before considering investing in AI technologies, it’s essential to understand some key trends currently driving AI development.

The Potential Impact on Search Ad Revenue

Google currently enjoys an overwhelming dominance in the search engine marketplace, generating search-related revenue of $162.5 billion in 2022. This is a 62% share of worldwide search advertising revenue, based on MagnaGlobal’s estimate for the global search advertising market from Bloomberg.

AI has the potential to finally challenge Google’s dominance, with LLMs able to deliver more powerful and extensive searches but at a higher cost. Bing had already embedded the technology behind ChatGPT into its search engine, with others likely to follow. Google is already following suit, expanding it’s new Search Generative Experience (SGE) and adding new languages. This means massive investment in the GPU infrastructure that will power these search engines, with Nvidia far and away the current leader in GPUs used for AI.

A Surge in Venture Capital Investment

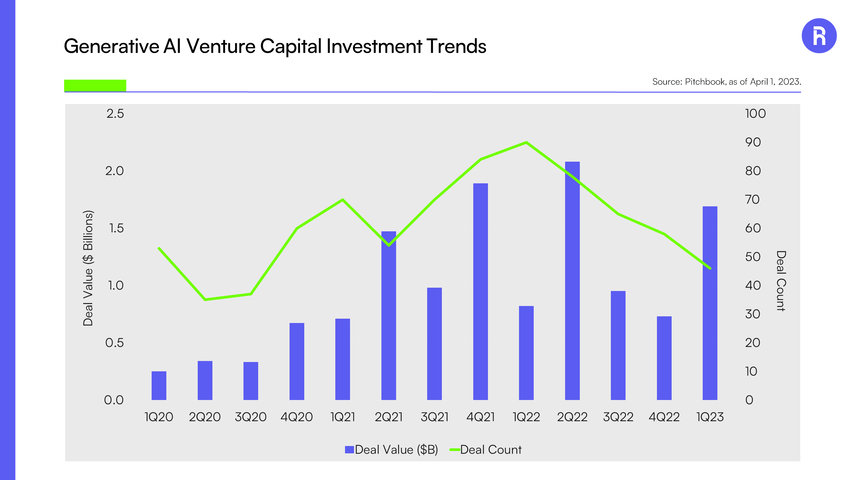

There was a surge in VC funding for generative AI startups in 2023. According to Pitchbook data, VC funding for GAI companies surged to $1.7 billion in Q1 2023, more than doubling both sequentially and year-over-year.

Although some of this investment will go to hiring more data scientists and machine learning experts, the bulk of this fundraising will flow to investments in infrastructure for these companies to train and implement generative AI technologies built on large language models.

Source: Pitchbook, as of April 1, 2023

AI in Video Games

Video game companies have been early adopters of emerging AI technologies for several years. AI tools present various opportunities for developers, including speeding up art prototyping, level and world design, and character creation.

Investors and analysts are currently trying to work out what the long-term impact of generative AI will have on the industry. New tools may lower development costs and increase the margin profile of the industry. Alternatively, they may raise the development bar for everyone, leading to greater competition and further fragmentation.

The Major Players in AI

There are several companies that are well-positioned to benefit from the growth of AI. Some are already seeing remarkable growth as a result of emerging AI technologies. These include:

NVIDIA

NVIDIA is a leading provider of graphics processing units (GPUs) essential for training and running deep learning models. The company is well-positioned to benefit from the growth of generative AI, as many researchers and developers use its GPUs in the AI industry.

Google is one of the world's leading AI companies, focusing on developing deep learning algorithms and neural networks. Google has already developed several generative AI models, such as DeepDream and Magenta, which can be used to create images, music, and other content.

Adobe

Adobe is a leading provider of creative software tools, such as Photoshop and Illustrator. The company has already incorporated AI into its products, with features like the Adobe Sensei AI platform, which can automate and enhance the creative process. Adobe is also working on new generative AI models that can be used to create unique designs and artwork.

Autodesk

Autodesk is a leading provider of 3D design software, such as AutoCAD and Revit. The company already uses AI in its products, with features such as generative design, which can be used to create new designs based on specific criteria. Autodesk is also working on new generative AI models that can be used to create new designs and simulations.

OpenAI

OpenAI is a research organization focused on developing advanced AI technologies. The company came to global attention with the launch of ChatGPT and is currently working on several other generative AI projects, including images and videos.

AI Market Potential & Growth Forecast

The impact of AI is likely to be huge, meaning there is enormous potential for growth and considerable opportunities for investors. As with all disruptive technologies, there is an element of uncertainty, with different players jostling for positions in a dynamic and fast-evolving marketplace.

Generative AI: A Disruptive Opportunity

Generative Artificial Intelligence (GAI) is shaping up to be the next big disruptive technology for many years to come. Analysts at Goldman Sachs estimate that the technology will create $7 trillion of economic value in the period, a staggering 7.3% of global GDP.

This growth will be driven by GAI technologies automating significant portions of the global economy, leading to a sharp rise in labor productivity.

At Roundhill Investments, we believe that GAI represents a multi-trillion-dollar economic disruption poised to impact nearly every corner of the global economy.

We predict that GAI applications alone will become a $120 billion market within a decade, with consumer applications driving additional growth opportunities.

How to Invest in AI Companies

There are several ways investors can take advantage of the growing opportunities presented by AI by investing in AI companies:

How to Invest in AI Stocks

Many investors will look to invest directly in companies that are developing AI. In contrast, others might look at those companies that could benefit from adopting AI technologies across society.

Some of the current leading stocks favored by AI investors include household names investing heavily in AI technologies and others less familiar. They include:

- NVIDIA (NVDA): NVIDIA has established a leading position in the generative AI marketplace by developing computer chips, hardware, software, and development tools to create AI systems. NVIDIA has established a commanding GPU market share.

- Microsoft (MSFT): Microsoft has made significant investments in AI projects, including OpenAI, the developers of ChatGPT. Microsoft has incorporated AI into numerous systems, including Bing, Microsoft 460, GitHub coding tools, and X-Box.

- Taiwan Semiconductor Manufacturing (TSM): Taiwan Semiconductor Manufacturing is the largest maker of chips globally and has a growing share of the AI chip manufacturing market. As a producer of chips for non-AI applications, it is a mature company with balanced interests.

- Meta Platforms (META): Meta has placed AI at the center of its plans for future growth, utilizing LLM AI to drive search results and tailor content. Not only has it developed a next-generation data center, but it has also developed its own silicon chip for AI processing applications.

- Amazon.com (AMZN): Amazon is incorporating AI across the business. Its Alexa system includes AI, and Amazon Web Services (AWS) has a comprehensive AI infrastructure that allows customers to incorporate AI into their existing systems. AI delivers greater personalization, improves security, and drives customer engagement.

- Apple (APPL): Apple’s Siri services use AI to interact with customers, and Apple receives growing revenues from AI services delivered to its platform. For example, OpenAI will pay Apple 30% of the revenue generated from its iPhone ChatGPT app. Apple’s considerable cash reserve can be used to invest in AI technologies.

How to invest in AI ETFs

Investing in a Generative AI ETF allows you to benefit from the research and experience of fund professionals. They will determine which companies to invest in, creating a portfolio of multiple AI stocks within a single investment. This gives you immediate diversification across the sector.

The Roundhill Generative AI & Technology ETF (“CHAT”) is the world’s first Generative AI ETF, as we believe generative artificial intelligence will be one of the most impactful technological innovations of the coming decades, driving productivity growth across the global economy.

Can I buy shares in Open AI?

You cannot currently purchase shares in Open AI directly, and this is unlikely to change in the near future. In June 2023, OpenAI CEO and co-founder Sam Altman said that his company has no plans to conduct an IPO, which is unlikely to change while Altman remains CEO. Open AI has received significant investment from Microsoft and others, meaning it does not need to raise extra capital. Investing in Microsoft (MSFT) is one way to invest in Open AI indirectly or if you invest in Roundhill’s AI ETF this is currently part of the funds holdings.

How can you invest in AI startups?

Investing in startup businesses carries significant risks with the potential for outstanding rewards. Identifying a startup with the idea and fundamentals to deliver can be challenging and requires extensive research.

How to invest in the best AI Stocks & ETFs

Successfully investing in AI stocks requires a careful, strategic approach that balances innovation with diversification.

Investing in AI stocks requires a strategic approach that considers both innovative AI trends and the importance of diversification. First, stay informed about cutting-edge developments in the AI industry, emphasizing companies at the forefront of innovative technologies like Generative AI, Explainable AI (XAI), and applications in healthcare, finance, and cybersecurity. Monitor advancements in Edge AI, robotics integration, and quantum machine learning.

Secondly, recognize the significance of diversification in mitigating market volatility risks. Spread investments across various AI sectors, including established tech giants and emerging startups. Diversifying into AI-focused Exchange-Traded Funds (ETFs) can provide exposure to a broader range of AI-related companies. Balancing a portfolio with different AI segments ensures resilience against industry-specific challenges and aligns with the dynamic nature of the AI landscape.

Always conduct thorough research or seek advice from financial professionals before making investment decisions.

- Innovative AI trends: Investors should stay informed about developments in AI and companies at the forefront of innovation, like Generative AI, Explainable AI, and practical applications across sectors such as finance and healthcare.

- Importance of diversification: Investments should be spread across different AI sectors, blending established tech companies with promising startups. Investing in AI-focused ETFs can secure exposure to a broader range of AI-related companies. ETF investors also benefit from fund managers' professional knowledge, research, analysis and insight.

Risks and Challenges of Investing in AI

As with any emerging technology, investing in AI carries some risks and challenges:

Volatility of Tech Industry

Tech stocks, particularly those in emerging technologies such as AI, can be subject to significant volatility compared to the rest of the market. Companies must be innovative to stay ahead and retain their market share.

Regulatory considerations

AI is an emerging technology generating considerable governmental attention. Regulatory changes and developments will potentially impact AI companies, affecting how AI is developed and deployed over the coming years.

Ethical considerations

AI is opening up a range of ethical debates, some of which you may wish to consider as an investor. These ethical considerations could inform future regulatory changes. Some investors may decide to invest only in companies committed to responsible AI development and strong ethical practices.

Future of AI

Is generative AI a bubble?

The rapid rise in the value of AI-related stocks has led to understandable investor concern that AI may already have entered a bubble. This means that stocks are overvalued based on hype but little substance, with the example of the tech bubble of the early years of the 21st century often cited as a reason to be cautious.

While it’s always good to take a hard-headed and critical look at investment opportunities, at Roundhill Investments, we believe that, although valuations of certain AI stocks may not be inexpensive, these companies have relatively solid fundamentals. That sentiment has not reached a fever pitch. In other words, we do not believe generative AI represents a genuine bubble.

Conclusion

Generative AI has vast potential and will likely deliver huge societal benefits over the coming years. Companies involved in its development and implementation will likely win big in the AI revolution. Despite this, there is still a need for some caution from investors. As with all disruptive technologies, some companies that look impressive may be less so within a few years, and many may no longer exist.

Why invest in Roundhill's Generative AI ETF

Navigating this dynamic investment landscape will take robust analysis and investment experience. Investing in an AI ETF gives investors access to research-driven investment decisions and immediate diversification across the sector.

The Roundhill Generative AI & Technology ETF (NYSE ARCA ticker CHAT) is the only ETF focused on GAI. As an actively managed fund, it invests in a combination of established and developing companies across the sector to create a diversified portfolio with significant growth potential.

With 37 holdings, investing in Roundhill’s Generative AI ETF gives you exposure to a range of the sector's most exciting and innovative companies, as well as established names renowned for their strong performance record.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at https://www.roundhillinvestments.com/etf/chat/. Read the prospectus or summary prospectus carefully before investing.

Click here for current fund holdings: https://www.roundhillinvestments.com/etf/chat/

Artificial Intelligence Company Risk. Companies involved in, or exposed to, artificial intelligence related businesses may have limited product lines, markets, financial resources or personnel. These companies face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing the consumer base of their respective products and services.

Technology Sector Risk. The Fund will invest substantially in companies in the information technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Small-Capitalization Investing. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities of small capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole.

Micro-Capitalization Investing. Micro-capitalization companies often have limited product lines, narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including companies which are considered small- or mid-capitalization.

Concentration Risk. The Fund will be concentrated in securities of issuers having their principal business activities in the technology group of industries. To the extent that the Fund concentrates in a group of industries, it will be subject to the risk that economic, political, or other conditions that have a negative effect on that group of industries will negatively impact them to a greater extent than if its assets were invested in a wider variety of industries.

CHAT is distributed by Foreside Fund Services, LLC.