The Evolution of AI: From Foundations to Industrialization

The early phase of the generative artificial intelligence revolution resembled the “picks and shovels” stage of a gold rush. The focus was on building the core tools, such as semiconductors, cloud platforms, and foundational models that made AI possible on large scale. Chipmakers such as Nvidia and Taiwan Semiconductor Manufacturing Company provided the computing power with specialized semiconductors, while hyperscalers and start-ups laid the groundwork with infrastructure and large-language-model development.

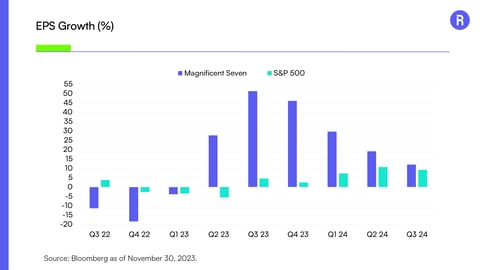

Today, that foundation is rapidly transforming into an industrial build-out. From our perspective, capital spending is surging as hyperscalers and enterprises race to construct AI-optimized data centers, deploy advanced networking, and secure sufficient power. The Magnificent Seven have helped establish this trend, dedicating billions of dollars to various AI initiatives.

In our opinion, the market narrative has shifted from simply supplying the tools to full-scale commercialization, where the ability to train, deploy, and scale generative AI systems at massive scale is becoming the new competitive frontier.

Where AI Is Going

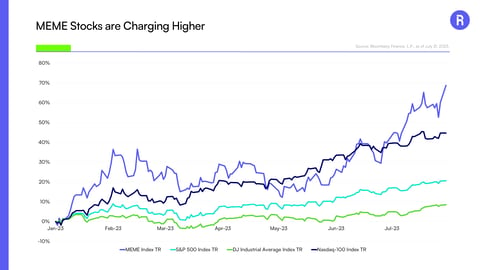

The road ahead points to both extraordinary opportunity and real separation between winners and losers. In our view, the early stage of the AI revolution was fueled heavily by investor enthusiasm, with capital chasing a wide set of AI ventures. As the industry matures, scrutiny is shifting toward companies that can demonstrate tangible progress, scalable business models, and clear proof of concept. Those that can convert investment into real-world applications and sustainable growth are likely to emerge as leaders, while less viable players risk being left behind. In our view, the baton of leadership will potentially pass on from riskier ventures to higher quality operators.

Demand for power, already a critical constraint, will continue to escalate as AI applications expand into consumer and enterprise use cases. Those with access to cheap, reliable energy and efficient infrastructure will gain an edge, while laggards risk falling behind.

Beyond infrastructure, the next frontier could be applications: productivity software, humanoid robotics, autonomous systems, and more. The AI leaders will capture value as adoption accelerates, while weaker players may struggle to monetize despite technological promise.

Across the AI value chain, we’re seeing this transition already. Palantir (PLTR) has emerged as a front-runner in enterprise AI adoption. Its Artificial Intelligence Platform (AIP) is being deployed by governments and corporations to integrate large-language models into real-time decision making. Nebius (NBIS) anchors the infrastructure layer with AI-optimized data centers, backed by a multi-year Microsoft agreement and new capital for expansion. CoreWeave (CRWV) adds cloud GPU capacity at scale, highlighted by a major deal with Meta. Together, these firms illustrate how leadership is consolidating around companies delivering real adoption, capacity, and customer traction.

Generative AI appears to be justifying the value proposition at the company level. In a recent Dallas Fed survey, ~60% of companies reported an increase in productivity (or expect one) with the implementation of generative AI. It will be crucial for companies to find ways to properly leverage generative AI and streamline processes.

For investors, the future of AI lies not just in allocating to innovation, but in discerning which companies can scale sustainably in a resource-intensive, hyper-competitive landscape. AI next-twelve-month P/E multiples are elevated. In our view, high valuations can be justified as long as they are supported by growth, cash flow, and progress. Companies that struggle could be punished with multiple contraction.

The global generative AI industry is in an exciting state of transition and transformation. Investors are shifting their focus from the “picks and shovels” of the AI revolution towards companies that are showing meaningful integration and implementation of AI applications at the software level. High quality operators are likely to be rewarded, while the laggards will be left behind. In our view, generative AI has approached a level of maturity that businesses can start to capture real-time benefits and could streamline operational processes. Headwinds, such as power constraints, continue to loom, but the aggressive industrial buildout and capital expenditure highlight profound optimism for the future.

This information is provided solely as general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment related course of action. Investing involves risk, loss of principal is possible.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact 1-855-561-5728 or consult with the professional advisor of their choosing.

Forward-looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Use of Third-party Information: Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Roundhill Financial Inc. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Roundhill Financial Inc. or any other person. While such sources are believed to be reliable, Roundhill Financial Inc. does not assume any responsibility for the accuracy or completeness of such information. Roundhill Financial Inc. does not undertake any obligation to update the information contained herein as of any future date.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index.

Except where otherwise indicated, the information contained in this presentation is based on matters as they exist as of the date of preparation of such material and not as of the date of distribution or any future date. Recipients should not rely on this material in making any future investment decision. The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.