Why Dividend Monarchs and Why Now

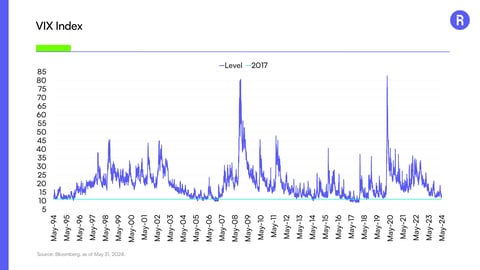

Volatility Spiking as Market Corrects

The market is staring down the barrel of multiple headwinds that are unnerving investors and fueling an ongoing market rotation. Election uncertainty has increased as investors attempt to handicap the policies of each administration and the respective investment implications. With seasonality weakening, volatility has surged amid the early-August unwind of the U.S. dollar/Japanese yen carry trade and the July jobs report indicated a worsening economic environment. The unemployment rate rose and non-farm payrolls came in well below expectations. The bond market caught a sharp bid, sending rates plummeting as investors fled into risk-off trades.

Bad news for the economy is now becoming bad news for stocks. The cost of capital is lessening and a fierce rotation is underway. Are small-caps, an economically sensitive group, the right place to hide, or is a full pivot to defensive equities perhaps a better place to rotate?

Dividend Monarchs, A Time-Tested Group

Dividend Monarchs are not as exciting as high beta or momentum stocks. They are not thematic innovators nor market disruptors. Dividend Monarchs, as defined by S&P, are companies that have increased their dividends each and every year for the past 50 years. While fads come and go, the 38 Monarchs comprising the S&P Dividend Monarchs Index have each exhibited a remarkable track record of delivering throughout various business cycles and market environments. While dividends are sometimes overlooked, their influence on shareholders’ total return and portfolio volatility remains crucial. Dividends can be utilized for reinvestment to compound returns over the long-run, minimize drawdowns, and supplement portfolio income.

What are the characteristics of Dividend Monarchs?

On average, Dividend Monarchs have lower price volatility relative to their S&P 500 peers. From a fundamental perspective, the group typically experiences less variance in their fundamental growth profiles, emblematic of lower growth and more stable fundamental profiles at below average lower valuations, relative to the S&P 500. Meanwhile, stable cash flows and balance sheet management enables the Dividend Monarchs to grow their respective dividends with remarkable consistency.

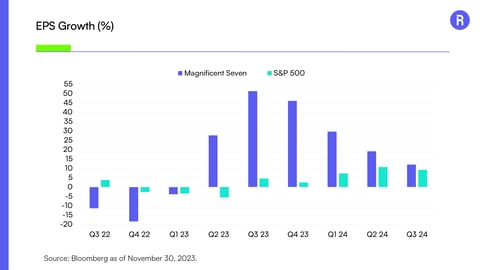

The Case for Low Growth & Less Volatile Stocks

At first glance, it can be easy to dismiss dividend-growing stocks in favor of growth stocks that garner media praise and attention for their technological innovation. However, dividend-growers have historically played a critical role in reducing portfolio volatility during turbulent times in the market. When compared with the S&P 500, dividend growers have experienced smaller drawdowns from all-time highs during down markets as seen in the dot-com bubble, the Great Financial Crisis, and the 2011 U.S. debt downgrade. Enhanced exposure to dividends can potentially provide investors with less painful drawdowns and a faster time to recovery.

Why KNGS Now?

Shareholders tend to tilt portfolios more defensively when market and economic conditions worsen. Falling interest rates make the dividend yields of the Dividend Monarchs more attractive. With a track record of prioritizing shareholder return, the Roundhill S&P Dividend Monarchs ETF (KNGS) could be a solution for investors looking for a more conservative approach for their portfolios. Despite sacrificing exposure to higher price appreciation and fundamental growth potential of growth stocks, Dividend Monarchs’ higher dividend yields relative to peers and other asset classes, lower price volatility profile, and prioritization of shareholder return make a compelling case for how to play the market during turbulent periods.

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the KNGS ETF please call 1-877-220-7649 or visit the website at https:// www.roundhillinvestments.com/etf/kngs/. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. Dividend Paying Stock Risk. Investing in dividend paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the broader market. Companies that issue dividend paying stocks are not required to pay or continue paying dividends on such stocks. It is possible that issuers of the stocks held by the Fund will not declare dividends in the future or will reduce or eliminate the payment of dividends (including reducing or eliminating anticipated accelerations or increases in the payment of dividends) in the future. Market Capitalization Risk. Investments made in small and mid-capitalization companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Concentration Risk. Fund investments will be concentrated in an industry or group of industries and the value of Fund shares may rise and fall more than diversified funds. Foreign Investment Risk. Foreign investing involves social and political instability, market illiquidity, exchange rate fluctuation, high volatility, and limited regulation risks. Emerging markets may be more volatile and less liquid than more developed markets and therefore may involve greater risks. American Depository Receipts (ADRs) Risk. Depository Receipts involve risks similar to the associated investments in foreign securities but may not provide a return that corresponds precisely with that of the underlying shares. Please see the prospectus for details of these and other risks. The fund is passively managed and attempts to mirror the composition and performance of the S&P Dividend Monarchs Index. The Fund’s returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index.

Roundhill Financial Inc. serves as the investment advisor. The Funds are distributed by Foreside Fund Services, LLC which is not affiliated with Roundhill Financial Inc., U.S. Bank, or any of their affiliates.

The S&P Dividend Monarchs Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and has been licensed for use by Roundhill Investments Inc. S&P®, S&P 500®, Dividend Aristocrats® and Dividend Monarchs™ are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by Roundhill Investments Inc. The Roundhill S&P Dividend Monarchs ETF is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Dividend Monarchs Index.

“Dividend Growers” are defined as the S&P Dividend Aristocrats Index. The S&P 500 Dividend Aristocrats index is designed to measure the performance of S&P 500 index constituents that have followed a policy of consistently increasing dividends every year for at least 25 consecutive years.