Introducing KNGS: Crowning a New King

With the launch of the S&P Dividend Monarchs Index, there may be a new king in town when it comes to dividend growth strategies.

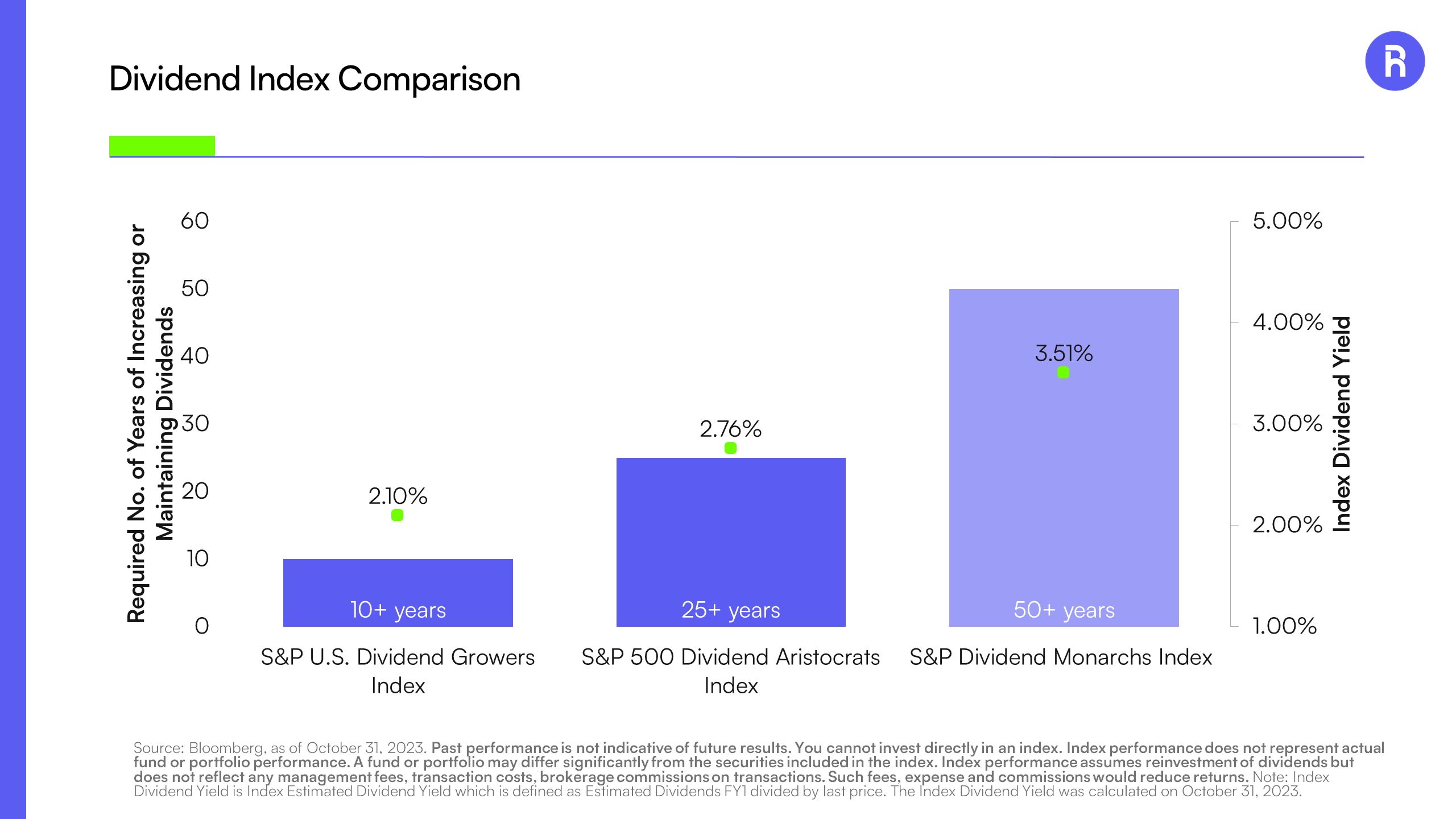

For the first time in history, an index offers exposure to companies that have increased their dividends for 50 or more years consecutively. It is called the S&P Dividend Monarchs Index.1 Dividend Monarchs represent the latest evolution in S&P’s renowned lineup of dividend growth indices, which includes its well-known Dividend Aristocrats brand, which includes companies that have raised their dividends for 25+ years.

The S&P Dividend Monarchs Index consists of over 30 blue-chip U.S companies, many of which are household names, including AbbVie, 3M, and Kimberly-Clark. As of October 31, 2023, the index yielded 3.51%2, offering a powerful combination of current income and potential income growth. Considering there are very few companies that have been public since 1973, it is remarkable that these 30+ names have been in a position to consistently raise their dividends for such a long period of time.

Divided Monarchs Seek to Offer High Yield

Source: Bloomberg, as of October 31, 2023. Past performance is not indicative of future results. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs, brokerage commissions on transactions. Such fees, expenses and commissions would reduce returns. Note: Index Dividend Yield is Index Estimated Dividend Yield which is defined as Estimated Dividends FY1 divided by last price. The Index Dividend Yield was calculated on October 31, 2023.

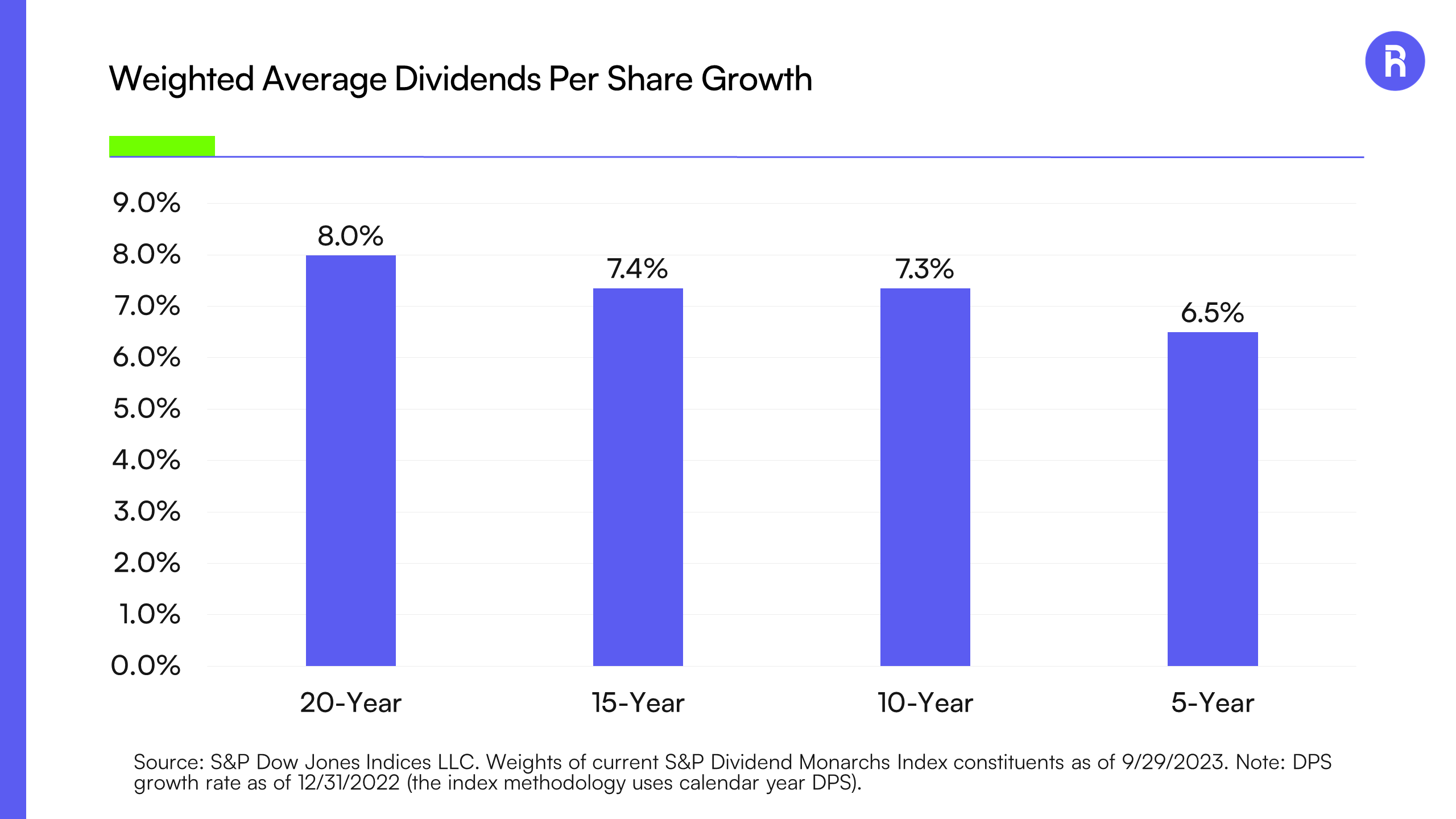

Since 1973, the Dividend Monarchs have successfully grown their dividends through an oil crisis, the Iranian hostage crisis, Black Monday, the Persian Gulf War, the breakup of the Soviet Union, the September 11 attacks, and the bursting of the TMT bubble. More recently, the Dividend Monarchs have grown their dividends through the Global Financial Crisis in 2008 and the COVID-19 pandemic in 2020. The below figure highlights the impressive dividend growth rate of the Dividend Monarchs over various time periods including 8% over the last 20 years.

Characteristics Highlight Monarchs Defensive Nature

Source: S&P Dow Jones Indices LLC. Weights of current S&P Dividend Monarchs Index constituents as of 9/29/2023. Note: DPS growth rate as of 12/31/2022 (the index methodology uses calendar year DPS).

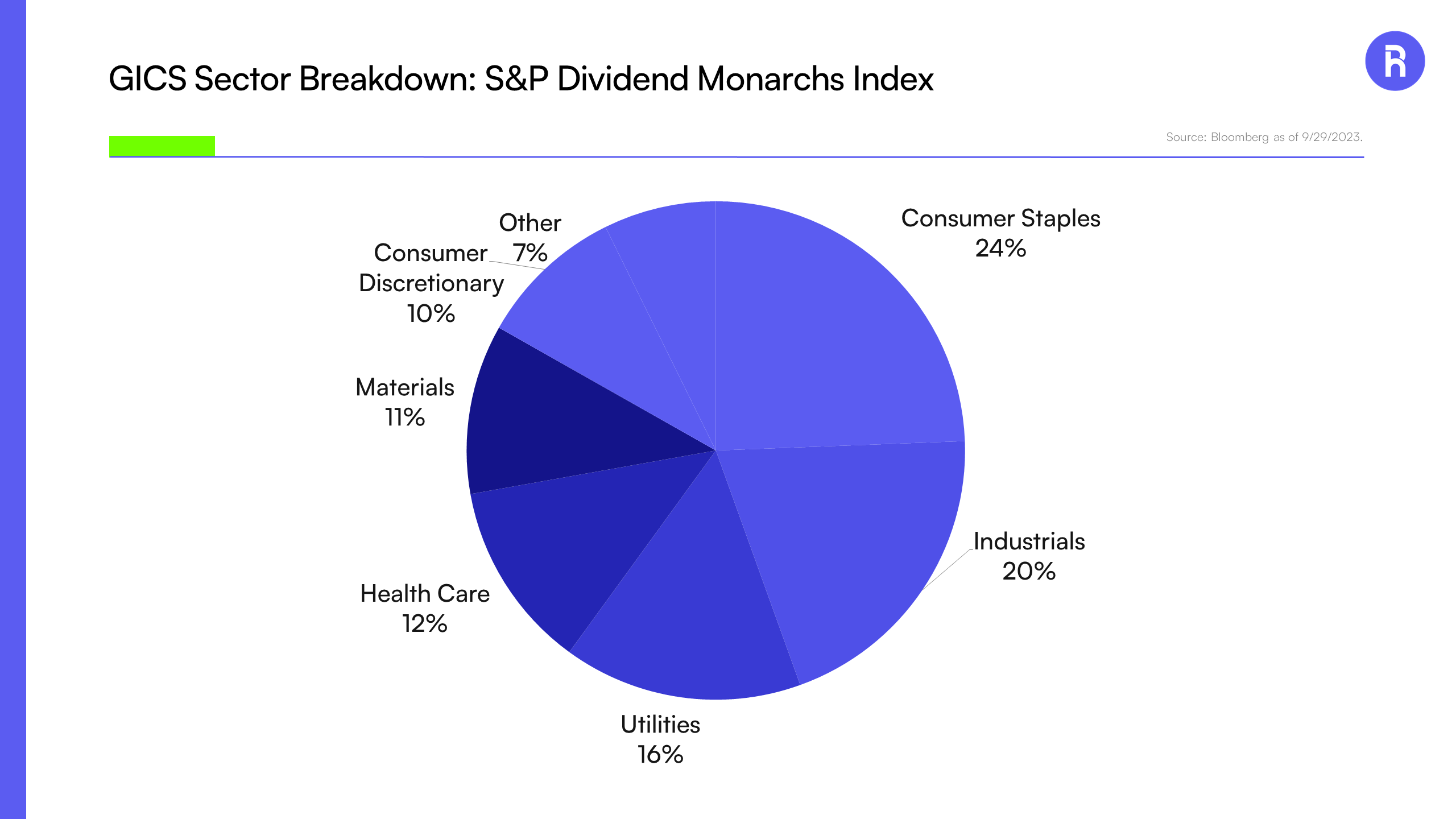

Over time, investors have come to recognize that stocks with a long-term history of increasing dividends can provide both income and the potential for capital appreciation. This dual-source return can be attractive, especially during times of market volatility. Consistently increasing dividends is typically associated with the overall strength and stability of a company’s business over time. Companies that have exhibited a long history of consistent dividend growth are often established, mature companies with stable but growing earnings. Such companies tend to have less stock price volatility compared to non-dividend-paying stocks or high-growth companies. Currently, the Dividend Monarchs primarily consists of stocks from the Consumer Staples, Industrials, and Utilities sectors.

Sector Exposures Skew Defensive

Source: Bloomberg, as of September 29, 2023.

As a group, Dividend Monarchs exhibit higher return on equity (ROE) than the broader market coupled with lower earnings variability. Above average ROEs may indicate that the Monarchs are more efficient at generating profits from shareholders’ equity. Meanwhile, lower than average price-to-book ratios (P/B) and price-to-earnings ratios (P/E), suggest that the Monarchs may be undervalued. Characteristics of this nature have historically translated to lower share price volatility and improved drawdowns, with strong win rates over time.

Why Dividend Monarchs Now?

In 2023, investors have been willing to pay a premium for companies they believe have strong future growth potential without caring too terribly much about their valuations. Meanwhile, stocks with high ROE and low P/B (like the Dividend Monarchs) are often viewed as traditional value stocks, so they have not been rewarded by market participants. However, now may be an attractive time to consider tilting away from growth and toward higher quality companies with attractive entry points.

The Roundhill S&P Dividend Monarchs ETF (NYSE Arca: KNGS) is the first U.S. listed ETF to track the S&P Dividend Monarchs Index. For more information on the potential to crown portfolios with KNGS, please visit: https://www.roundhillinvestments.com/etf/kngs.

1 Index Definition: The S&P Dividend Monarchs Index measures the performance of companies that have followed a policy of consistently increasing dividends every year for at least 50 years. Only securities issued by companies that have increased their total dividend per share amount every year for at least 50 consecutive years are eligible for inclusion in the Index.

2 Source: Bloomberg, Roundhill Investments, S&P Dow Jones Indices LLC. Data as of October. 17, 2023. Note: Dividend Yield is Index Estimated Dividend Yield which is defined as Estimated Dividends FY1 divided by last price.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the KNGS ETF please call 1-877-220-7649 or visit the website at https:// www.roundhillinvestments.com/etf/kngs/. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the broader market. Companies that issue dividend-paying stocks are not required to pay or continue paying dividends on such stocks. It is possible that issuers of the stocks held by the Fund will not declare dividends in the future or will reduce or eliminate the payment of dividends (including reducing or eliminating anticipated accelerations or increases in the payment of dividends) in the future. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments will be concentrated in an industry or group of industries, and the value of Fund shares may risk and fall more than diversified funds. Foreign investing involves social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. Depository Receipts involve risks similar to those associated investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks. The fund is passively managed and attempts to mirror the composition and performance of the S&P Dividend Monarchs Index. The Fund’s returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.

The S&P Dividend Monarchs Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and has been licensed for use by Roundhill Investments Inc. S&P®, S&P 500®, Dividend Aristocrats® and Dividend Monarchs™ are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by Roundhill Investments Inc. The Roundhill S&P Dividend Monarchs ETF is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Dividend Monarchs Index.