There’s More to Generative AI than Nvidia, Why Active for AI Exposure

Artificial Intelligence, commonly known as AI, is all set to transform our daily lives. As with previous industrial and technological revolutions, AI, specifically Generative AI, holds tremendous potential.

The surge in media attention on generative AI's potential has sparked substantial investments in research and development. This interest is fueled by AI's proficiency in problem-solving, enhancing productivity, and streamlining routine operational tasks

Much of the future is unmapped, but the prospects for generative AI are clear. That means there may also be opportunities for investors to benefit from the growth and development of AI over the coming years. Many investors are undoubtedly convinced of its potential.

Investors old enough to remember the tech bubbles of earlier decades may be understandably wary. Rapid growth often precedes a steep fall, but with AI still in its relative infancy, the potential for further growth looks robust.

This article offers an in-depth exploration of artificial intelligence (AI), examining what trends shape AI development, the potential for future growth, and strategies to invest in generative AI companies.

Generative AI has the potential to be as transformative as the introduction of the internet was in the 1990s. What is most exciting is that this is not a pipe dream, this is about enhancing how we work and live today. Nvidia CEO Jensen Huang summed up the current state of affairs when he recently said “accelerated computing and generative AI have hit the tipping point.” Goldman Sachs economists Joseph Briggs and Devesh Kodnani noted that generative AI could boost global labor productivity by more than one percentage point a year in the 10 year period following widespread usage.

Companies of all shapes and sizes are asking, how do we get AI right? Along with new applications, a key driver of growth is how generative AI will be integrated into mainstream use cases. Let’s dive into a handful of stocks in the Roundhill Generative AI & Technology ETF (CHAT) that are emblematic of how the portfolio, and generative AI in public markets, is positioned today.

As one may expect, Nvidia’s been the top holding since launch and remains in the number 1 position as the current king of AI. In the most recent quarter, the company produced $22.1 billion of quarterly revenue, up 22% from Q3 and 265% from a year earlier. A key driver of this record revenue is Nvidia’s GPUs providing the advanced computing power needed for AI research and development. Their GPUs are crucial for training complex AI models, including those for generative AI, which can create new images, texts, and sounds. With recent eye popping returns, many investors are now fully aware of Nvidia’s leadership, but there are a number of lesser-known companies powering AI forward today.

When Super Micro Computer (SMCI) was introduced to the CHAT portfolio in June 2023 most had not heard of the company, let alone followed the stock. Since its addition, it is the top performing stock in the CHAT ETF. SMCI creates computer servers that work well with graphics processing units (GPUs) and builds server racks tailored to customer needs. The company aims to reduce the overall costs for the customer by offering features like liquid cooling, which improves the efficiency of the chips and reduces operating expenses. In the AI arms race, these servers can support the maintenance and development of generative AI applications, enabling faster and more efficient AI operations.

Like SMCI, we added ServiceNow to CHAT in June 2023. In simple terms, the company acts as a digital backbone for companies, streamlining work by automating routine tasks and workflows across different departments, from IT to customer service. Think of it as a high-tech Swiss Army knife for businesses, making work life smoother and more efficient. NOW is integrating generative AI into their offering to help companies automatically create or suggest content, solutions, or code, helping teams work even faster and smarter by reducing manual processes.

There are also opportunities outside of the US, including chipmaker SK Hynix Inc. SK Hynix, a South Korean company, manufactures memory chips crucial for computers, smartphones, and other electronic devices. They specialize in developing components that store and process data, enhancing device speed and efficiency. Recently, SK Hynix has also ventured into supporting generative AI technologies by providing advanced memory solutions. These solutions are vital for the high-speed data processing and large storage requirements of AI systems, powering innovations in AI-driven applications and services.

Sakura Internet, a Japanese company, provides web hosting and cloud computing services, offering the digital infrastructure needed for websites and online applications to run smoothly. Their robust servers and cloud platforms can support AI-driven projects, including generative AI applications, by providing the necessary computing power and storage. This enables developers and businesses to create, deploy, and manage AI applications efficiently, fostering innovation in AI technologies and their practical uses.

These five companies are only a handful of the current portfolio and their weights are subject to change as the marketplace evolves. Ultimately, there will be winners and losers in the generative AI revolution, which can make an actively managed approach beneficial to separate the wheat from the chaff. There will be many new products and services introduced in the coming months as companies attempt to participate in this whether they are legit or not. This may be particularly fruitful in avoiding the AI-washing that SEC Chair Gary Gensler warned companies about in December 2023.

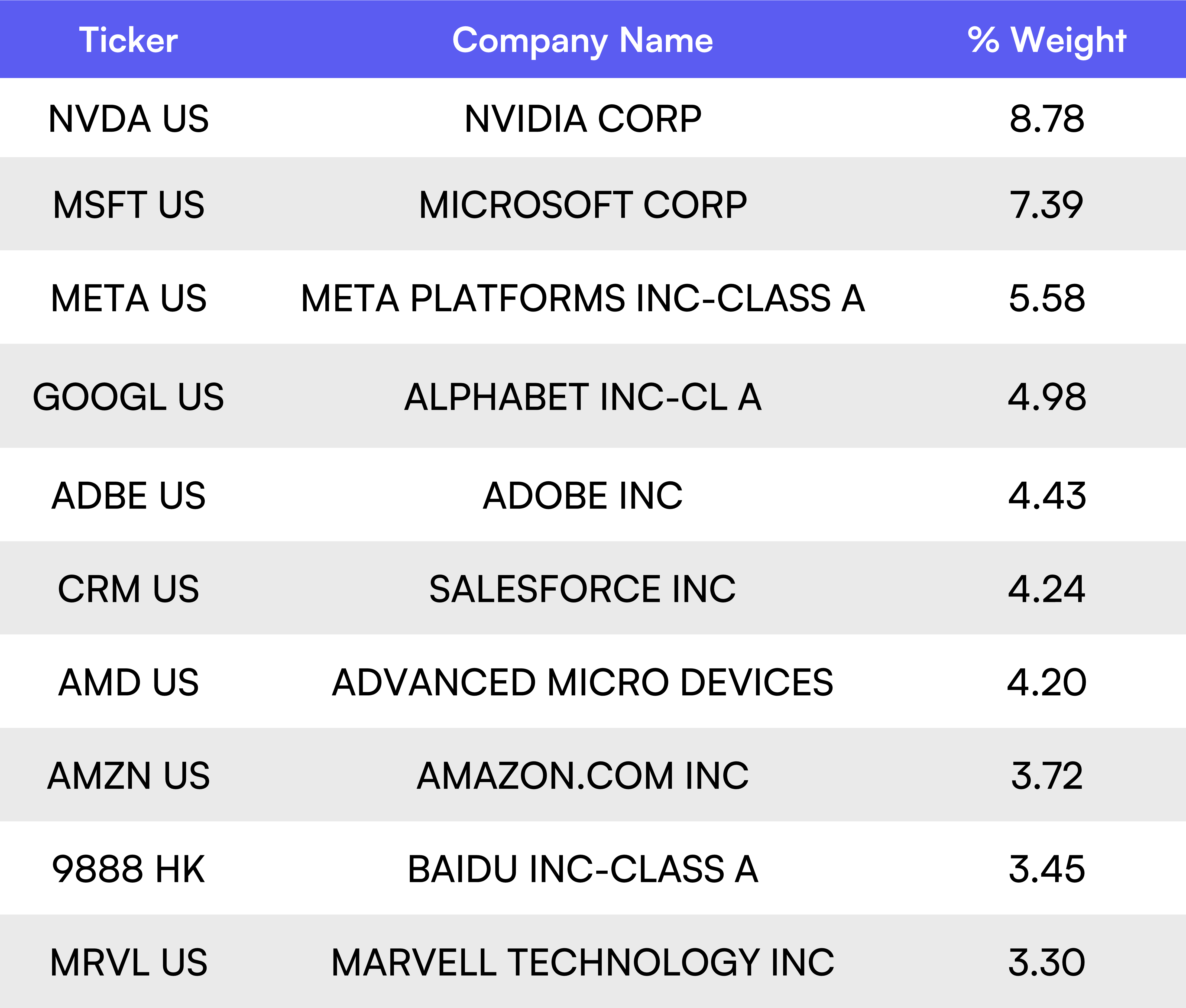

CHAT Top 10 Holdings

Source: Bloomberg, as of February 29, 2024.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/chat/. Read the prospectus or summary prospectus carefully before investing.

Click here for current fund holdings: https://www.roundhillinvestments.com/etf/chat/

Artificial Intelligence Company Risk. Companies involved in, or exposed to, artificial intelligence related businesses may have limited product lines, markets, financial resources or personnel. These companies face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing the consumer base of their respective products and services.

Technology Sector Risk. The Fund will invest substantially in companies in the information technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Small-Capitalization Investing. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities of small capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole.

Micro-Capitalization Investing. Micro-capitalization companies often have limited product lines, narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including companies which are considered small- or mid-capitalization.

Concentration Risk. The Fund will be concentrated in securities of issuers having their principal business activities in the technology group of industries. To the extent that the Fund concentrates in a group of industries, it will be subject to the risk that economic, political, or other conditions that have a negative effect on that group of industries will negatively impact them to a greater extent than if its assets were invested in a wider variety of industries.

CHAT is distributed by Foreside Fund Services, LLC.