Still Magnificent — The Magnificent Seven Stocks Roar Back

From FAANG to a New Center of Market Gravity

A decade ago, “FAANG” (Facebook, Apple, Amazon, Netflix, Google) was the shorthand for U.S. tech leadership. By early 2023, that label no longer captured reality. Microsoft had become the operating system for enterprise cloud and AI, Nvidia emerged as the compute vendor for that AI, and Netflix’s weight had waned. Here’s the rough timeline:

- May 25, 2023 — Hartnett reframes the narrative. In his weekly Flow Show, Bank of America’s Michael Hartnett singled out seven cash-rich, network-effect platforms, Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla, doing most of the index’s heavy lifting. He dubbed them the “Magnificent Seven,” a nod to the 1960 Western.

- Early June 2023 — Cramer makes it mainstream. Jim Cramer swapped “FAANG” for “Magnificent Seven” on CNBC, giving the term mass adoption across financial TV, social feeds, and sell-side research.

- Late 2023 onward — The label sticks because the numbers do. Major outlets (Reuters, FT, Bloomberg, WSJ) began using “Mag 7” as a matter of course, reflecting how returns, earnings, margins, and capital expenditures (cap-ex) had consolidated in a handful of truly global platforms.

However, since then there’s been a constant swirl around market concentration and how the Magnificent Seven might no longer be “Magnificent”. See the chart below highlighting the negative Magnificent Seven headlines from top tier financial publications.

The takeaway isn’t that these outlets are wrong to probe concentration; it’s that skepticism has been persistent and frequent, even as fundamentals and cash generation kept compounding. Judging by the table below, short term volatility from the Magnificent Seven is normal, but it has not been profitable to bet against the group.

Fundamentals Looking Strong

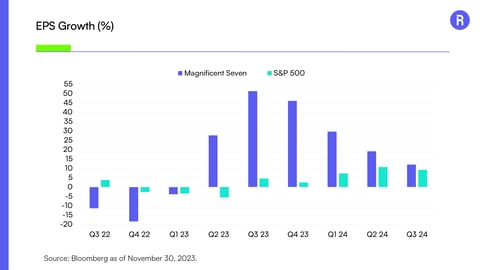

- Revenue velocity: In 2024, the group grew top-line at a ~14% pace, more than double the broader market and roughly triple the S&P 500 ex-the Magnificent Seven.

- Profit power: Net margins for the cohort sit in the mid-20s, which are nearly 2x the large-cap average, driven by operating leverage in cloud, ads, software, and high-end hardware.

- Cap-ex muscle: Spending stepped up dramatically in 2024 and is set to rise again in 2025, aimed squarely at AI infrastructure (data centers, accelerators, networking).

- Liquidity: Aggregate cash in the hundreds of billions allows self-funded build-outs and buybacks through macro chop.

*All data sourced from Bloomberg as of 8/21/25.

Valuation & Growth Context

Valuation should be discussed with growth, not apart from it. The Price/Earnings-to-Growth (PEG) ratio does exactly that by dividing forward P/E by expected EPS growth.

A PEG near 1.7 indicates the Mag-7’s premium isn’t necessarily inexpensive, but the “S&P 493” trades at roughly three the price per unit of growth, despite lower revenue momentum, flatter margins, and weaker balance sheets. In other words, the valuation risk today is more acute in the “other 493” than in the seven.

After a tariff-driven stumble in the spring, leadership reasserted into mid-year. Since the April trough, the group has contributed an outsized share of the S&P 500’s rebound, even amid healthier breadth.

Outlook: What Could Extend (or End) Leadership

- AI infrastructure super-cycle. Hyperscalers and large platforms continue to lift cap-ex targets to feed inference and training demand. The build-out spans land acquisition, power, cooling, networking, accelerators, and software. Secular drivers (enterprise AI adoption, ad monetization, edge devices with on-device models) support multi-year spend.

- Earnings visibility and mix. Consensus points to ~20% net income growth for the group in 2025, versus high-single-digits for the rest of the S&P 500 (Bloomberg as of 8/21/25). Importantly, growth is not reliant on a single line item: cloud and software subscriptions, ad platforms, custom silicon, and services each contribute. That diversification reduces single-product shock risk.

- Valuation path. Multiple expansion is not required for leadership to persist if earnings compound at a premium rate. A base-case glide path is modest multiple drift with earnings doing the heavy lifting; upside scenarios include renewed multiple support if rates fall or if AI monetization proves faster than expected.

We believe the Magnificent Seven will continue to attract naysayers. That’s the price of leadership. Investors, however, may be better served by tuning out the headlines and focusing on the data: superior revenue growth, higher margins, robust balance sheets, and disciplined reinvestment. On those metrics, in our view, the evidence remains clear. The Magnificent Seven remain, in fact, magnificent.

Glossary:

The price-to-earnings (P/E) ratio measures a company's share price relative to its earnings per share (EPS). Often called the price or earnings multiple, the P/E ratio helps assess the relative value of a company's stock. It's handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market.

The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period. The PEG ratio is used to determine a stock's value while also factoring in the company's expected earnings growth. It provides a more complete picture than the standard P/E ratio.

The estimated Index Long Term Growth Rate of Earnings per Share (EPS) is a weighted average of underlying members' Estimated LTG. Long term growth forecasts generally represent an expected annual increase in operating earnings over the company's next full business cycle. In general, these forecasts refer to a period of between three to five years.

Bloomberg Magnificent 7 Price Return Index is an equal-dollar weighted equity benchmark consisting of a fixed basket of 7 widely-traded companies classified in the United States and representing the Communications, Consumer Discretionary and Technology sectors as defined by Bloomberg Industry Classification System (BICS).

Bloomberg 500 ex Magnificent 7 Price Return Index is a float market-cap weighted benchmark designed to measure the most highly capitalized US companies, excluding members of the Bloomberg Magnificent 7 Index.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/MAGS. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. The Fund expects to have concentrated (i.e., invest more than 25% of its net assets) investment exposure in one or more of the Technology Industries at any given time, which may vary over time. Further, the Fund expects to obtain such investment exposure by transacting primarily with a limited number of financial intermediaries conducting business in the same industry or group of related industries. As a result, the Fund is more vulnerable to adverse market, economic, regulatory, political or other developments affecting those industries or groups of related industries than a fund that invests its assets in a more diversified manner. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.