The BIG Picture - The Bulls are Back in Charge

As calendars turn from June to July, everyone from seasoned strategists to casual market participants start to think about what the second half will bring. After a downright awful 2022 for just about every asset class, the bulls regained control in the first half of 2023, particularly thanks to AI-exposed tech giants.

Yet, many are pointing to the extreme narrowness of this rally as cause for caution. Year-to-date, the top ten stocks in the S&P 500 Index account for over 85% of returns and the five largest stocks make up a sizable 24% of the index.

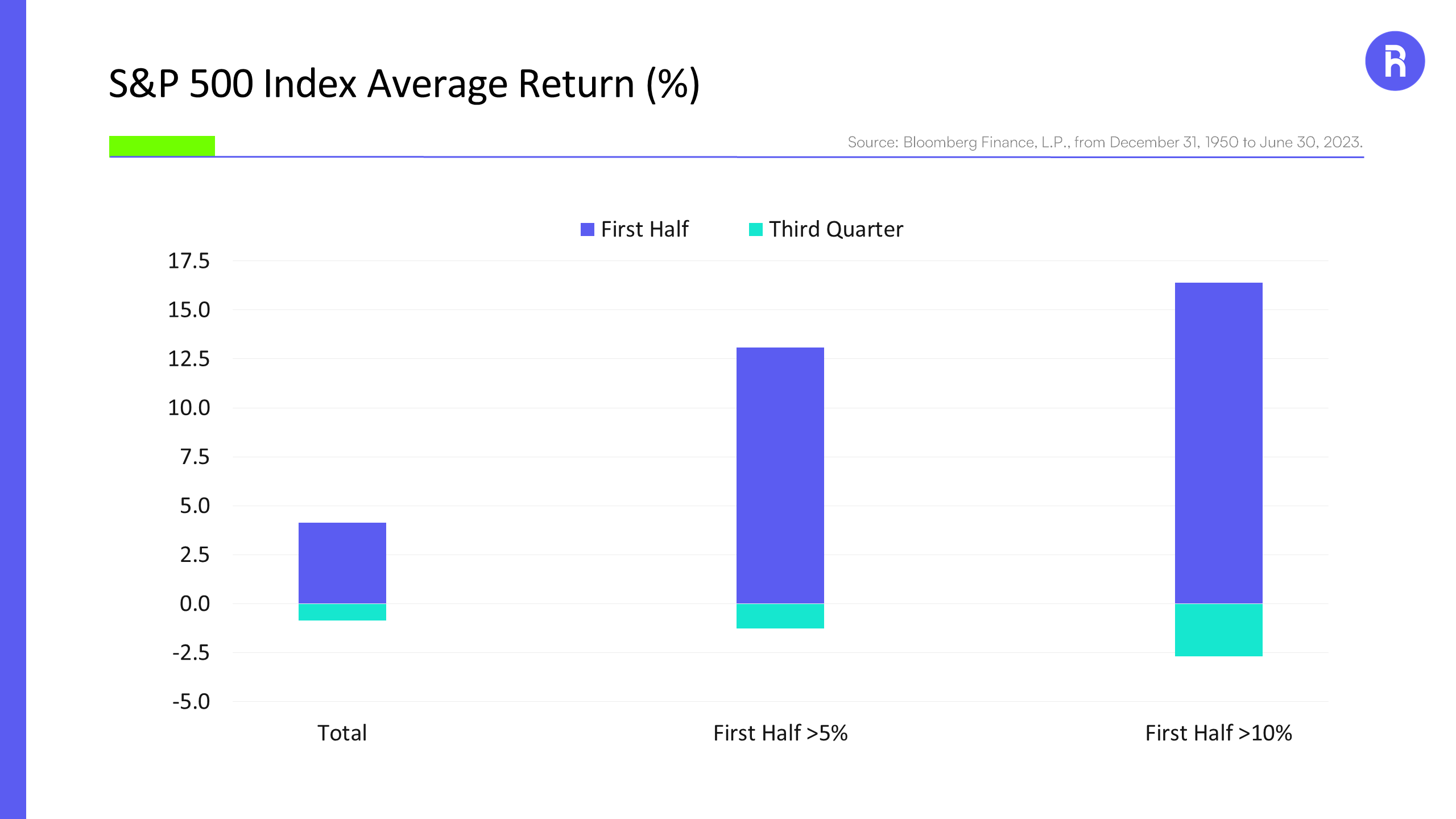

Is it time for the markets to take a well-deserved breather? From a seasonality standpoint, the idea of “sell in May and go away” may be fraught with issues. The primary one being that market timing is problematic. However, it is true that the third quarter offers the worst returns of any other. In fact, using data back to the 1950s, the greater the performance of stocks in the first half, the worse they perform in the summer months perhaps as stocks have more to give back.

Source: Bloomberg Finance, L.P., from December 31, 1950 to June 30, 2023. Past performance is not indicative of future returns. It is not possible to invest in an index

Source: Bloomberg Finance, L.P., from December 31, 1950 to June 30, 2023. Past performance is not indicative of future returns. It is not possible to invest in an index

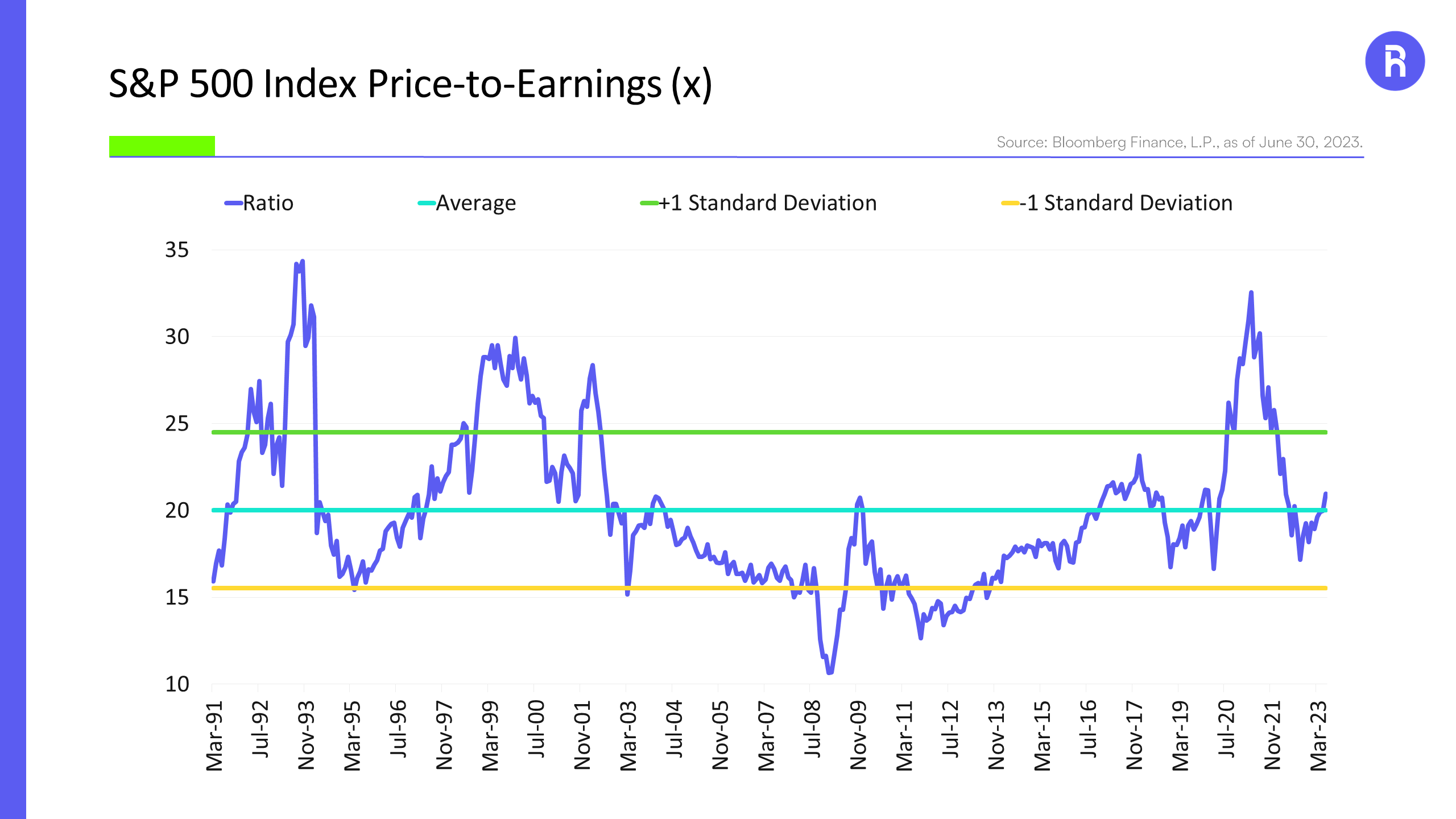

Regardless of whether old adages apply this year, the recent increase in valuation multiples for stocks, especially in the U.S., remain a concern for many investors. After peaking in April 2021 at 32.5 times, the price to earnings ratio (P/E)1 dropped sharply during last year’s selloff to below the long-term average of 20.0 times. At the end of June, the P/E sat at 21.0 times. In other words, markets may not be cheap, but it’s challenging to say that they are trading expensively.

Source: Bloomberg Finance, L.P., as of June 30, 2023. Note: Standard deviation is defined as a measurement of the degree to which an individual probability value varies from the distribution mean.

Source: Bloomberg Finance, L.P., as of June 30, 2023. Note: Standard deviation is defined as a measurement of the degree to which an individual probability value varies from the distribution mean.

But let's not forget that markets are not merely driven by the present; they are a reflection of future expectations. Current stock prices may have baked in some level of optimism about less dire than feared economic data. However, lingering inflation concerns, tightening monetary policies, and geopolitical tensions cannot be entirely discounted and the better economic data itself makes it harder to see how additional interest rate hikes can be avoided.

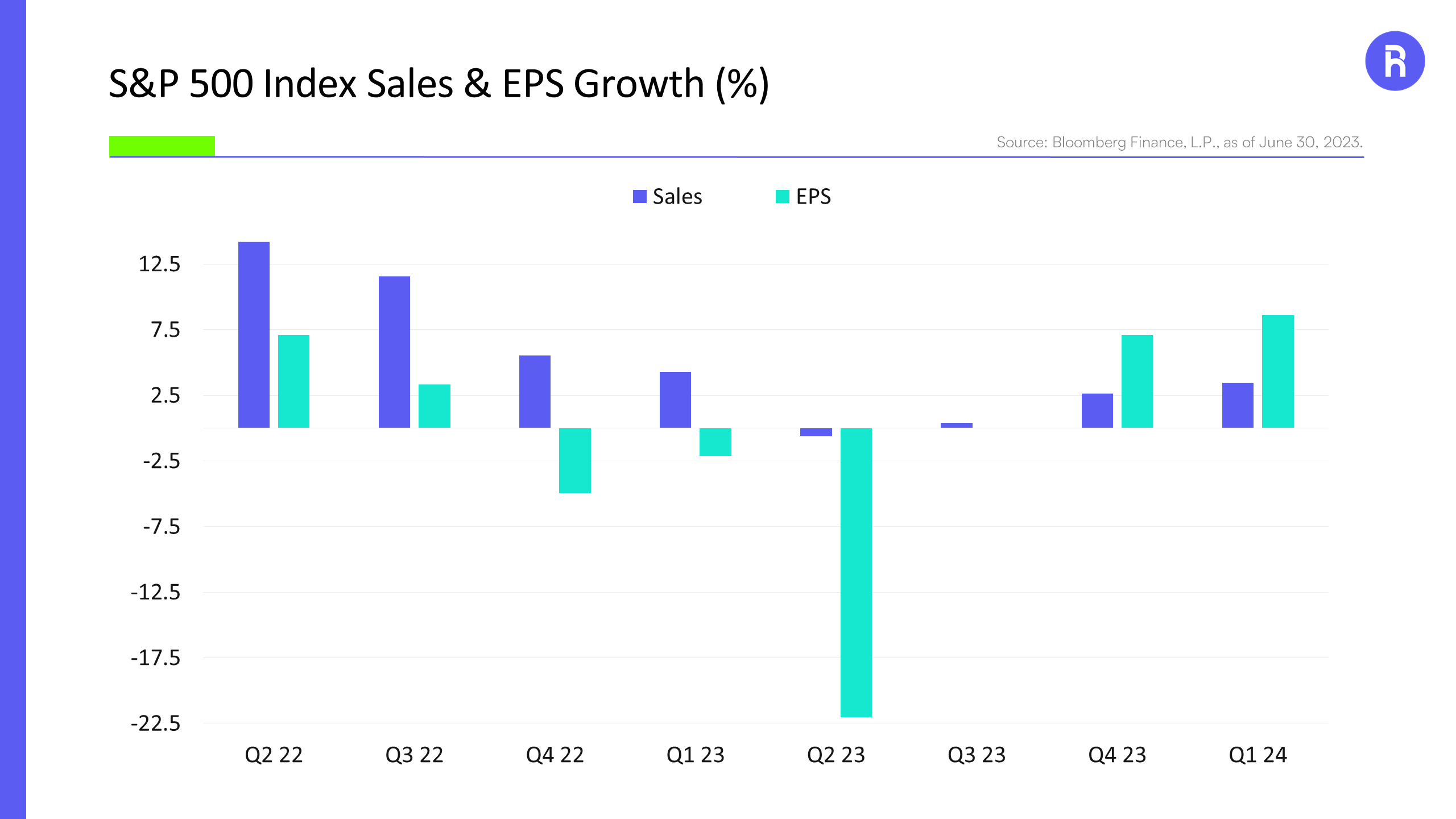

What may be more credible for the bears is that expectations are calling for the third straight quarter of decline in earnings for S&P 500 companies. Earnings per share (EPS)2 declined 4.9% in Q4 2022 and -2.2% in Q1 2023. Notably, companies beat estimates by over 6% last quarter, representing the best beat in over a year. However, Q2 estimates are calling for a much greater decline of 22.0%, while revenue growth is expected to be near zero.

Source: Bloomberg Finance, L.P., as of June 30, 2023.

Source: Bloomberg Finance, L.P., as of June 30, 2023.

A potential pause for stocks is not necessarily a cause for alarm, but rather can be seen as natural and indicative of a healthy market. The universal principle of moderation applies here as well — after a sprint, even the most resilient runners need to slow down, catch their breath, and prepare for the next stretch. Stocks, having run fast and hard to start the year, may be ready for their breather.

While stocks may take an inevitable breather, a credible argument is brewing that investors who have loaded up on money market funds may start to fear missing out even as cash is yielding the highest since 2007. In other words, FOMO may come back into play and investors may move out of cash and into stocks. Equity ETF flows through the first half this year have been lackluster compared to the previous three, so there appears to be ample room for investors to buy stocks.

For investors looking at opportunities to put cash to work heading into the summer doldrums, we believe AI should remain front and center. While equity flows have been relatively lackluster, we are starting to see a pickup in interest for funds related to artificial intelligence. For those who are seeking precision exposure to Generative AI, the technology powering ChatGPT and other large language models, the Roundhill Generative AI & Technology ETF (NYSE: CHAT) may be the right option. CHAT is the only ETF globally focused generative AI. For information on the fund, including access to a full prospectus, the fund’s holdings and how to invest, visit https://www.roundhillinvestments.com/etf/chat/.

1 Price to Earnings Ratio Definition: Ratio of the price of a stock and the company's earnings per share.

2 Earnings Per Share Definition: Earnings Per Share (EPS) is the portion of a company's profit allocated to each shareholder.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about Roundhill ETFs please call 1-855-561-5728 or visit the website at www.roundhillinvestments.com/etf/. Read the prospectus or summary prospectus carefully before investing.

Artificial Intelligence Company Risk. Companies involved in, or exposed to, artificial intelligence related businesses may have limited product lines, markets, financial resources or personnel. These companies face intense competition and potentially rapid product obsolescence, and many depend significantly on retaining and growing the consumer base of their respective products and services.

Technology Sector Risk. The Fund will invest substantially in companies in the information technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions. Small-Capitalization Investing. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large- or mid-capitalization companies. The securities of small capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large- or mid-capitalization stocks or the stock market as a whole.

Micro-Capitalization Investing. Micro-capitalization companies often have limited product lines, narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including companies which are considered small- or mid-capitalization.

Concentration Risk. The Fund will be concentrated in securities of issuers having their principal business activities in the technology group of industries. To the extent that the Fund concentrates in a group of industries, it will be subject to the risk that economic, political, or other conditions that have a negative effect on that group of industries will negatively impact them to a greater extent than if its assets were invested in a wider variety of industries.

The CHAT ETF is distributed by Foreside Fund Services, LLC

¹Generative artificial intelligence (generative AI or GAI) is a type of artificial intelligence that is designed to create new content, such as images, videos, or music. Unlike traditional AI, which is focused on recognizing and analyzing existing data, generative AI is focused on creating new data. This has the potential to revolutionize many industries, from entertainment and media to healthcare and education.