Sizing up the Generative AI Opportunity: $120 Billion+ in Enterprise TAM

Generative Artificial Intelligence (GAI) is rapidly becoming one of the next disruptive technologies poised to revolutionize every corner of the global economy. But just how much revenue can GAI generate?

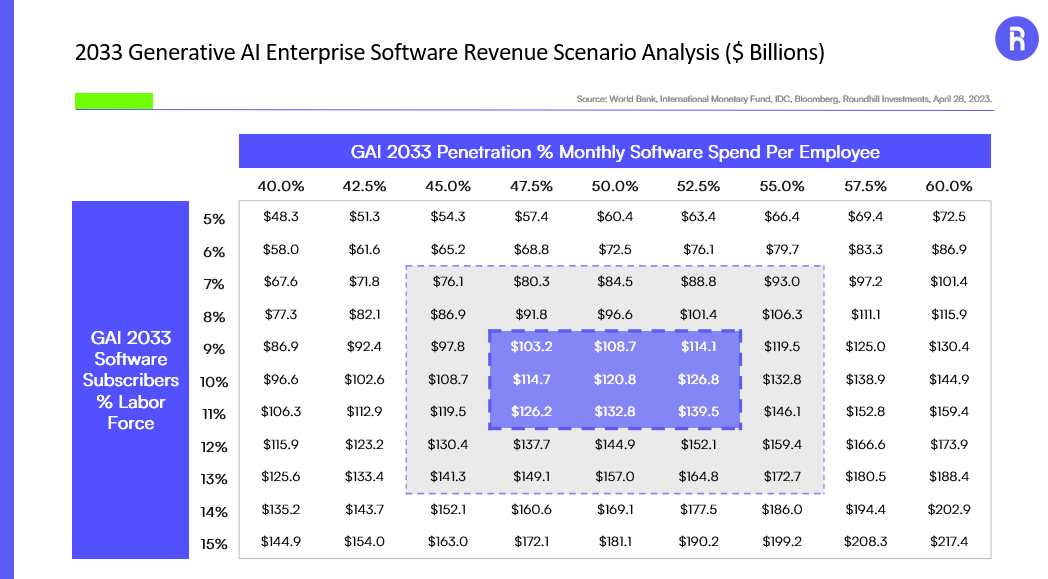

Although it remains extremely early days, we have established a framework for assessing the opportunity in GAI enterprise software revenue. Our analysis shows that GAI could eclipse $120 billion of enterprise software sales in a decade. For context, the global software market generated $800 billion in revenues for 2022.

How Did We Come to this Number?

Our base scenario results in GAI enterprise software reaching $120.8 billion in a decade, fueled by rising overall software spend, deep penetration of GAI applications and growth in the global labor force. Our base scenario assumes that 10% of the global labor force utilizes GAI enterprise applications and that 50% of monthly software expenditure per employee shifts to GAI.

Source: World Bank, International Monetary Fund, IDC, Bloomberg, Roundhill Investments, April 28, 2023

If the share of software spend that shifts to GAI applications were to reach 60% in a decade and 10% of the global labor force were to use the applications, the total revenue from GAI applications would reach $118.6 billion. If 50% of software spend went to GAI but 15% of the global labor force were to use them, the total revenue in this scenario would climb to $148.2 billion.

Model Inputs:

Our model uses several key inputs to estimate future GAI enterprise software revenue. First, we take the World Bank’s estimate of the global labor force, which was 3.5 billion people as of 2021. We grow the labor force at the IMF’s long-term growth rate estimate of 1.1% per year to reach a 2033 labor force estimate of nearly 4 billion people.

For software expenditures, we grow IDC’s estimate for 2021 total software spending at IDC’s long-term software spending CAGR of 10.5% to reach a 2033 software market size. We then calculate the monthly software expenditure per employee from these inputs.

Additional GAI Use Cases

In addition to enterprise use cases, generative AI technology has the potential to impact the everyday consumers. While it is far too early to identify all relevant use cases, one market that we believe to be exposed is online search. Market leader Google and challengers such as Microsoft’s Bing are rapidly rolling out GAI-powered search to provide a more sophisticated and responsive search experience.

The search advertising market generated $231 billion of revenue in 2021 and is forecast to grow at a 9.9% annual growth rate through 2027 to over $400 billion, according to Magna Global. If this growth rate continues longer-term, it suggests a 2033 market size of $655 billion of search advertising revenue. If 50% of search is GAI-powered in 2033, that would mean that GAI search alone is generating over $325 billion of annual advertising revenue.

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact Roundhill Investments or consult with the professional advisor of their choosing.

Investing involves risk, including possible loss of principal. Artificial Intelligence (AI) Companies and other companies that rely heavily on technology are particularly vulnerable to research and development costs, substantial capital requirements, product and services obsolescence, government regulation, and domestic and international competition, including competition from foreign competitors with lower production costs. Stocks of such companies, especially smaller, less-seasoned companies, may be more volatile than the overall market. AI Companies may face dramatic and unpredictable changes in growth rates. AI Companies may be targets of hacking and theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses.