How to Invest in Luxury Stocks: The Complete Beginners Guide

Luxury goods is one sector that has performed consistently well over recent decades, despite the market setbacks and uncertainty caused by the 2008 crash and the COVID-19 pandemic. Investors in luxury stocks have seen consistent year-on-year growth, with emerging markets for luxury goods in China and across Asia continuing to expand.

According to the global consulting firm Bain & Company, the luxury sector has grown at a compound rate of 6 per cent from 1996 to 2022. That’s double the 3 per cent global GDP growth over the same period. The company also predicts that the luxury market’s consumer base will expand from 400 million people in 2022 to 500 million by 2030.

What differentiates Luxury Brand Stocks from other investments, and how can ordinary investors take advantage of the opportunities they may offer?

Introduction to Luxury Stocks

Luxury stocks are typically those of companies that sell premium goods and services that are non-essential but have high desirability. This might include premium watches, cars, fashion, wine, and leather goods. It can also include services such as luxury hotels, resorts, and casinos.

The Concept of Luxury Brand Stocks

Luxury brands are associated with success and desirability. They provide goods and services to customers with high levels of disposable income and those who may aspire to attain greater wealth. Luxury brands are highly recognisable, and their strength is built on their desirability and exclusivity. Stocks in luxury brands give investors access to this exclusive marketplace.

How is ‘luxury’ defined

Luxury can have different meanings to different people, meaning that luxury in terms of goods, services and companies needs to be more definitively defined. As highlighted earlier, luxury represents goods and services beyond fulfilling basic needs. They are generally considered discretionary rather than essential and will carry a premium price due to craftsmanship, innovation and the exceptional experience they provide.

The brand reputation of luxury goods is critical to their desirability, so luxury brands will invest heavily in strengthening and sustaining that reputation. Luxury brands like Ferrari often extend their reach by offering lower-priced items like caps and clothing that feature their iconic brand logo to a broader market. Consumers who may not be able to afford luxury goods still wish to associate themselves with luxury brands.

Luxury companies also tend to be global, exposed to a growing consumer base across different regions. This brings diversification in demand for products and services across the economic cycle of individual countries. This means that luxury stocks are broadly non-cyclical. The high disposable income of luxury brand consumers also means that they have some resilience against economic shocks.

For a more detailed overview of luxury stocks, read our recent article:

Introducing LUXX: A Guide to the Global Luxury Market

The Classification of Luxury Stocks

Luxury Stocks can be placed into three distinct categories:

Durables (or Hard Goods)

These are companies that sell luxury goods that will have a useful life of more than three years. This might include products such as cars, furniture, and jewelry.

Consumables (or Soft Goods)

These companies manufacture and sell products with less than three years of useful life, such as textiles and clothing.

Services

These are primarily luxury brands operating exclusive hotels, casinos and resorts.

Luxury stocks are further divided into several classifications. These include:

- Apparel & Accessories

- Automobiles

- Hotels, Resorts & Cruise Lines

- Distillers & Vintners

- Personal Products

- Footwear

- Casinos & Gaming

Why Invest in Luxury Stocks

Luxury stocks, with their strong brand reputation and high-profit margins, are an attractive proposition for many investors. Adding luxury stocks to your portfolio exposes you to leading global brands that create some of the world's most desired products and services.

There is a substantial investment case for luxury stocks that rests on three financial pillars:

Resilience

Luxury goods and services have a track record of resilience during periods of economic downturn. Luxury companies like LVMH, Kering, Hermes, and Richemont have shown remarkable resilience during market downturns, such as during the Great Recession, when their share prices recovered swifter than the broader market.

While general consumer spending on non-essentials can decrease during more challenging economic times, higher-wealth consumers will often stay loyal to their favorite brands. The target market for luxury goods and services, possessing a larger disposable income, tends to exhibit spending habits less influenced by broader economic conditions. This wealth resilience can give luxury stocks some protection during economic downturns.

Strong historical performance

The growing popularity of luxury stock investments is, to a significant extent, built on their record over recent decades, with the Luxury Index outperforming the broader market across all standard periods.

This robust performance is underpinned by the superior pricing power that luxury brands often possess, allied to free cash flow generation. In our view, this long-term performance further illustrates the strength of luxury brands, achieved via superior pricing power and free cash flow generation. This time-tested performance supports predictions of continued growth over the coming years.

Strong growth forecast

As well as a strong historical performance, evolving fundamentals strongly support predictions of sustained growth for the luxury sector over the next few years and beyond.

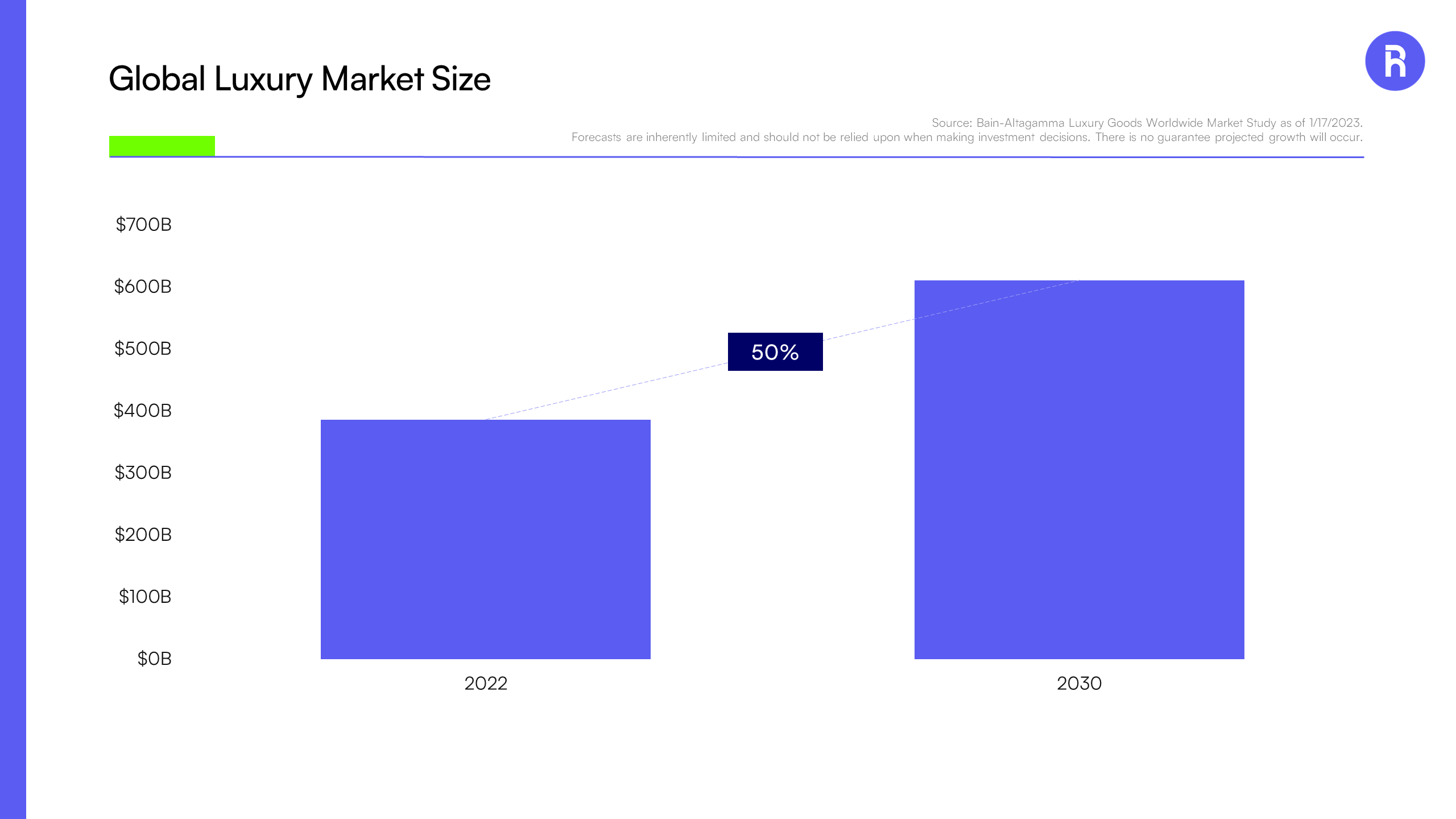

According to Bain & Company, the global luxury market size is forecast to eclipse $600 billion in 2030, a 50% increase from 2022. Generation Y, Z, and Alpha (i.e., people born between 2010 and 2025) are expected to be key growth drivers for the expected $600 billion global luxury market, with their spending set to grow three times faster than other generations. By 2030, these younger generations are expected to account for one-third of the overall market.

New technologies are generating new activities, predicted to spark an additional $67.8 billion to $135.6 billion in sales by 2030 from sources such as the metaverse and brand-related media content.

With the growth of wealthy consumers in China, India and elsewhere, the potential for luxury brands over the coming decades looks considerable. This presents an opportunity for investors to benefit from this predicted growth.

Source: Bain-Altagamma Luxury Goods Worldwide Market Study as of 1/17/2023. Note: Forecasts are inherently limited and should not be relied upon when making investment decisions. There is no guarantee projected growth will occur.

How to Invest in Luxury Brand Stocks

Adding luxury brand stocks to your investment portfolio allows you to benefit from the predicted growth of the sector over the coming years.

Most investors will invest in luxury stocks through individual shares or a luxury stocks ETF. Whichever method you choose, it’s essential to remember the importance of diversifying your portfolio to mitigate potential risks.

Buying shares in luxury brand stocks

Investors may choose to select specific luxury brand stocks in which they want to invest. This requires careful consideration of various factors to make the right investment decision. The best luxury stocks will meet several different criteria.

Luxury stocks you’re evaluating should have strong, recognizable and desirable brands emphasizing exclusivity. They should create high-end products and services with timeless appeal that have already stood the test. The companies should have high operating margins and a track record of delivering profits over time.

Investors may also want to consider:

Global Brand Presence

Companies operating in different global marketplaces can benefit from diversified revenue streams. When companies already have an established international presence, this can underpin sustained growth.

Commitment To Innovation

Successful luxury brands will often innovate and adapt to meet changing market trends. This can ensure they’re better positioned for long-term success.

Financial Health

Luxury doesn’t always mean a company is in the best financial health. Luxury brands can and do sometimes fail, so attention should be paid to critical metrics such as debt levels, liquidity, and the ability to generate cash flow. Strong financial fundamentals ensure a company is well-equipped to weather economic downturns.

Brand Resilience

Luxury brands that have demonstrated resilience during challenging economic times are likelier to do so again.

Management Team

Luxury brands often attract high-profile managers. A management team that combines competence and vision is essential for strategic decisions.

Shareholder Returns

Pay attention to the company’s historical stock performance and shareholder returns. If you are looking for income, it’s essential to consider the brand’s dividend history.

Market Trends

Understanding changing consumer trends can help you anticipate the future performance of particular luxury brands. Some may be well placed to take advantage of emerging consumer preferences.

Luxury Stock ETFs

Investing in a diversified Luxury Stocks ETF can be an accessible way for ordinary investors to gain exposure to a range of quality luxury brands as part of a diversified portfolio.

ETFs can provide a more balanced approach to investment in the sector, enabling investors to diversify their holdings across multiple companies and sub-sectors. Dividends and capital gains within the ETF can be automatically reinvested to contribute to the compounding of returns over time. This enhances the long-term growth potential of the investment.

By investing in an ETF, investors gain access to the latest research and investment expertise, saving time and increasing the chances of success. Investing in an ETF is especially beneficial for novice investors or those with limited time. It eliminates the need for extensive research typically required for well-informed stock selection.

While European investors have been able to invest in an ETF tracking the leading luxury index for more than a decade, U.S. investors finally have the opportunity to invest in luxury brands via an ETF with the launch of LUXX, the Roundhill S&P® Global Luxury ETF.

Why it’s important to diversify

ETFs give you immediate diversification in the sector. This mitigates some risks associated with individual company performance, reducing the impact of poor performance in any single investment and moderating the volatility within your portfolio.

Changes in consumer preferences and broader economic factors may affect the luxury sector differently compared to other industries. If a particular brand or market segment encounters specific difficulties, having your investment spread across various luxury companies can help manage some of the inherent risks and enhance the predictability of your returns.

A diversified ETF provides exposure to global markets, with different companies that are proficient in capturing emerging trends across diverse regions. This gives investors a greater chance of gaining from new opportunities while increasing resilience to regional downturns.

Different companies within the sector also excel in embracing innovation or in catering to particularly niche markets. By investing in a diversified ETF, investors tap into this innovation and exclusivity, potentially adding value to their overall portfolio.

Investing in a diversified ETF reduces reliance on a single investment, and better conditions are created for long-term, sustainable growth.

What are the Risks of Investing in Luxury Brand Stocks?

As with any other form of stock market investment, investing in luxury brand stocks does carry some risks:

- Price Volatility: Even high-end markets may experience fluctuation in demand, particularly during economic downturns, but also due to other factors such as changing consumer tastes.

- Competition: This is a highly competitive sector, with well-resourced brands competing for consumer attention and purchasing power. This competition may lead to challenges in maintaining market share.

- Consumer Trends: Shifts in fashion and lifestyle choices may impact the desirability of some luxury products. This could lead to declining sales and profit margins if brands fail to adapt to changing tastes.

Investing in an ETF provides diversification and managed exposure across a complex and competitive sector. Investment professionals make strategic decisions about the funds in an ETF, evaluating trends, company performance, market conditions and prospects.

An ETF immediately spreads the risk for smaller investors, allowing them to benefit from the luxury sector's dynamism and consistently strong performance.

The Future of The Luxury Market

The luxury market looks well placed to enjoy impressive growth over the coming years. Several factors look set to support this growth:

- Technological Innovation: As technology develops, luxury brands are embracing innovation. One example is the creation of desirable NFTs by the fashion and accessories industry.

- Digitalization: Luxury brands are investing heavily in digitalization, including advanced data analytics, AI and augmented reality, to expand and refine their product offerings and customer engagement.

- Strong Growth Predictions: The emergence of wealthy young consumers with a taste for luxury products, a growing number of high-wealth individuals globally, and the positive impact of innovation all support strong growth predictions for the luxury sector over the coming years.

Conclusion

The Luxury Sector has achieved consistently strong growth figures over recent decades, outperforming other sectors even during economic downturns. It comprises established brands with solid reputations, selling high-end goods and services to wealthy consumers.

The number of wealthy consumers globally continues to grow, with younger consumers expected to be key growth drivers for the luxury sector over the coming years. With new technologies creating new categories of desirable luxury products, such as NFTs, the luxury sector has strong fundamentals for growth.

This creates a compelling investment case, but it’s important to remember that diversification across the sector is critical. This can immediately be achieved by investing in a luxury stocks ETF.

Why Invest in Roundhill’s Luxury Stocks ETF?

Roundhill Investments believes that the luxury goods sector has the potential to generate attractive long-term total returns-driven by high margins and strong free cash flow generation.

The Roundhill S&P® Global Luxury ETF (“LUXX”) seeks to track the performance of the S&P® Global Luxury Index, a leading benchmark comprised of 80 publicly traded luxury companies.

Companies in the Apparel, Accessories and Luxury Goods Sub-Industry account for over 40% of this diversified fund. This includes many well-known luxury goods brand owners such as Richemont, LVMH, Hermes and Kering.

The fund also has significant exposure to auto manufacturers Mercedes-Benz, Ferrari, and Tesla, as well as BMW, Porsche, and Aston Martin. Combined with the Apparel, Accessories and Luxury Goods GICS Sub-Industry, these groups account for over 60% of fund holdings. Additional GICS sub-industries such as hotels, resorts and cruise lines, distillers and vintners, personal products and footwear are also represented.

The Roundhill S&P® Global Luxury ETF (“LUXX”) is an accessible way to invest in this dynamic and exciting sector with a strong track record of delivery. Click here for current fund holdings: https://www.roundhillinvestments.com/etf/luxx/

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the LUXX ETF please call 1-877-220-7649 or visit the website at https://www.roundhillinvestments.com/etf/luxx/. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Luxury companies face intense competition, both domestically and internationally, may have products that face rapid obsolescence, and are heavily dependent on the protection of patent and intellectual property rights. Such factors may adversely affect the profitability and value of luxury goods companies. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may risk and fall more than diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Depository Receipts involve risks similar to those associated investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. The fund is passively managed and attempts to mirror the composition and performance of the S&P® Global Luxury Index. The Fund’s returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index. Please see the prospectus for details of these and other risks.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.

The “S&P® Global Luxury Index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Roundhill Investments Inc. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Roundhill Investments Inc. The Roundhill S&P® Global Luxury ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P® Global Luxury Index.