Introducing LNGG: There’s More to LNG than just the L, N, G

LNG is an acronym you may have heard, but do you really know what it is?

If you don’t, that’s okay — you probably aren’t alone. Let’s start at the top.

LNG, short for liquefied natural gas, is natural gas that’s been cooled down into liquid form. Natural gas itself is produced in basins and transported by pipelines. Once it's cooled, LNG can be shipped around the world in specialized ships. It’s then turned back into gas, which can be piped into homes and businesses to be used as an energy source. A benefit of natural gas is that it’s clean burning, abundant, and affordable.

In fact, LNG is the cleanest fossil fuel generating 40% less carbon dioxide than coal and 30% less than oil.1 So while LNG isn’t exactly “green”, it’s on the friendlier end of carbon intensive energy sources and considered to be a transitional source of energy as the world moves toward more renewable sources.

Now that We Know LNG is, Why is It an Interesting Investment?

LNG, and natural gas more broadly, has been in the news more of late thanks to the ongoing war in Ukraine. Historically, Russia was a key supplier of natural gas to Europe, accounting for 45% of supply. Due to the conflict, however, Russian gas has been replaced by LNG shipments from around the world (especially the U.S.), in order to meet the ongoing demand. Last year, Europe was fortunate as they had a warmer than expected winner, which meant less need for energy than expected.

In the first half of 2023, U.S. LNG exports to Europe accounted for 67% (7.7 Bcf/d) of total U.S. exports.2 Thanks to the increase in demand, the U.S. exported more LNG than any other country in the first 6 months of 2023.

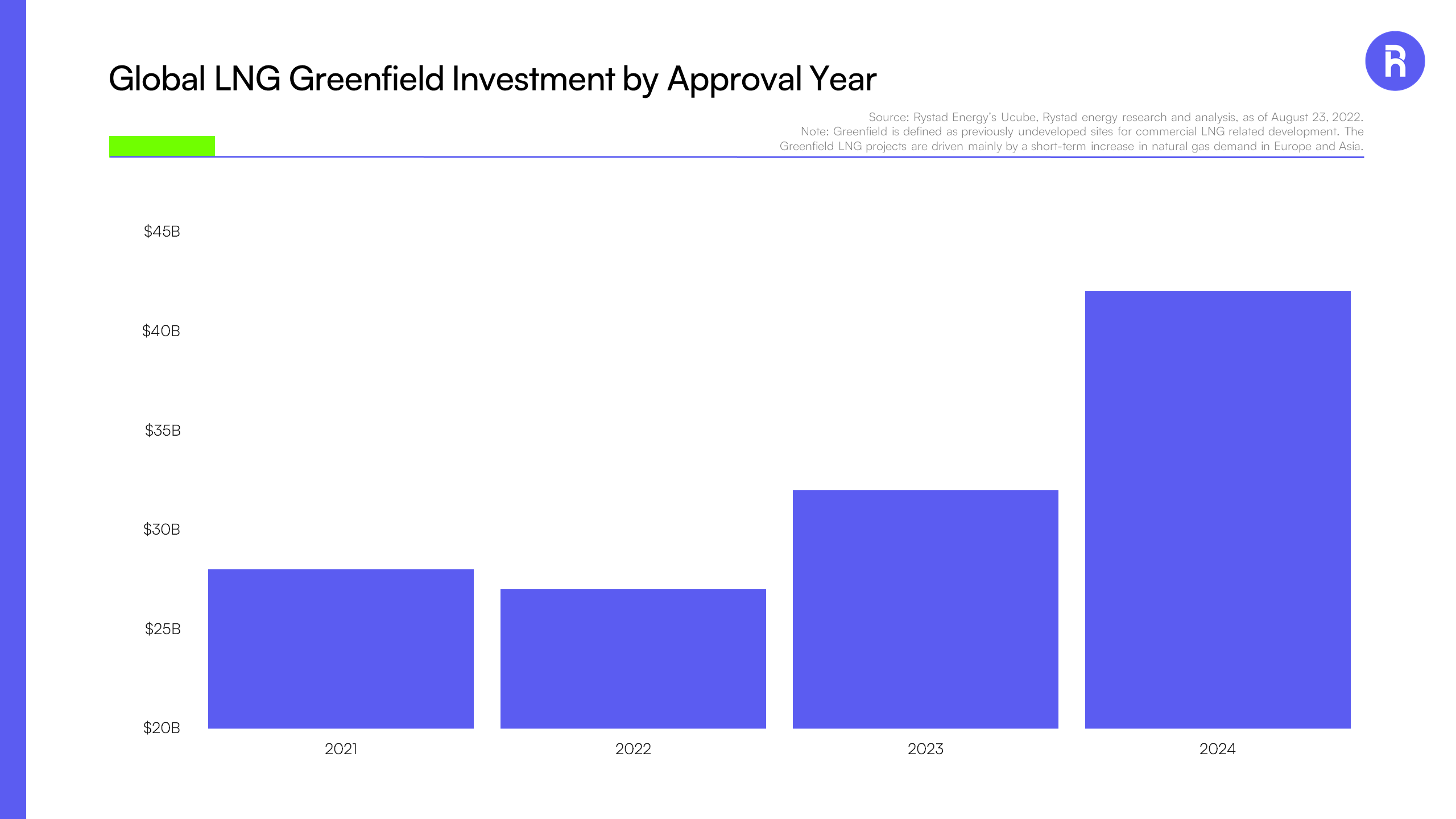

This spike in demand has gotten the attention of investors. Spending on U.S. LNG project investments is estimated to expand to $100 billion over the next five years. 3 Warren Buffett's $3.3 billion investment in the Cove Point LNG export project grants Berkshire Hathaway Energy control of one of just seven operational U.S. facilities capable of exporting LNG.

Source: Rystad Energy’s Ucube, Rystad energy research and analysis, as of August 23, 2022. Note: Greenfield is defined as previously undeveloped sites for commercial LNG related development. The Greenfield LNG projects are driven mainly by a short-term increase in natural gas demand in Europe and Asia.

LNG is in such high demand that import facilities in the U.S. are being repurposed into export facilities. For example, Golden Pass Trains 1 and 2 are being converted by a joint venture between QatarGas and Exxon Mobil.

How to Play It

The Roundhill LNG ETF seeks to track the Alerian Liquified Natural Gas Index. The Alerian Liquefied Natural Gas Index (ALNGX) is an index of stocks that are materially engaged in the Liquefied Natural Gas Industry. Included in the Index are companies engaged in liquefied natural gas liquefaction, carrier services and regasification. Constituents are weighted by a revenue adjusted float market cap. The index includes 28 stocks weighted by exposure adjusted market cap. The index is truly global, with U.S. companies comprising only 33.3% of exposure. Australia is the next largest country, weighing 27.6%. Meanwhile, the index is relatively concentrated with the top three holdings accounting for over 40%. The largest is Cheniere Energy Inc. (LNG US), which is the largest LNG producer in the U.S. and the second largest globally. Santos Ltd (STO AU), the second largest weight, is a leading producer of natural gas with operations across Australia, Papua New Guinea, Timor-Leste, and North America. Woodside Energy Group Ltd (WDS AU) is the largest independent producer of oil and gas in Australia and is the third largest holding. For more information on LNGG holdings, visit our website: https://www.roundhillinvestments.com/etf/lngg/

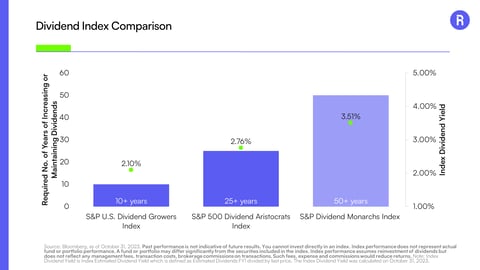

We believe LNG presents a global opportunity set. However, the market itself had been heavily localized with shipping routes historically being regional. In turn, LNG companies can be found around the globe that are engaged in liquefied natural gas liquefaction, carrier services and regasification. These firms tend to offer attractive yields as they focus on returning cash to shareholders in addition to investing in new projects. The Alerian LNG Index was yielding 4.5% as of August 31, 2023, outpacing major indexes and the broader energy market.

What’s the Outlook?

LNG’s share of global gas supply is expected to increase from 13% today to 23% by 2050, driven by meeting demand growth and replacing declining pipeline and domestic gas sources.4 Considering that the EU only produces enough gas domestically to meet 10% of its demand, eyes will remain focused on the thermometer to see if supply can meet demand. Meanwhile, natural gas’ share in the global energy mix o is expected to grow relative to other fossil fuels, such as coal and oil, as large economies transition to cleaner energy. LNG plays a key role in helping with the ongoing energy dilemma including affordability and the move toward a net zero world.

1 Source: National Grid.

2 Source: U.S. Energy Information Administration3 Source: Wood Mackenzie, as of February 22, 2023.

4 Energy Insights by McKinsey, Global Gas Outlook 2050, as of February 26, 2021.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Alerian LNG ETF please call 1-877-220-7649 or visit the website at https://www.roundhillinvestments.com/etf/lngg/. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Alerian Liquefied Natural Gas Index. The Index is composed of the common stock of domestic and international companies in both developed and emerging markets, that are principally engaged in or derive significant revenue from the LNG industry. An Index cannot be invested in directly. Concentration Risk. Because the Fund’s assets will be concentrated in an industry or group of industries to the extent the Index concentrates in a particular industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry or group of industries. Oil & Gas Producers Industry. Companies in the Oil and Gas Producers Industry (the Industry) are affected by worldwide energy prices and exploration and production costs. The Industry may have significant operations in areas at risk for natural disasters, social and political unrest, and environmental damage. These companies may also be at risk for increased government regulation and intervention, litigation, and negative publicity and public perception. Depositary Receipt Risk. Depositary receipts, including American depositary receipts, involve risks similar to those associated with investments in foreign securities, such as changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies. Foreign & Emerging Markets Risks. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid, and more volatile than securities markets in more developed markets. New Fund Risk. The Fund is a recently organized investment company with no operating history. As a result, prospective investors have no track record or history on which to base their investment decision. Non-Diversification Risk. Because the Fund is “non-diversified,” it may invest a greater percentage of its assets in the securities of a single issuer or a lesser number of issuers than if it was a diversified fund. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a lesser number of issuers than a fund that invests more widely. This may increase the Fund’s volatility and cause the performance of a relatively small number of issuers to have a greater impact on the Fund’s performance. Passive Management Risk. The fund is passively managed and attempts to mirror the composition and performance of the Alerian Liquefied Natural Gas Index. The Fund’s returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index. Tracking Error Risk. As with all index funds, the performance of the Fund and its Index may differ from each other for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the Index. In addition, the Fund may not be fully invested in the securities of the Index at all times or may hold securities not included in the Index.

The Roundhill Alerian LNG ETF is not issued, sponsored, endorsed, sold or promoted by VettaFi LLC or its affiliates (collectively, “VettaFi”). VettaFi makes no representation or warranty, express or implied, to the purchasers or owners of the Roundhill Alerian LNG ETF or any member of the public regarding the advisability of investing in securities generally or in Roundhill Alerian LNG ETF particularly or the ability of the Alerian Liquefied Natural Gas Index (the “Index”) to track general market performance. VettaFi’s only relationship to Roundhill Financial Inc. is the licensing of the Index which is determined, composed and calculated without regard to Roundhill Financial Inc. or the Roundhill Alerian LNG ETF. VettaFi is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the Roundhill Alerian LNG ETF to be issued. VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of the Roundhill Alerian LNG ETF.

“Alerian Liquefied Natural Gas IndexSM”, “AlerianSM”, “VettaFiSM”, and “LNGISM” are servicemarks of VettaFi and their use is granted under a license from VettaFi. VettaFi does not guarantee the accuracy and/or completeness of the Index or any data included therein and VettaFi shall have no liability for any errors, omissions, interruptions or defects therein. VettaFi makes no warranty, express or implied, representations or promises, as to results to be obtained by Roundhill Financial Inc., or any other person or entity from the use of the Index or any data included therein. VettaFi makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, or fitness for a particular purpose or use with respect to the Index or any data included therein. Without limiting any of the foregoing, in no event shall VettaFi have any liability for any direct, indirect, special, incidental, punitive, consequential, or other damages (including lost profits), even if notified of the possibility of such damages.

Please see the prospectus for details of these and other risks. Roundhill Financial Inc. serves as the investment advisor.

The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.