The BIG Picture - June 2023

Based on the market’s reaction heading into the so-called “X date”, the debt ceiling debacle will hopefully come and go as nothing more than a distraction, just as it has in previous episodes. While earlier debt ceiling debates showed greater spikes in volatility, this time around the market focus has been generally isolated to the T- Bill market as stocks have looked elsewhere for direction. When the debt deal is firmly in the rear view mirror, investors will likely turn their attention back to the economic data for signs of what the Federal Reserve may do at their upcoming meeting. And that picture does not look particularly clear.

The Fed’s dual mandate of maximum employment and stable prices (and interest rates) looks more like the dual challenge these days. The Federal Reserve is attempting to guide the economy away from something worse than the mild recession the Staff is anticipating. At the same time, until the inflation bogeyman shows signs of moderating closer to their targeted levels, it is challenging for them to pivot away from the bias of higher rates.

The Federal Reserve has two options at this stage. They can continue to raise rates and see through the issues that rising rates are causing to select regional banks, commercial lending, and home affordability. If they decide to pause, they risk losing their inflation-fighting credibility that Chair Powell has tried to imprint on investor psyche since they started hiking in March 2022.

While Federal Reserve Chair Powell indicated that he is open to pausing their interest rate hiking cycle, the market is not entirely convinced, even in the face of deteriorating economic data. In fact, the hotter than expected inflation data has pushed the market into pricing in a hike at the June meeting. It is also worth noting deciding to pause does not mean a cut is forthcoming.

Overall, having a cautious take on the markets seems prudent, but that does not mean investors should necessarily only hide out in cash forever. The longer someone does the harder it can become psychologically to get back into other risk assets .

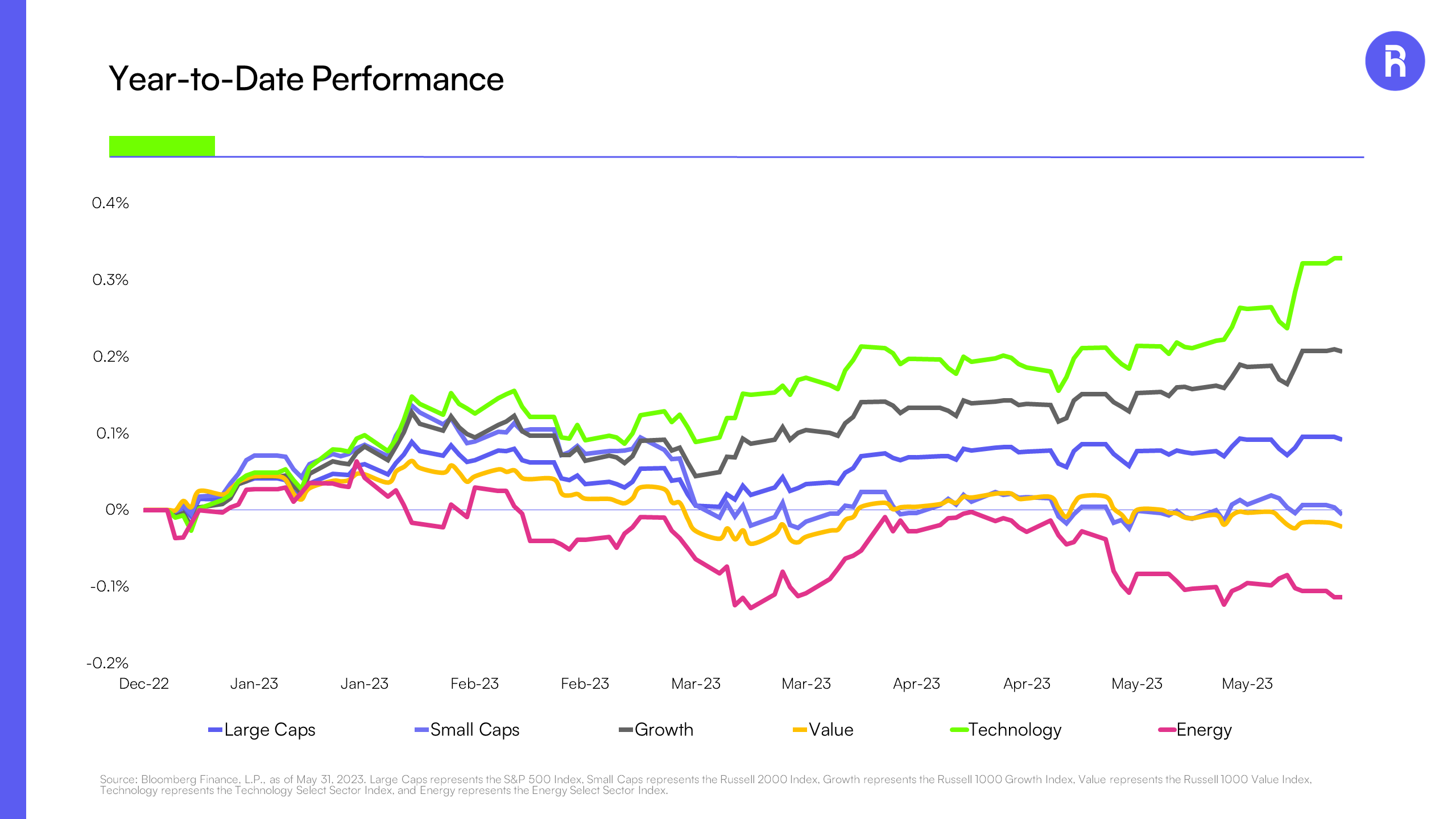

One of the key takeaways from this most recent earnings season is that we remain firmly in a “haves” and “have nots” market environment. By this we mean an environment where there are clear winners and losers, both across and within markets. We believe that this is a sign of amore normalized market environment where interest rates are not pinned to zero. Recent examples of this phenomenon include the outperformance of large caps versus small caps, growth stocks versus value stocks, and technology stocks versus energy stocks. The same phenomenon is occurring within industries as well. Look no further than NVIDIA Corporation (NVDA) versus Intel Corporation (INTC) among the chip stocks or Duolingo, Inc. (DUOL) versus Chegg, Inc. (CHGG) among online education companies.

Source: Bloomberg Finance, L.P., as of May 31, 2023. Large Caps represents the S&P 500 Index (the index includes 500 leading companies and captures approximately 80% coverage of available market capitalization), Small Caps represents the Russell 2000 Index (the Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index), Growth represents the Russell 1000 Growth Index (the index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values), Value represents the Russell 1000 Value Index (the index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values), Technology represents the Technology Select Sector Index (the index is intended to track the movements of companies that are components of the S&P 500 and are involved in the development or production of technology products), and Energy represents the Energy Select Sector Index (The index is intended to track the movements of companies that are components of the S&P 500 and are involved in the development or production of energy products). An investment can not be made directly in an index. Past performance does not guarantee future results.

Recently, there may be no bigger example of “haves” and “have nots” than when it comes to AI, especially generative AI1. Generative AI is shaping up to potentially be the next big disruptive technology for many years to come. We believe it will be one of the most impactful innovations in history thanks to its ease of use and wide ranging applications, which may help propel it to be as impactful as the internet itself and adoption of the iPhone.

The Roundhill Generative AI & Technology ETF (NYSE: CHAT) is the only ETF focused on GAI and offers precise exposure to global companies at the forefront of the development of GAI tools and technologies. CHAT is actively managed so that it can be flexible in identifying potential winners in a fast moving market. For information on the fund, including access to a full prospectus, the fund’s holdings and how to invest, visit https://www.roundhillinvestments.com/etf/chat/

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/. Read the prospectus or summary prospectus carefully before investing.

Artificial Intelligence Company Risk. Companies involved in, or exposed to, artificial intelligence related businesses may have limited product lines, markets, financial resources or personnel. These companies face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing the consumer base of their respective products and services.

Technology Sector Risk. The Fund will invest substantially in companies in the information technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Small-Capitalization Investing. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities of small capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole.

Micro-Capitalization Investing. Micro-capitalization companies often have limited product lines, narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including companies which are considered small- or mid-capitalization.

Concentration Risk. The Fund will be concentrated in securities of issuers having their principal business activities in the technology group of industries. To the extent that the Fund concentrates in a group of industries, it will be subject to the risk that economic, political, or other conditions that have a negative effect on that group of industries will negatively impact them to a greater extent than if its assets were invested in a wider variety of industries.

The CHAT ETF is distributed by Foreside Fund Services, LLC

¹Generative artificial intelligence (generative AI or GAI) is a type of artificial intelligence that is designed to create new content, such as images, videos, or music. Unlike traditional AI, which is focused on recognizing and analyzing existing data, generative AI is focused on creating new data. This has the potential to revolutionize many industries, from entertainment and media to healthcare and education.