The BIG Picture - Getting Recession Ready (‘08 Redux)

“History never repeats itself, but it does often rhyme.” This quip from Mark Twain tends to pop up when storm clouds are brewing. It’s now being used to compare the current economic environment to 2008. This may be a convenient comparison, or worse, clickbait. Nonetheless we wanted to explore and confirm for ourselves, and thought it beneficial to look at the period prior to the Global Financial Crisis (GFC).

Why?

The regional banking crisis in the spring of 2023 has parallels to the precursors of the GFC. In March 2023, Silicon Valley Bank and Signature Bank collapsed. First Republic Bank lasted a few more months until it fell in May 2023. On the surface, these bank closures appear similar to the failures of two Bear Stearns hedge funds in the spring of 2007 followed by BNP Paribas freezing three money market mutual funds in August 2007. Stock markets largely carried on ignoring the culprit at the time subprime as an isolated issue.

Sound familiar?

While the causes of the GFC are complicated, ranging from overleveraged financial institutions to capital imbalances, a key similarity to today is an interest rate hiking cycle coupled with easy credit conditions and speculative behavior in certain markets. Throw in the recent run-up in oil prices and an increase in corporate bankruptcies, the similarities start to grow.

However, cracks in the system are appearing more quickly than they did in 2008.

Let’s get into it

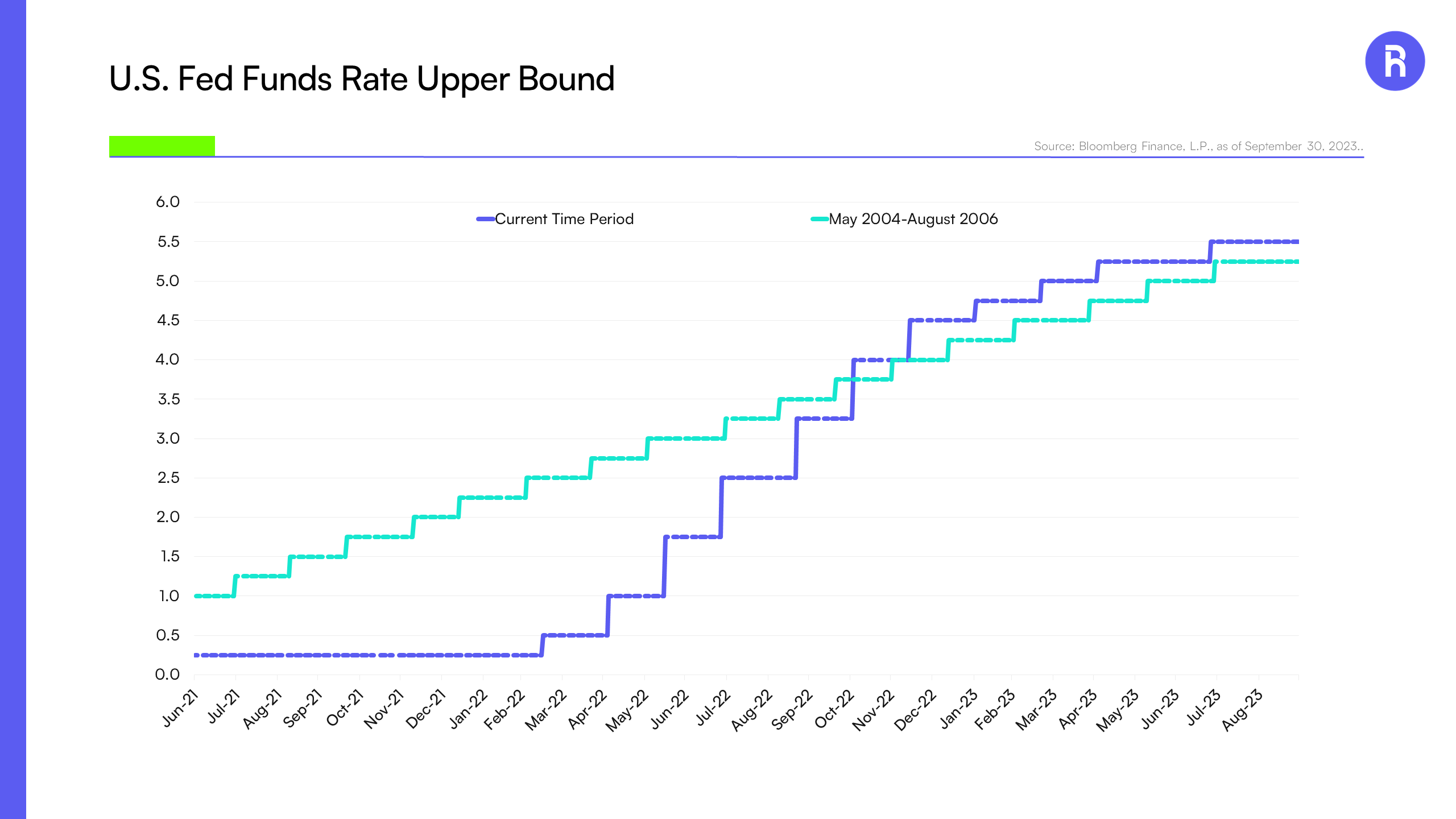

In the figure below, we compare the most recent Fed hiking cycle to the period leading up to the GFC between 2004 and 2006. They don’t begin in the same fashion, but end up in a similar place. Back then, the Federal Reserve stopped their hiking cycle in June 2006 after a series of 0.25% hikes. A key difference in this hiking cycle has been the pace of rate increases, with the upper bound of the Fed Funds Rate moving from 0.25% to 5.50% in less than two years. These aggressive hikes are starting to affect the real economy, particularly real estate.

Fed Funds Landed Higher This Cycle

Source: Bloomberg Finance, L.P., as of September 30, 2023.

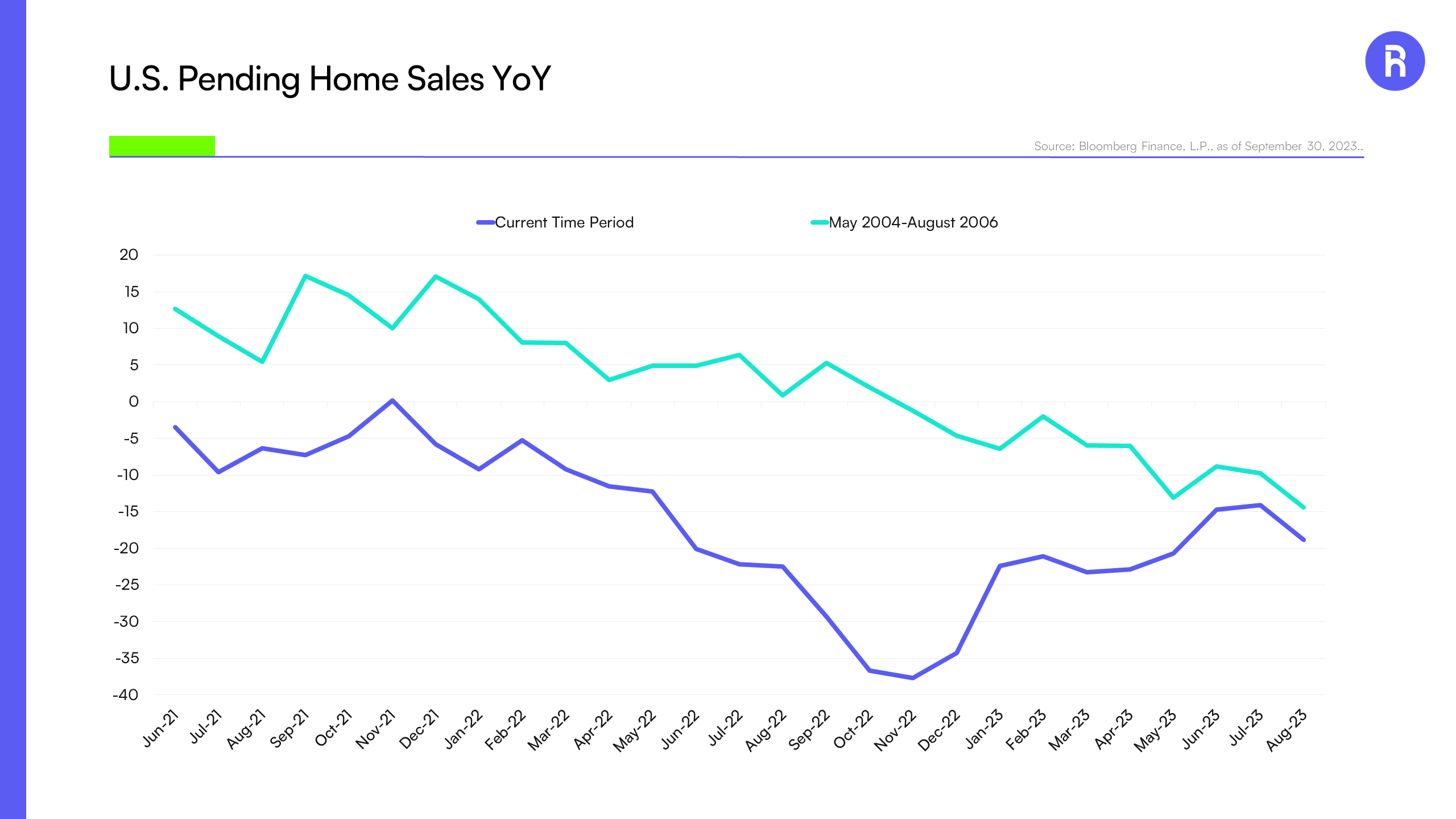

Let’s look at the housing market

A spike in mortgage rates has weighed on the housing market, with existing home owners reluctant to trade up as new loan rates are likely considerably higher than what they may be currently paying. Comparatively, the post-COVID hiking cycle seems to have had a larger impact on pending home sales than even the GFC.

Pending Home Sales Collapsing

Source: Bloomberg Finance, L.P., as of September 30, 2023.

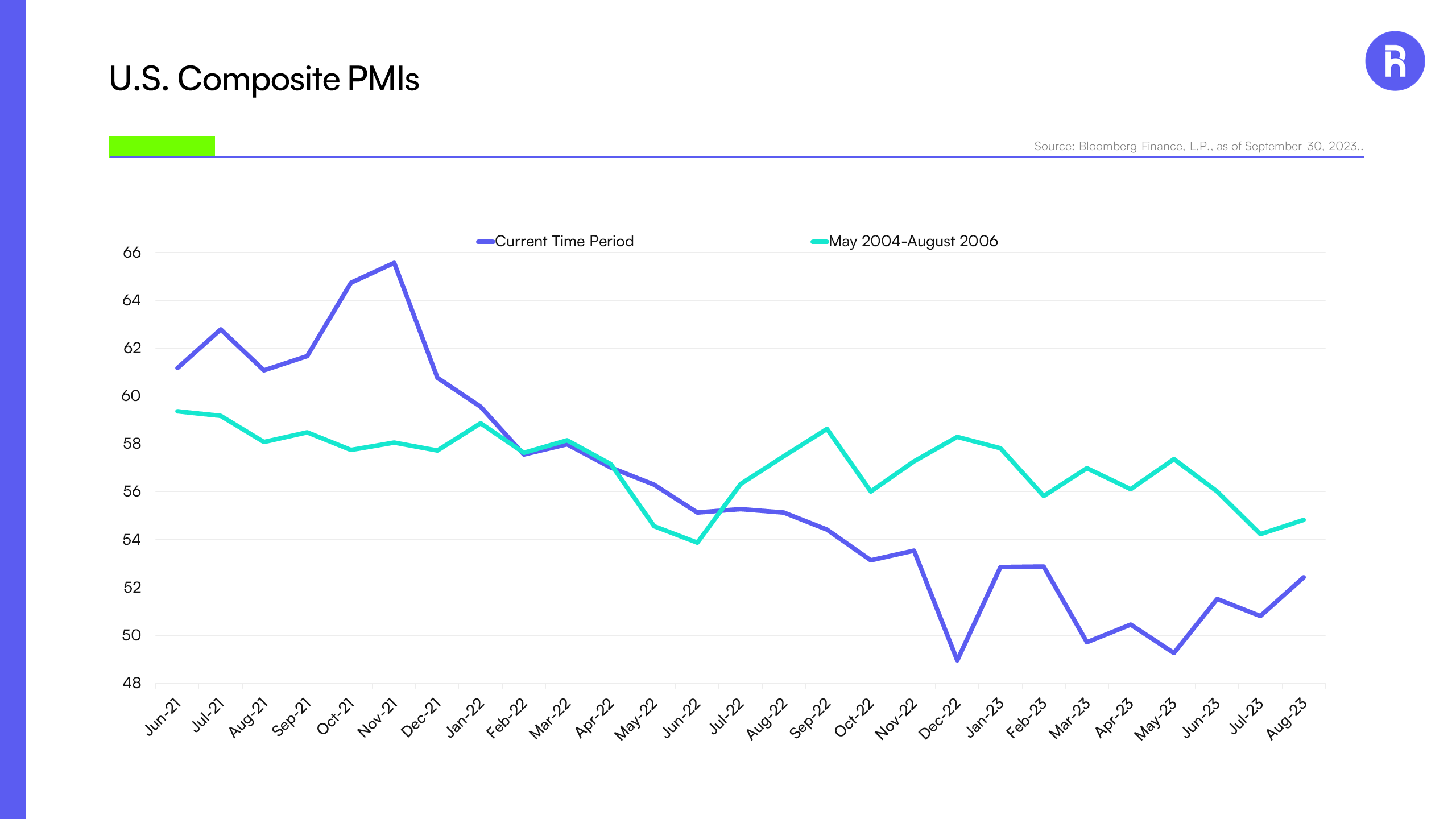

We could highlight other data points including a rise in credit card delinquencies that showcase a slowdown is already underway and perhaps a recession is imminent. While we aren’t the first to point out that the Fed’s been hiking in the face of weakening economic data, the decline in U.S. PMIs relative to the period prior to the Global Financial Crisis are notably similar to one another. PMIs have recovered in 2023, but their trajectory hasn’t exactly been bullish.

PMIs Slowing Sharply from their 2021 Peak

Source: Bloomberg Finance, L.P., as of September 30, 2023.

What do these similarities mean?

Just like the seeds of the Global Financial Crisis were planted years before 2008, the same likely happened this time around with the aggressive monetary and fiscal stimulus pumped into the system during the pandemic. Today, the bond market needs to absorb the impact of QT, massive debt, and deficits. There are also labor strikes across multiple industries, resumption of student loan payments, and a potential government shutdown looming in November.

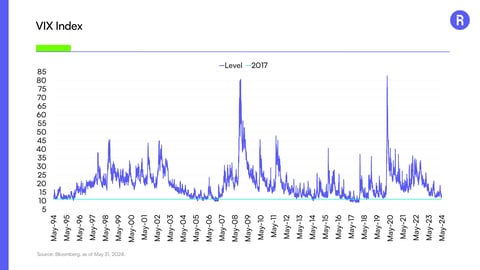

However, the job market remains incredibly resilient with September payrolls coming in way above consensus. Maybe it shouldn’t be a surprise that long bonds are selling off sharply. Ultimately, no one knows where this ends, but a bear steepener where long rates are increasing faster than short rates isn’t exactly “risk on”.

Recession ready yet?

As Mark Twain's words echo in our minds, we must remember that while history may not repeat itself, it does offer lessons. With preparation, we can navigate the uncertain waters ahead. It's not about predicting the future, but about being ready for whatever it holds. In these turbulent times, simplicity and prudence might just be our best allies. Let's get recession ready.

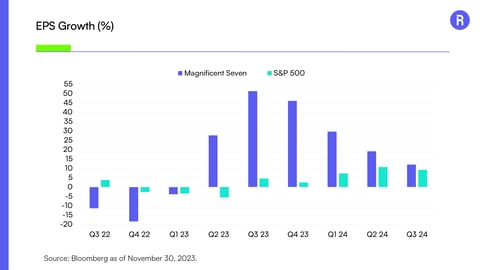

To us, the market looks poised to continue its downward trend until we see what earnings season brings us, particularly 2023’s blue chips - the “Magnificent Seven” stocks. In the short-term, unless the S&P 500 Index regains the 4,300 level, be prepared for the index to test 4,200 or below. Sector-wise, old-school defensives like utilities and consumer staples may not hold up well considering how interest rate sensitive they are. Bonds aren’t working as safe havens either with their correlations to stocks incredibly high. Better opportunities to navigate this may be to look for the new defensives - companies that have shown resilience in a variety of market conditions, especially those with consistent earnings growth.

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (855) 561-5728. You cannot invest directly in an index. Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the Primary Exchange official closing price. Brokerage commissions will reduce returns.

Carefully consider the investment objectives, risks, charges and expenses of Roundhill ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Funds investments may be non-diversified, meaning its assets may be concentrated in fewer individual holdings than a diversified fund and, therefore, more exposed to individual stock volatility than diversified funds. Investments in foreign securities involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more develop countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

NERD, BETZ, METV, BYTE, MEME, WEED, CHAT, BIGB, BIGT and LUXX are distributed by Foreside Fund Services, LLC. DEEP is distributed by Quasar Distributors, LLC.